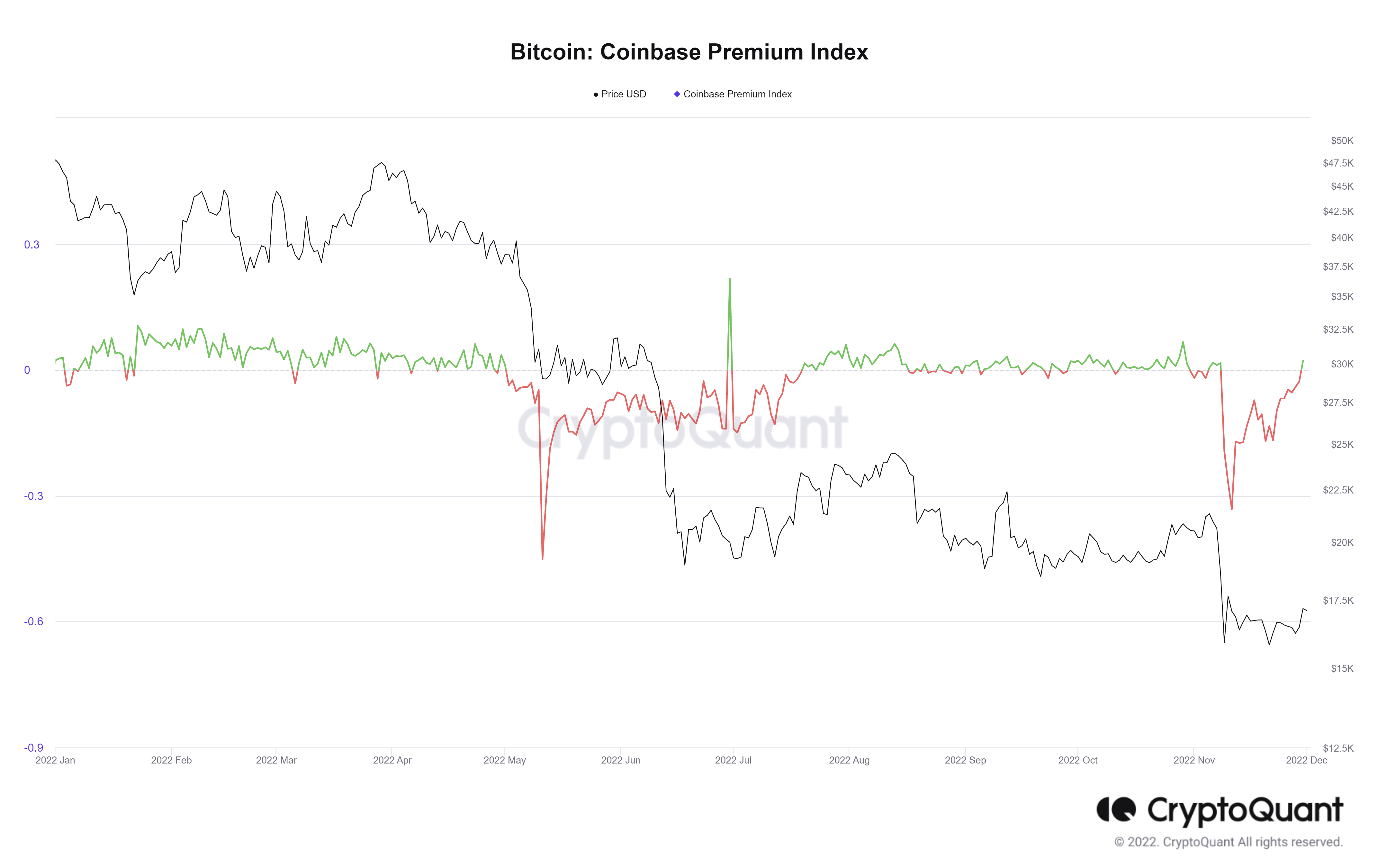

Coinbase Premium Index goes green for the first time since FTX collapse

According to the on-chain data and analytics provider, CryptoQuant, the Coinbase Premium Index has turned green for the first time since the fallout of the FTX collapse.

As an indicator that shows a sign of “whale accumulation,” Coinbase Premium is the price difference between Coinbase’s BTC/USD pair and Binance’s BTC/USDT pair.

