Understanding TRX’s scenario and what to expect from it in near term

- The proposal for a new TRON update is underway that would increase energy cost

- TRX’s weekly chart was green and metrics were supportive of a price increase

Twitter account TRON Community recently revealed that a new update for TRON [TRX] was underway. It will result in several network changes. According to the tweet, if the update gets approved, the energy cost of the TRON network will be increased to $420. This change will also cause an increase in the daily burning rate of eight million TRX, with an inflation rate of -3.17%.

A new update to the #TRON network is currently being discussed in which energy costs will be raised to 420 sun 🤯 which means an increase in the daily burning rate of 8 million #TRX 🔥 with an inflation rate of -3.17% pic.twitter.com/lZBxTmjNa6

— TRON Community 🅣 (@TronixTrx) November 28, 2022

Read TRON’s [TRX] Price Prediction 2023-24

As of 28 November, TRON had burned over 8,483,079 coins with a net production ratio of less than zero, or -3,417,095, further proving its deflationary characteristics.

28th November: #TRON burns more than 8,483,079 coins 🔥 with a net production ratio less than zero -3,417,095 🤯 pic.twitter.com/sTruqtBSJq

— TRON Community 🅣 (@TronixTrx) November 29, 2022

Interestingly, TRX’s recent price action also looked pretty promising. It gave investors hope as its price increased by nearly 10% over the last week. According to CoinMarketCap, at the time of writing, TRX was trading at $0.05398 with a market capitalization of more than $4.9 billion.

Not only that, but TRON also remained quite popular in the crypto industry, as it was among the top 15 coins by trending searches on Binance.

TOP-15 COINS BY TRENDING SEARCH ON @BINANCE!#BNB $BNB #BTC $BTC $DOGE #ETH $ETH $VIDT $LEVER $SHIB $SOL $MATIC #TRX $TRX $LOKA $ATOM $STX $SUSHI $AVAX pic.twitter.com/6SZdsN5OUR

— 🇺🇦 CryptoDiffer – StandWithUkraine 🇺🇦 (@CryptoDiffer) November 28, 2022

Are the good days ending for TRON?

