BinaryX (BNX), XDC Network (XDC), and Radicle (RAD) Lead the Charge in the Best Performing Altcoins

BeInCrypto looks at the five altcoins that gained the most from the entire crypto market last week, especially from December 16 to 23.

These digital assets have grabbed crypto news and crypto market headlines:

- BinaryX (BNX) increased in price by 21.26%

- XDC Network (XDC) price rose by 10.23%

- Radical (RAD) price increased by 5.61%

- iExec RLC (RLC) price increased by 5.54%

- Toncoin (TON) increased in price by 0.97%

BNX Altcoins Lead The Rally

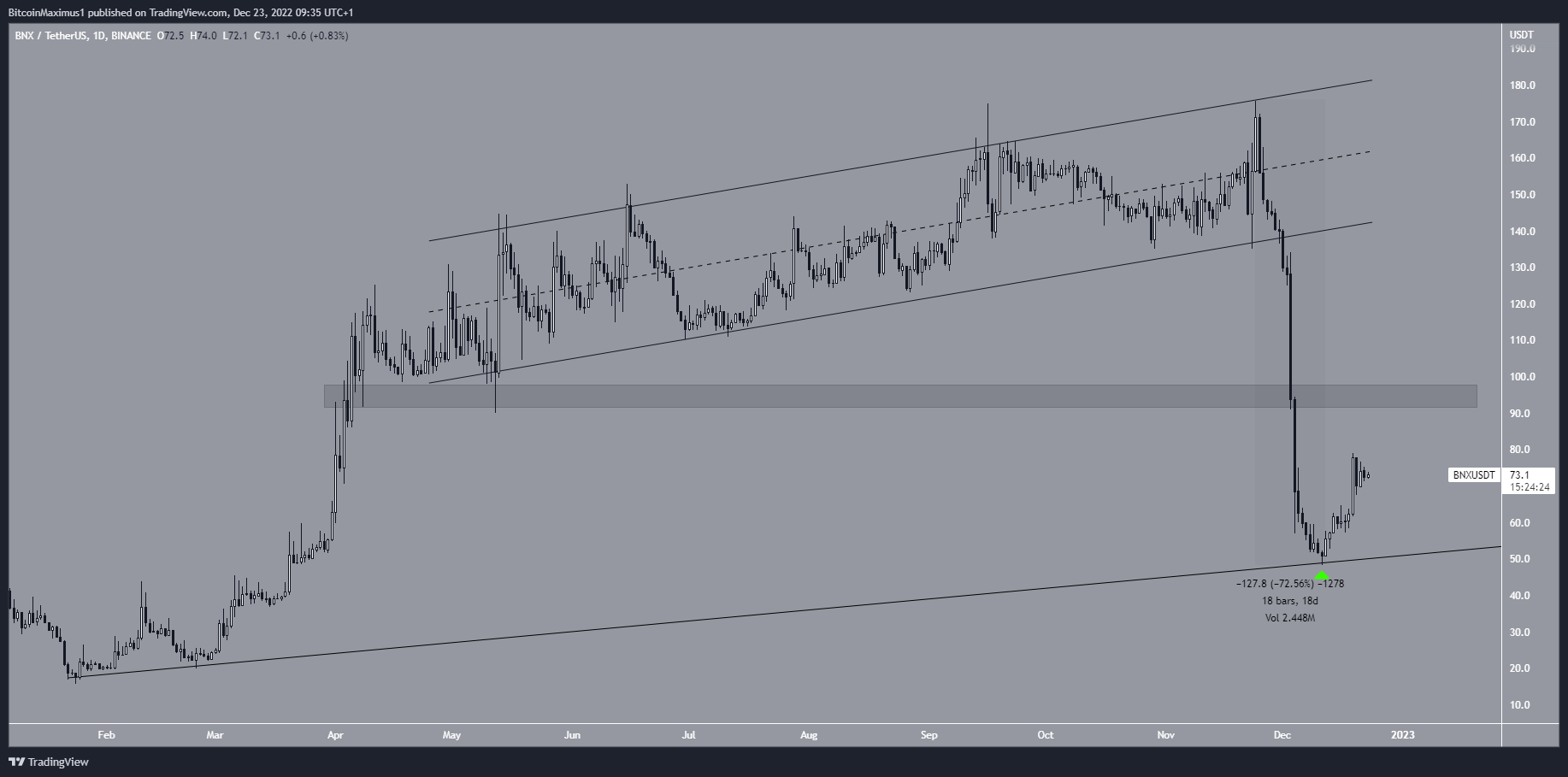

BNX price has declined since reaching a high of $175.60 on Nov 24. Five days later, it broke out of an ascending parallel channel and accelerated its rate of decline. This led to a low of $48.40 on 11 December, a 72% drop in just 18 days.

However, BNX price subsequently rebounded, validating a long-term ascending support line (green icon) dating from January 2022.

If the upside momentum continues, the nearest resistance area will be at $95.

Whether BNX price reclaims this area or breaks above the ascending support line will determine the future trend direction.

XDC attempts to breakout

XDC price has been falling below a descending resistance line since August 11. The downward momentum reached a low of $0.02 on December 7th. Due to the overlap in movement (red line), the reduction potential is a full ABC conformational structure (black). It was supported by a strong bounce back from the December 7 low, which took XDC price back to the resistance line.

A breakout from the line is likely to propel it towards $0.036

Conversely, a drop below the $0.070 low will invalidate this bullish hypothesis.

RAD gets rejected by resistance

RAD price has declined below a descending resistance line since May 28. The line has caused several rejections so far (red icon), most recently on 17 December.

The nearest support area is at $1.45. This area has acted as support for the yearly low. As a result, a breakdown below this could accelerate the rate of decline.

Whether RAD price breaks above the resistance line or declines below the $1.45 area will determine the future trend direction.

RLC breaks above resistance

RLC price had fallen below a descending resistance line since early August. The downside movement resulted in a low of $0.748 on November 14.

RLC price has since risen higher and broke above the resistance line on 17 December. It also led to a retest of the $1.05 resistance area.

If the upward move continues, the next nearest resistance area will be at $1.55.

Conversely, a drop below the $1.05 area indicates that the trend is bearish.

TON is one of the few altcoins with a bullish setup

Since hitting a low of $1.33 on November 10, TON price has made a rapid upward move. The upward momentum caused a breakout above the $1.95 resistance area, which further accelerated the rate of increase.

So far, the price of TON has reached a high of $2.90.

The upward movement looks like a five-wave upward structure, with the TON in wave three (black) and the sub-wave five (white). A possible target for the top of the upward momentum is $3.44.

The lack of a high (red line) at the bottom of the wave would invalidate the bullish hypothesis.

For the latest crypto market analysis from BeInCrypto, click here.

disclaimer

BeInCrypto endeavors to provide accurate and up-to-date information, but shall not be responsible for any missing facts or incorrect information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.