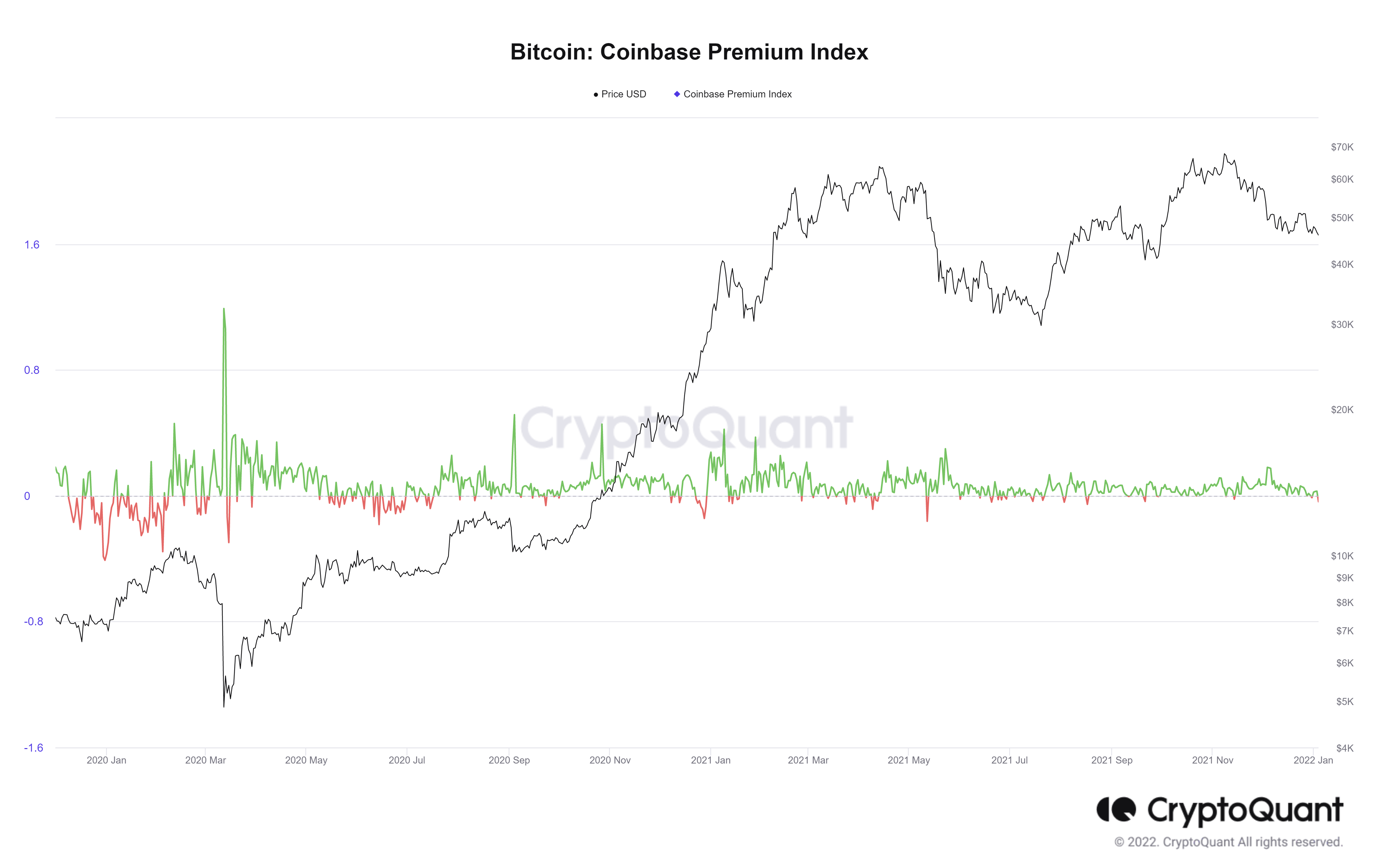

“For example. when the Bitcoin price continuously broke 20k, 30k, and 40k while the Coinbase premium was maintaining more than $50 premium. It indicates that during these dips, institutions or other whales were accumulating.”

Coinbase Pro is considered “the gateway” for institutional investor purchases of cryptocurrencies, and as such, Coinbase Premium is used to track institutional whale’s movement.

CryptoQuant states that the “2020 bull run was driven by institutional investors and high net-worth individuals in the U.S., which makes investors check Coinbase Premium more than ever.”

Historically, the highs and lows of the Coinbase Premium Index have signaled possible strong buys and strong sells from Coinbase.

For example, when the Coinbase Premium reaches high values, it signals Coinbase whales may be accumulating Bitcoin regardless of the high price. However, the reverse also applies when the Index falls to low values, indicating Coinbase whales are either not buying as regularly or possibly selling their coins.

Reviewing the year so far, the Coinbase Premium Index has flipped between red and green marginally – only straying from this pattern during the two major capitulation events witnessed this year (Luna and FTX). This shows a level of uncertainty and a lack of conviction from institutions this year compared to previous years.