Quant [QNT] investors may need to consider this before going long

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Quant’s sway above its EMA ribbons exhibited a buying edge, can the buyers sustain this edge?

- The altcoin noted a substantial decrease in network growth.

Quant [QNT] expedited its bullish edge after the market-wide recovery over the last few days. The ongoing gains put the coin well above its EMA ribbons while they offered support over the past month.

Here’s AMBCrypto’s price prediction for Quant [QNT] for 2023-24

Should the recent reversal rally rebound from its immediate support, QNT could see a near-term bullish revival. At press time, QNT was trading at $165.9.

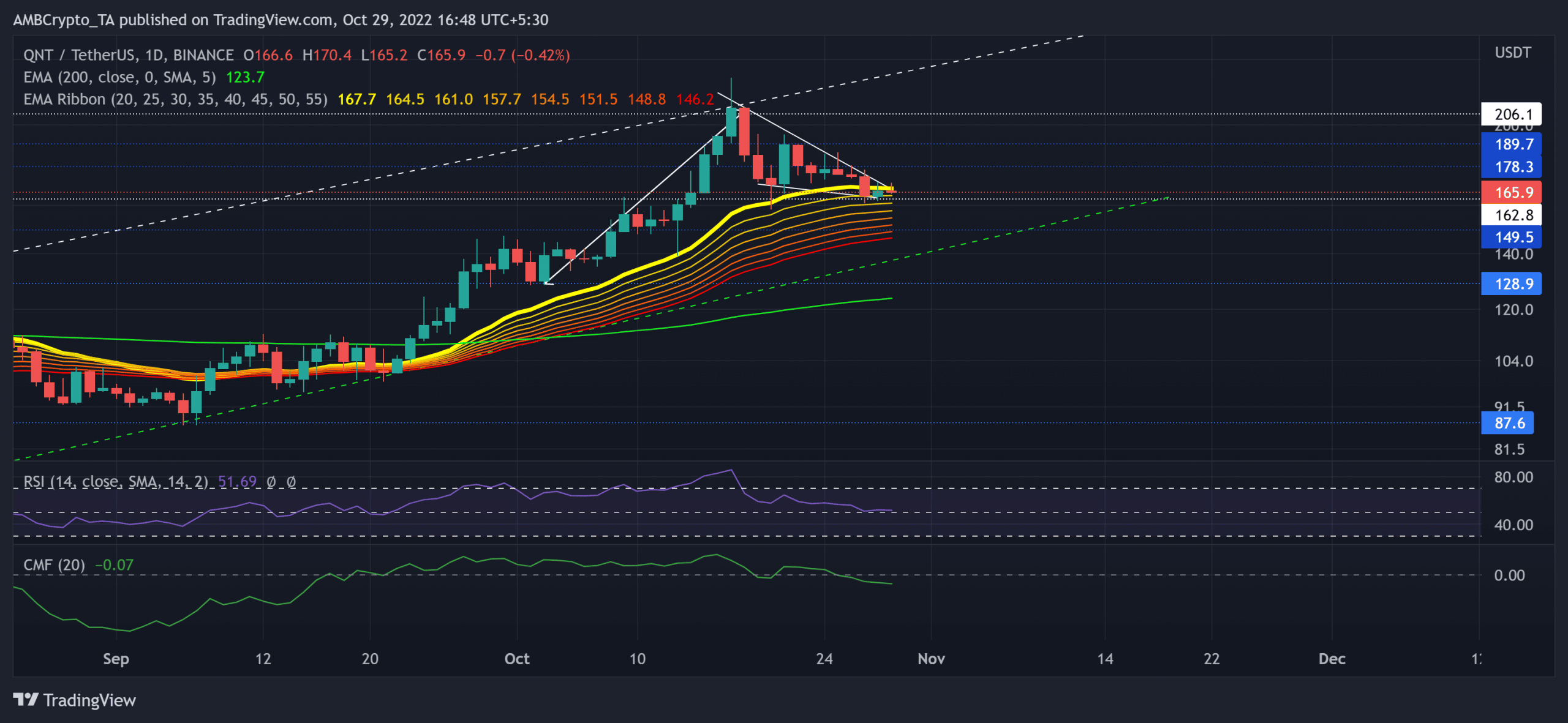

QNT formed a bullish pattern near the EMA ribbons support

Since mid-June, QNT’s revival from the $44 baseline defied the broader selling inclinations of the market as the altcoin consistently grew. In the meantime, it chalked out a five-month trendline resistance (white, dashed).

