52% of Bitcoin Holders Now Losing Money vs 58% in March 2020

The on-chain data of Bitcoin shows that 52% of total Bitcoin holders are now losing money. What are the signs of a bottom?

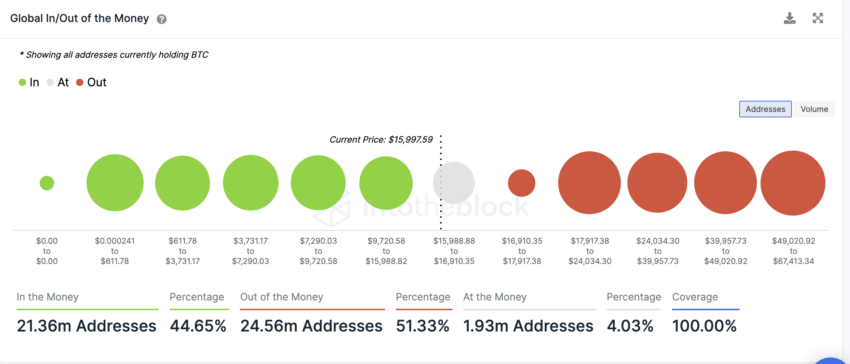

According to data from IntoTheBlock, 21.36 million Bitcoin (BTC) addresses are In the Money. Whereas 24.56 million addresses are Out of the Money and 1.93 million Bitcoin addresses are At the Money.

In the Money are wallets with an average purchase price of Bitcoin below the current price, which means the wallets are still making a profit. Over 44.65% of wallets are profitable. Whereas Out of the Money means that the average purchase price of Bitcoin is above the current price, which means the wallets are at a loss now. 51.33% of wallets are making a loss on their Bitcoin holding

4.03% of wallets are At the Money, meaning BTC’s price is just near their purchasing price. They are at a break-even point. The price of Bitcoin is over $16,100 as of writing

What portion of the Bitcoin HODLers were at a loss during bottoms?

During the recent Mar. 2020 bottom, over 58% of wallets were making losses.

Whereas during 2018 bottom over 55% of wallets were in loss. In 2014 bottom more than 65% of the BTC wallets were Out of the Money. According to historical data, the bottom generally falls when more than 50% of BTC wallets are making losses.

Is BTC in for a bottom?

If the Covid crash of Mar. 2020 is taken as an exception, the percentage of wallets making losses during every bear market has decreased. The percentage may also be decreasing because the total number of Bitcoin wallets with balance (green line) is in a steady rise since the inception of Bitcoin.

During the 2014 bottom, over 400k wallets were Out of the Money, whereas as of writing, in 2022, over 24 million wallets are Out of the Money.

Also, the market crashed by over 85% in the 2013 crash and around 80% in the 2017 crash. The market has already crashed by over 77% since Nov. 2021. The trend indicates that the bear markets are getting shorter over time. Does that mean that the market is in for a bottom anytime soon?

Got something to say about this on-chain analysis or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.