Bitcoin: FTX’s implosion and its impact on profitability, blockspace demand, and more

- Bitcoin’s Realized Loss touched an all-time high when FTX collapsed.

- New demand for block space is re-entering the market.

- The market is dominated by small-sized transactions.

In the wake of FTX’s unexpected collapse, Bitcoin [BTC] exchanged hands for $15,000, trading at a 2-year low.

As the king coin bounced from the range lows of $16,065 to a high of $17,197 to begin recovery, on-chain analytics platform Glassnode assessed the impact of FTX’s implosion on market participants, miners, and BTC network activity.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

How big were the losses?

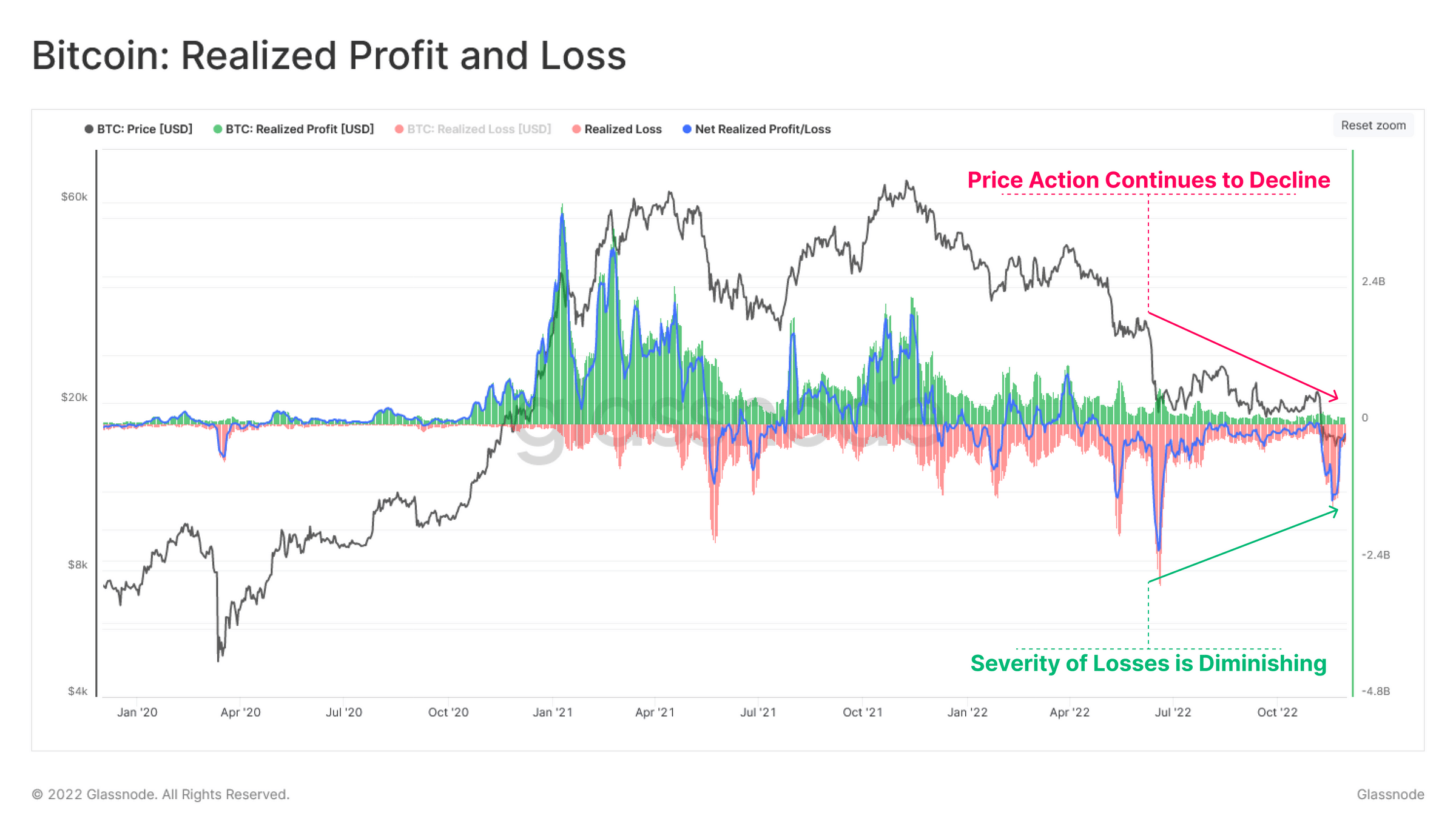

Glassnode first considered the quantum of losses incurred by the various cohorts of holders that make up the BTC market. An assessment of BTC’s Realized Profit and Loss metric revealed that the FTX debacle led BTC to record a single-day loss of $4.435 billion, an all-time high.

As BTC’s price regained the $17,000 price mark, a re-assessment of the metrics on a weekly moving average showed that losses have started to decline, Glassnode found.

