Solana Developers Work to Remove FTX Control Over Serum DEX

Solana developers want to fork liquidity hub Serum after the compromise of FTX led to hackers withdrawing over $400 million from the bankrupt exchange.

Given that FTX developed Serum, many developers believe that the FTX hack could have affected the decentralized network.

Developers Rush to Fork

Solana founder, Anatoly Yakovenko, said developers are forking Serum code today and will resume the protocol free of FTX involvement.

This is necessary because someone at FTX has a private key that could control the original code, and the key might have been compromised.

Yakovenko made this known to clarify the concerns expressed by Adam Cochran that Jump Trading is trying to fork Serum even though it might have liquidity issues itself. He said:

“This has nothing to do with SRM or even Jump. A ton of protocols depend on serum markets for liquidity and liquidations.”

The developer leading the forking, Mango Max, has also provided more updates about what led to the decision to fork. According to him, “the serum program update key was not controlled by its own organization, but by a private key connected to FTX. At this moment no one can confirm who controls this key and hence has the power to update the serum program, possibly deploying malicious code.”

The significance of the Serum protocol for Solana cannot be overstated. Several projects, including Magic Eden, Phantom, Mango Markets, and Jupiter, have all stopped using Serum as a liquidity source, citing security concerns.

Serum SRM Price Crashes 70%

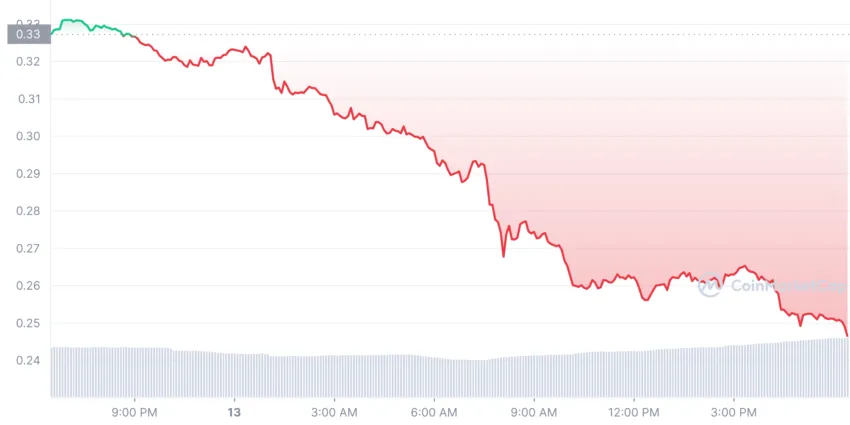

Meanwhile, the past week’s events have sent the value of SRM crashing. It has lost more than 70% of its value just in the last week alone.

It lost more than 34% of its value today following the news that it could be affected by the FTX hack. Its SRM cryptocurrency is currently trading at $0.2617.

Reports have revealed that SRM coins account for $2.2 billion of assets on FTX books.

DefiLlama data showed that Serum TVL has also dropped to barely $1 million. This is a significant decline in the year-on-year metrics. Its TVL was $1.7 billion as of this time last year.

It has gradually been reducing since the start of the year, reaching around $108 million by Nov. 7. The recent FTX crash has led to a more drastic decline for several tokens linked to the crypto exchange.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.