After facing bottlenecks near the 200 EMA (green), QNT bulls pulled off a rally beyond its high liquidity range to find fresher highs. The latest reversal from the trendline resistance confirmed a bullish pennant-like structure on the daily charts.

A plausible rebound from the $162-mark could open a pathway for a patterned breakout. Any convincing close above the 20 EMA can offer good buying opportunities.

In this case, the buyers must look for a potential retest of the $190-$200 range before a likely revival. An immediate decline below the $162-support and the 50 EMA could invalidate the bullish tendencies.

The Relative Strength Index’s (RSI) decline from the overbought levels rested near the midline to depict a neutral position. Any revival from this level could aid the bullish endeavors in the coming sessions. Nonetheless, the Chaikin Money Flow (CMF) was yet to find a spot above the zero mark to affirm a bullish advantage.

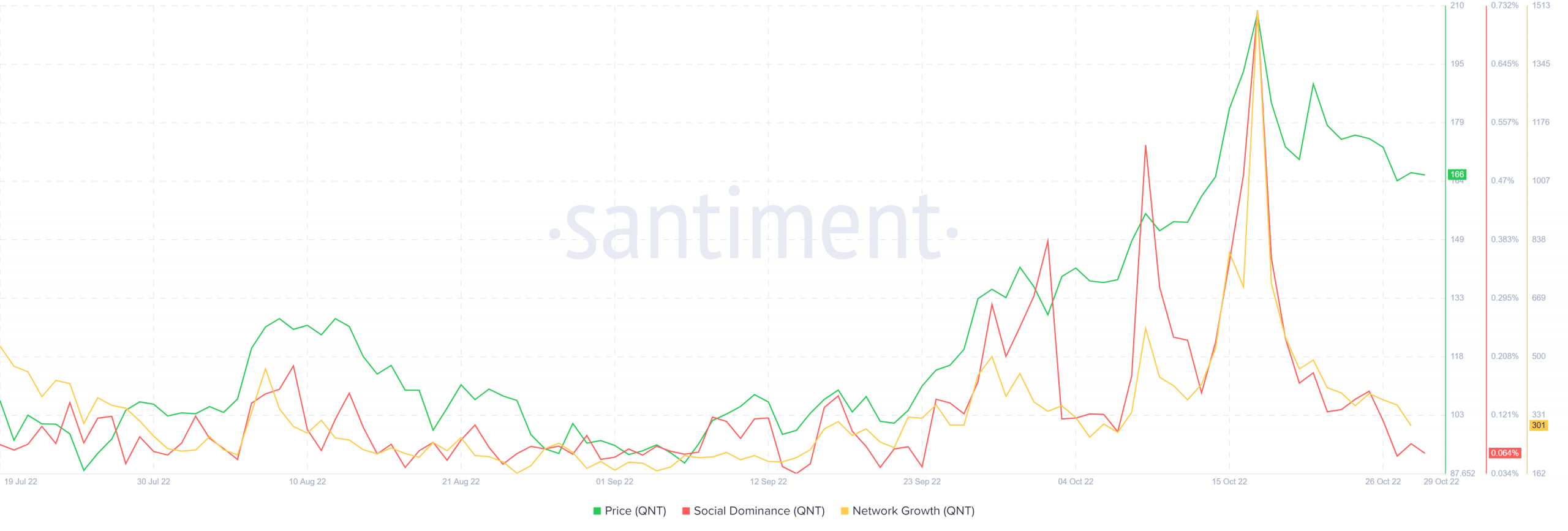

A decline in Social Dominance and Network Growth

An analysis of data from Santiment revealed a robust spike in QNT’s social dominance and network growth from mid-September to mid-October. However, over the last few days, QNT saw a substantial plunge in both of the above metrics.

While the price action seemed sensitive to them, the price did not decline as much. The buyers should keep a close watch on these metrics to gauge the underlying sentiment toward the crypto. Finally, keeping a watch on the king coin’s movement could help make a profitable bet.