MakerDAO: What this “Optimistic” proposal may mean for MKR and DAI

- MakerDAO has offered to integrate the Optimism chain on its network subject to community approval

- Its stablecoin, DAI, has remained top of supply on the protocol, and could also be impacted by the integration

MakerDAO’s [MKR] mission to enable its users to get better incentives seems to have taken another turn with a proposed Optimism [OP] partnership. The project, in a very recent communique, noted that the aim of the proposal was to get its stablecoin, DAI users, deeply the application on the Optimism network.

Furthermore, the proposition centered around Optimism’s support for DAI around the Total Value Locked (TVL), bridging, and swapping via the network. As an update to the proposal, Maker reminded its community that,

“Since July 21’, Dai has been supported in the Optimism ecosystem through the Optimism official bridge. Dai is one of the most used stable-coins in Optimism with over ~$55M liquidity and it was the first stable coin to reach 1M and 50M in TVL on Optimism.”

Read Maker’s [MKR] price prediction 2023-2024

Staying put nonetheless

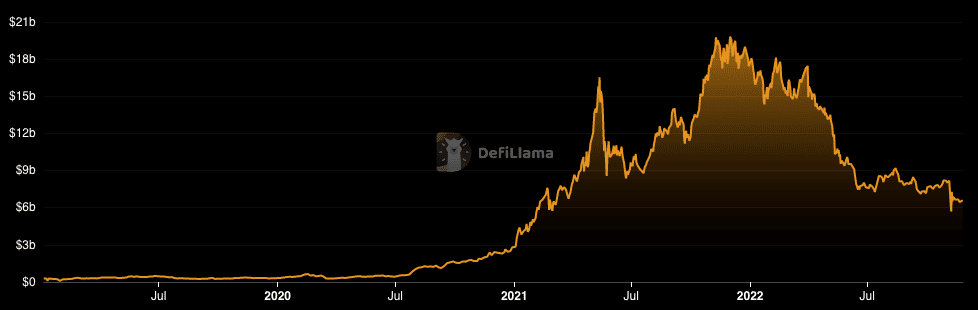

While the scheme could signal a positive development for the Maker ecosystem, its TVL hardly reacted to it. According to DeFi Llama, MKR’s TVL was 6.62 billion at press time.

This value represented a 1.04% increase in the last 24 hours, and a 19% fall-off in the last thirty days. So, this meant that the overall crypto assets deposited in the Maker protocol has not been so significant.

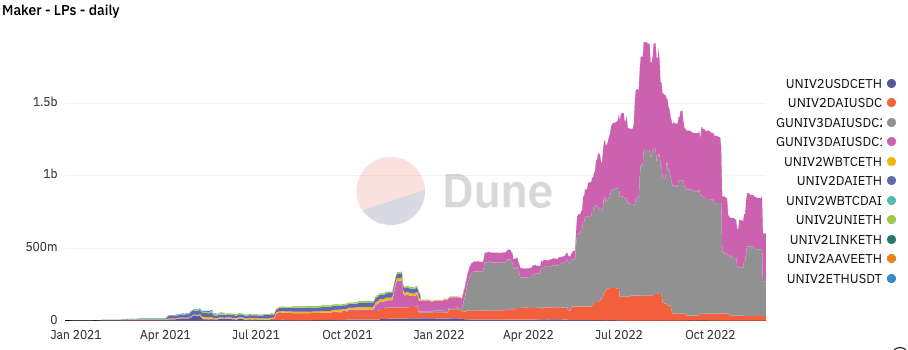

As for its liquidity pool daily deposits, DAI had the most volume according to Dune Analytics. With other assets including Ethereum [ETH] , and USDC forming a part, the Maker protocol addition of Optimism, if approved, could trigger a monumental increase in liquidity pool pledge.

Another reason this might be the case was because of the interest Layer-Two (L2) protocols have experienced in 2022. DAI further proved its importance to the Maker ecosystem with the position of the stablecoin ratio.

According to Dune, the stablecoin ratio for DAI was 65% at press time. For USDC, it was 48%. So, considering the possible integration of Optimism, DAI might increase its dominance.

The state of supply

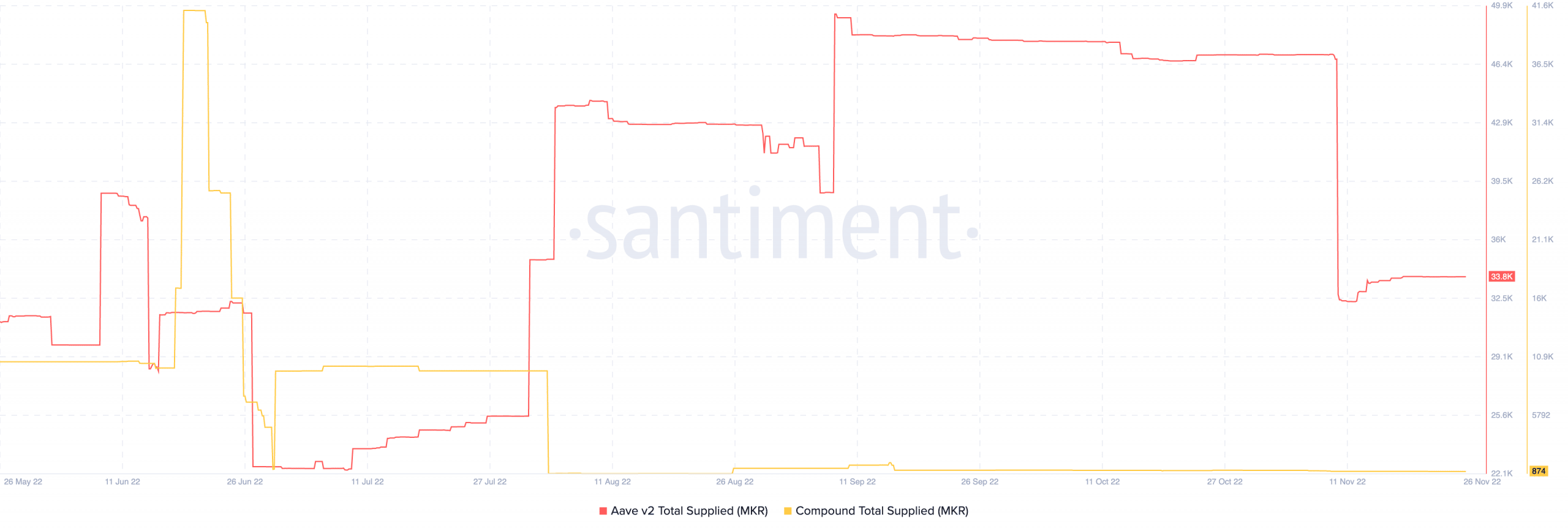

With regards to other protocols deposited on Maker, it has been a sideways occurrence. According to Santiment, AAVE’s total supply on Maker improved since 12 November. As of this writing, the total supply was 33,800.

This could indicate more demand for the market maker and positive pressure from AAVE holders. On the other hand, the Compound [COMP] total supply stood flat at 874. This was a position that it had maintained since September. Thus, Compound had contributed much less to the Maker protocol.

However, Maker noted that the OP integration might not happen before this year comes to an end. According to the protocol, if its community consents, it would happen in a win-win situation for both projects.