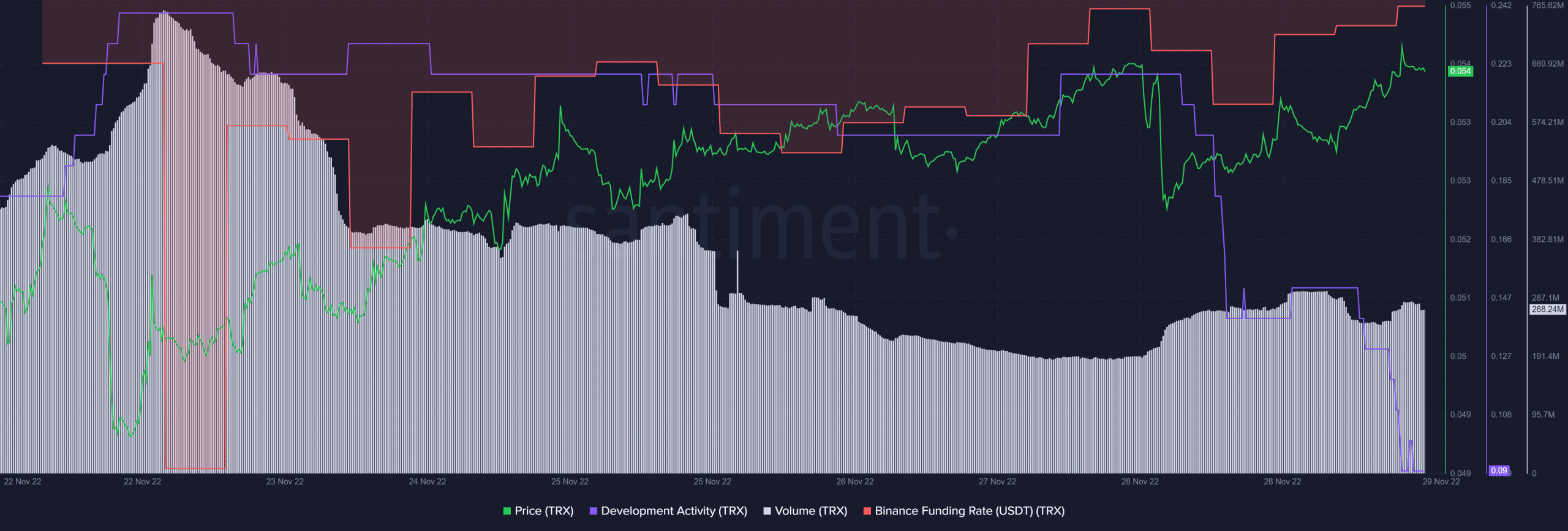

Though TRX’s performance of late looked good for the token, let’s have a look at the network’s on-chain metrics to better understand what’s going on. For instance, despite the commendable price hike, TRX’s volume registered a sharp decline, questioning the legitimacy of the surge.

TRX’s development activity also took a southward path, which was not a positive signal. However, the token managed to garner interest from the derivatives market; its Binance funding rate went up over the past few days.

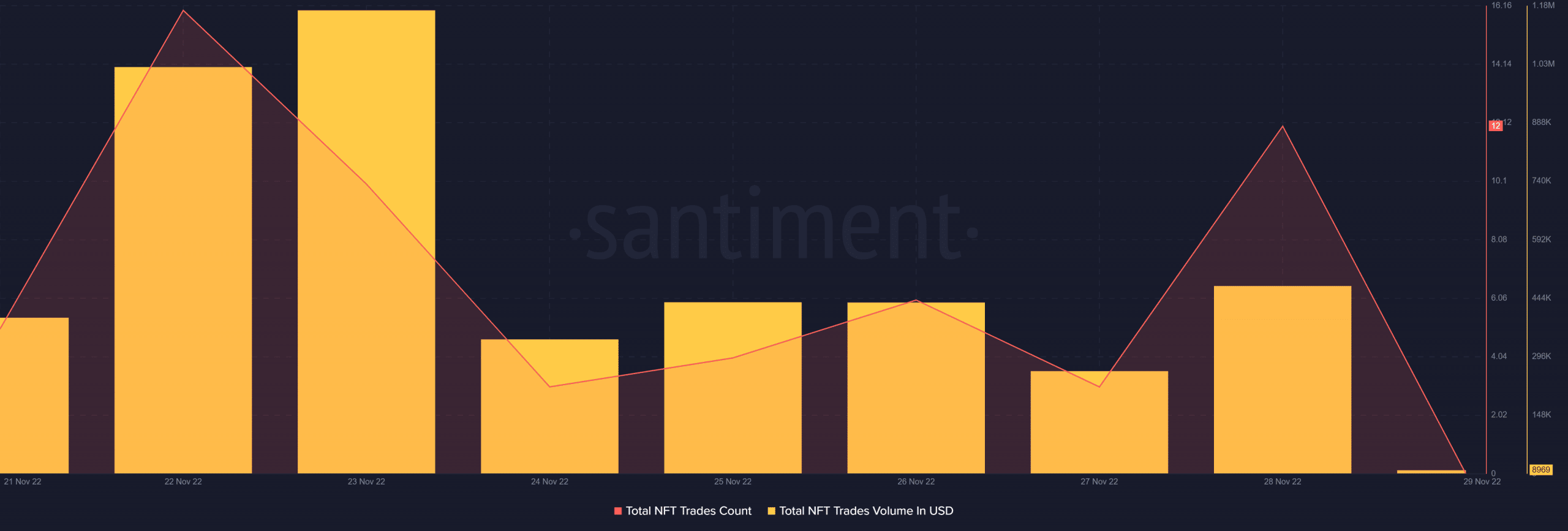

Curiously, TRON’s NFT space did not perform well over the last week. After registering a spike, TRX’s total NFT trade count and total NFT trade volume in USD went down.