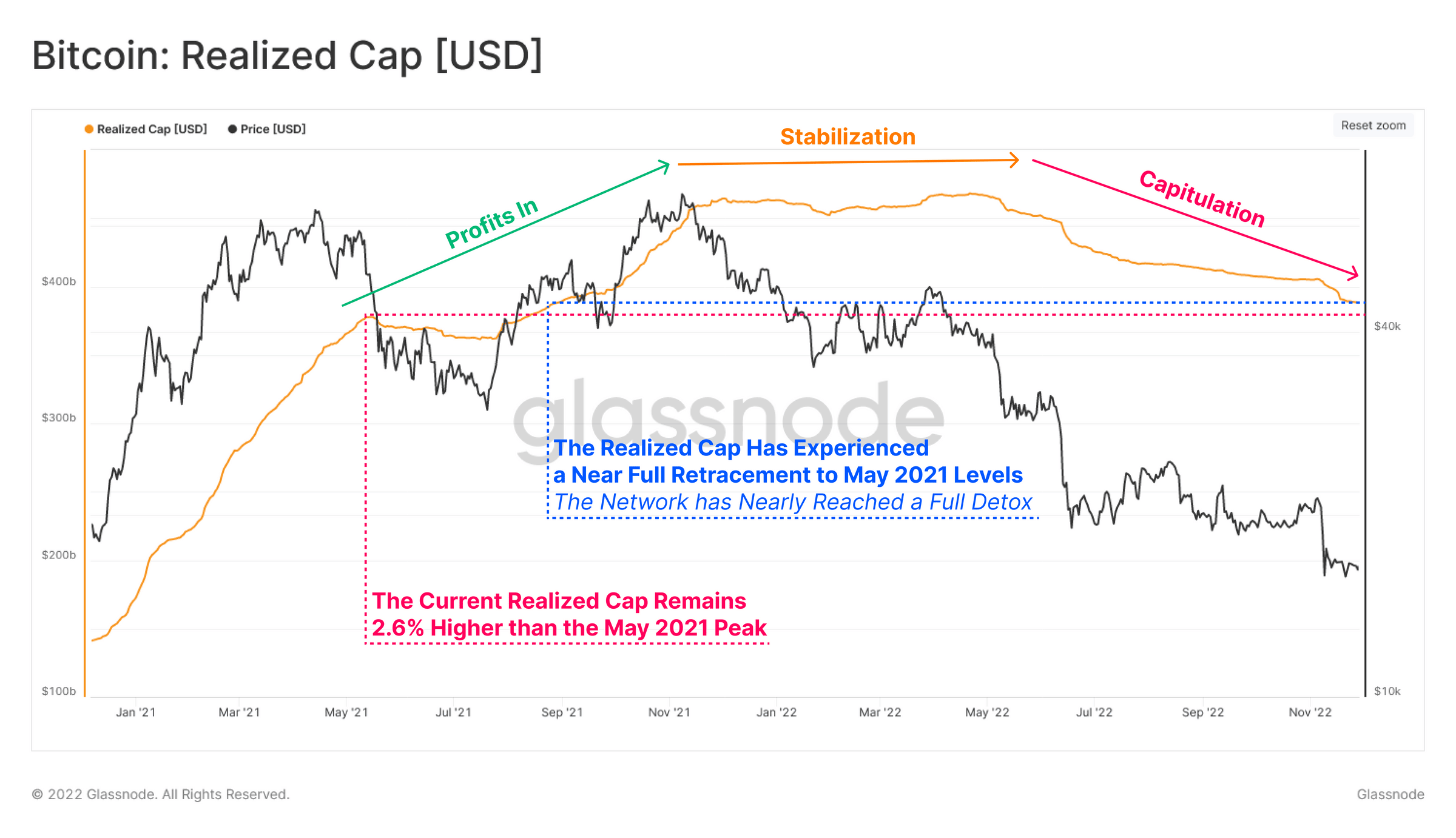

To further understand the severity of losses incurred by market participants, Glassnode assessed the Realized Capitalization metric. This metric displays the net sum of capital inflows and outflows into the network since its inception. It is used to determine the severity of capital outflows from the network after the market cycle peak.

Following FTX’s fallout, BTC’s Realized Capitalization fell to May 2021 levels causing “the exuberance experienced during the H2 2022 rally to the ATH” to near the point of full retracement. This, according to Glassnode, suggested “a near complete detox of this excess liquidity.”

Glassnode noted that,

“The realized loss experienced by Bitcoin investors across the past 6 months has been historic in magnitude. Profitability stress is starting to diminish after the event, but has resulted in a complete flush out of all excess liquidity attracted over the last 18 months. This suggests that a complete expulsion of (the) 2021 speculative premium has now occurred.”

Blockspace demand sees growth

Historically, prolonged bear markets have been marked by a decline in the network activity, culminating in little fee revenue for miners on the BTC network.

As the bear market continued, the continued decline in BTC’s price would usually entice new demand for blockspace. As sellers got displaced by buyers, demand for blockspace would also grow, thereby increasing miners’ fee revenue.

As BTC rebounded from its two-year low, Glassnode found that BTC’s “monthly miner revenue fees are beginning to pick up.” It, however, added a caveat that

“Of most interest is whether this uptick is fleeting or whether it can be sustained, signifying a potential regime shift is underway.

While the market makes an attempt to recover following FTX’s collapse, Glassnode found that smaller-sized transactions (up to $100k) have dominated the market while the dominance of larger institutional-sized transfers has fallen.

A look at BTC’s Total Transfer Volume metric confirmed this. While transaction count grows, transfer volume declines, and according to Glassnode, it “is likely a reflection of more small size transfers.”