Polygon releases zkEVM achievements; will MATIC witness a halt on its pullback

- Polygon revealed the achievements of its zkEVM since its launch

- MATIC’s reaction was not up to the mark, but metrics supported a price surge

Polygon [MATIC] had a lot to share with the crypto community with regards to its zkEVM’s achievements. To offer comprehensive EVM opcode equivalency for a seamless user experience and the security of Ethereum, Polygon zkEVM is the first zk-rollup with source code available.

As per a tweet dated 24 December, Polygon’s zkEVM, since its launch in October 2022, processed nearly 22,000 transactions.

Since the rollout of Polygon zkEVM’s public testnet in October, we’ve seen:

– 21,966 txs processed

– 14,930 ZK proofs generated & verified

– 10,508 wallet addresses createdAnd counting… @0xpolygondevs are floored by the Ethereum community’s support.

— Polygon ZK (@0xPolygonZK) December 23, 2022

How many MATICs can you get for $1?

More in store

The tweet also revealed that 10,508 wallet addresses were created. Furthermore, the total number of deployed contacts increased by more than 4%. Moreover, Polygon zkEVM remained the first EVM-equivalent ZK rollup and the only ZK rollup with all of the source code available for every component—including the prover.

Interestingly, not only the zkEVM but also Polygon’s NFT space also witnessed a boom. According to NFT Scan, over 1,000 NFT contracts were created in the last 24 hours, and Polygon’s NFT volume registered a spike of over 73,000.

Santiment’s chart also revealed that MATIC’s total NFT trade count and trade volume in USD went up in the last few days. This reflected Polygon’s popularity in the NFT ecosystem.

Another major milestone was recently revealed when Polygon outperformed BNB in terms of the number of daily transactions on the chain. This was reported on Twitter by the crypto analytics firm Delphi Digital.

A 43.38x hike on the cards if MATIC hits Bitcoin’s market cap?

Was MATIC affected?

While these developments were quite positive for Polygon, MATIC too made it to the list of the top gainers in the Polygon ecosystem. However, MATIC’s weekly price action was not up to the mark. Thanks to the bearish market condition, the growth of most cryptos and MATIC witnessed restricted movement.

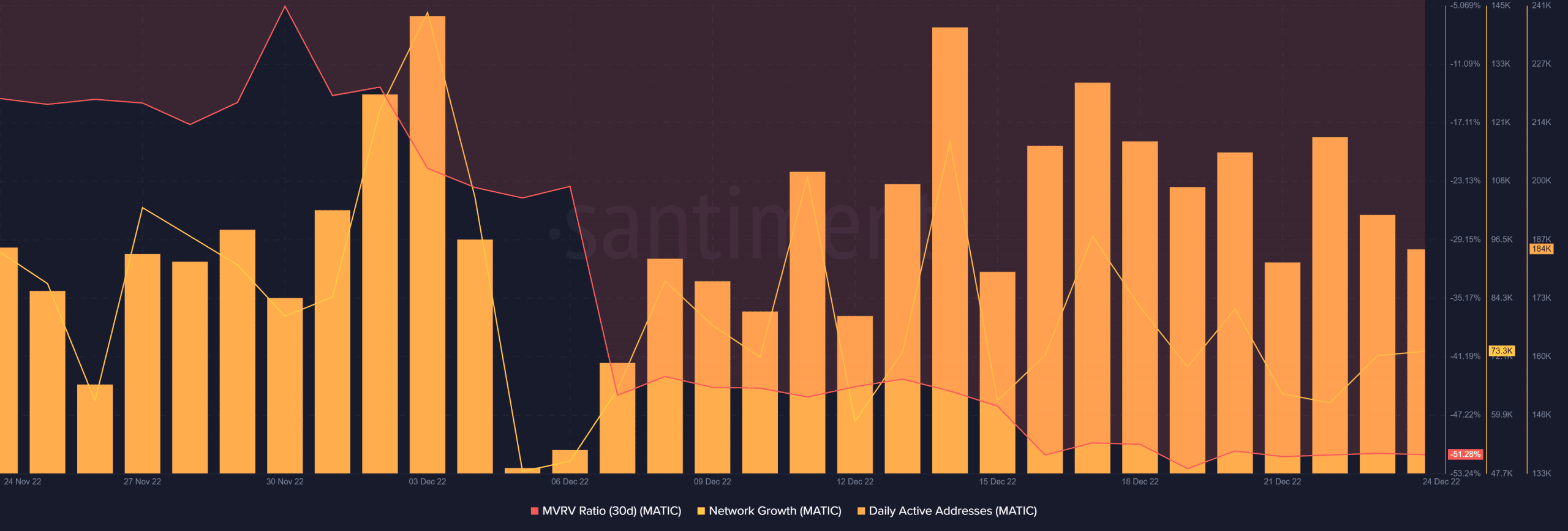

At press time, MATIC was trading at $0.797 with a market cap of more than $6.9 billion. However, things might soon change as MATIC’s Market Value to Realized Value (MVRV) Ratio has declined considerably over the past month. This could be an indicator of a market bottom.

MATIC’s active addresses also remained pretty consistent, which was also a positive signal. CryptoQuant’s data revealed that MATIC’s exchange reserve was decreasing, suggesting less selling pressure. Nonetheless, Polygon’s network growth did not look optimistic, which might cause trouble in the coming days.