Going forward

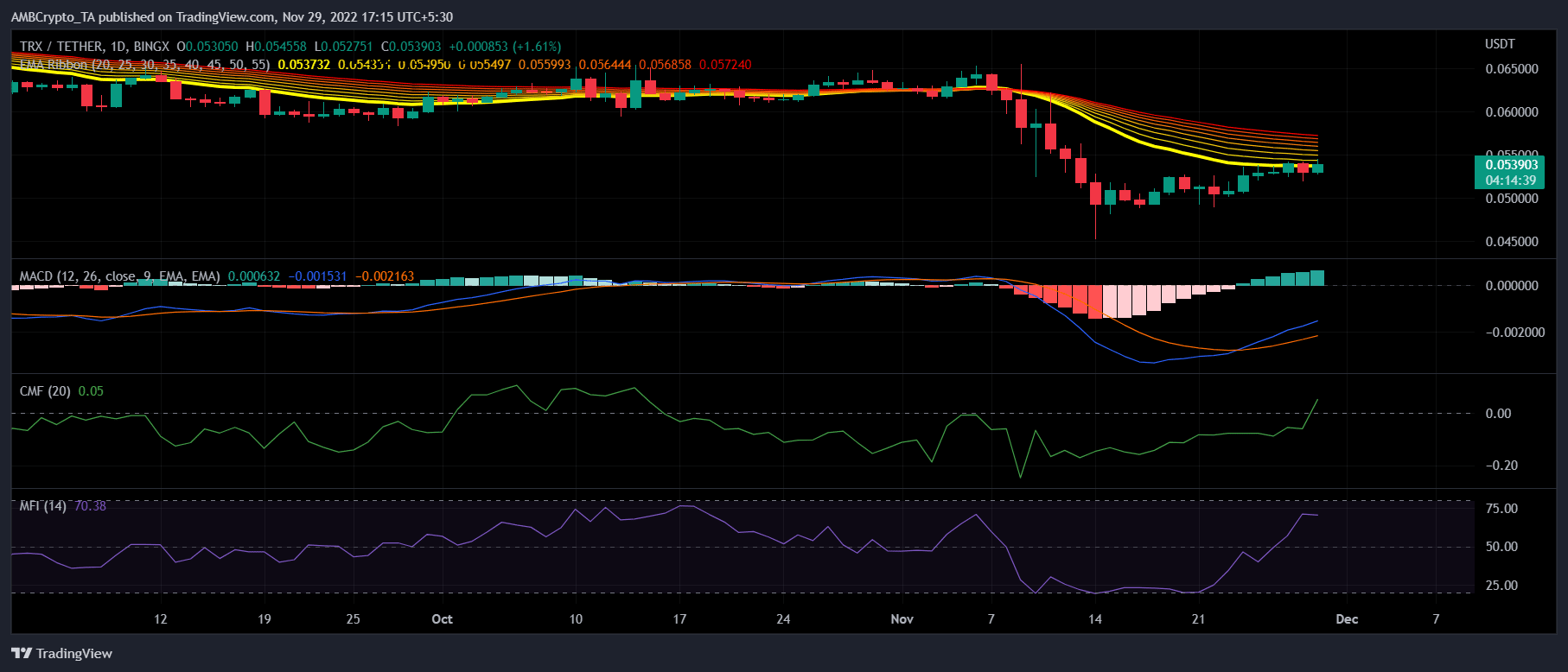

TRON’s daily chart revealed an ambiguous story, a few indicators were supportive of a further price hike. TRX’s Chaikin Money Flow (CMF) marked a sharp spike, which was a positive development. The MACD also displayed a bullish crossover, increasing the chances of an uptrend.

Nonetheless, though the Money Flow Index (MFI) had risen, it registered a slight downtick. The Exponential Moving Average (EMA) Ribbon revealed that the bears had an advantage in the market, which might be troublesome for TRX in the days to follow.