DOGE investors jumping with joy should watch out for these Musk-induced injuries

After five months of trial and error, Dogecoin [DOGE] crushed the $0.1 mark following the completion of the Elon Musk Twitter acquisition. Since the world’s richest man “let that sink in” tweet, DOGE has not halted its increase. In fact, the meme coin seemed even prepared since 25 October.

However, the 32.95% increase between 28 and 29 October which led DOGE to $0.1131 as of 29 October might call for more attention. In curious terms, will Dogecoin remain in the bullish zone for a few more days?

Here’s AMBCrypto’s Price Prediction for Dogecoin [DOGE] for 2022-2023

Here I abide, and will remain

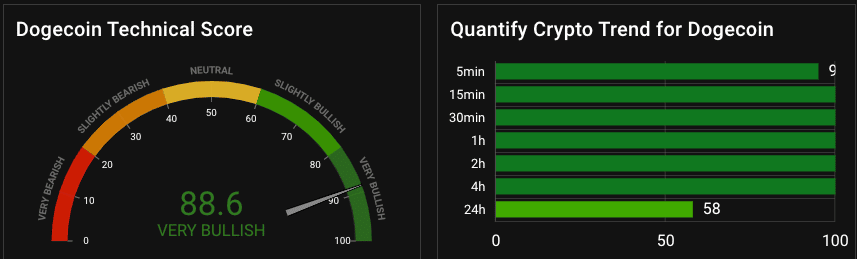

Before the recent hit, the last time DOGE hit $0.1 was on 11 May. In an unexpected turn of events, it seemed this increase was not a regular meme “pump and dump”. According to Quantify Crypto, DOGE was still very bullish at 88.6%. The technical analysis information platform also noted that the coin stayed at the top of the crypto minds. Although, the interest had decreased slightly.

Even with the technical data, it might sound too hasty to conclude that DOGE would continue to produce profits. Hence, it was important to consider the price action.

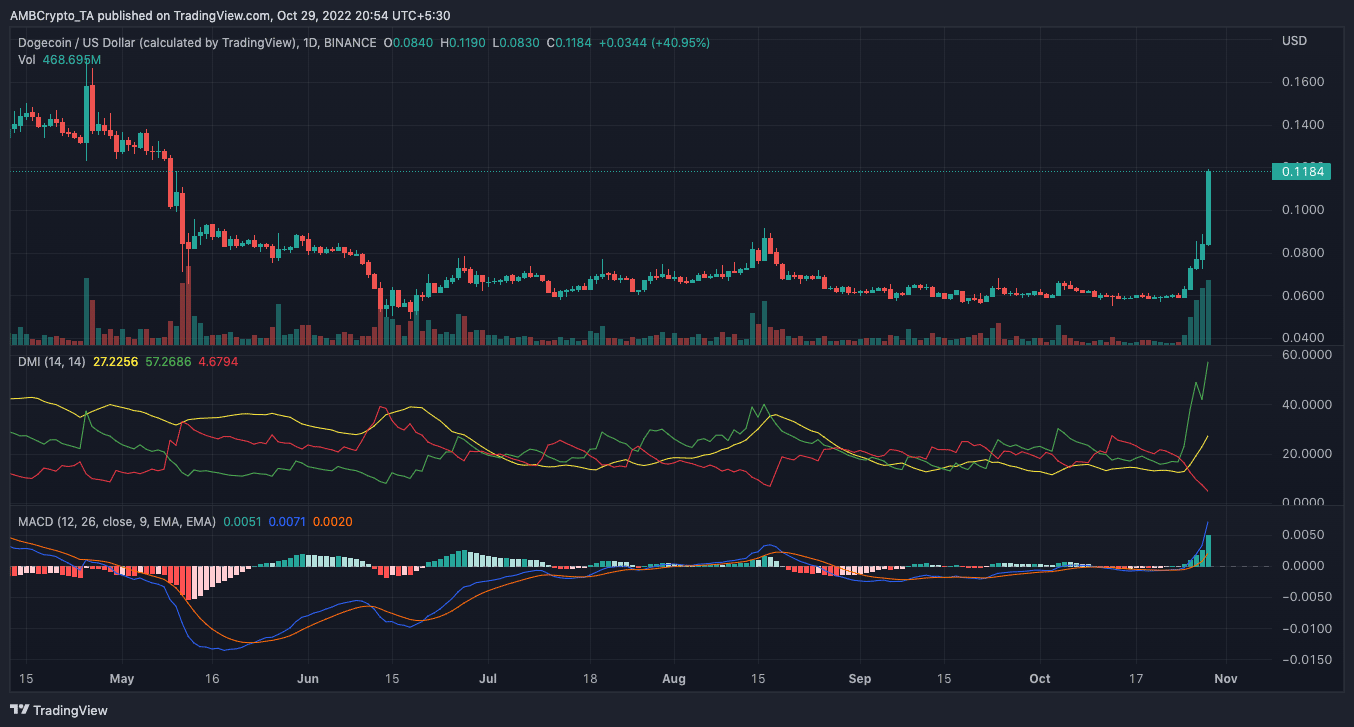

On the daily chart, the Directional Movement Index (DMI) was in full agreement with the Quantify Crypto report. At the time of writing, the positive DMI (green) was in completely focused uptrend mode at 56.26.

In the same accord was the Average Directional Index (ADX). The ADX (yellow) at 27.22 showed that the buyer impact which also meant the positive DMI had strong directional movement. For the sellers (red) in the opposite direction, there was little to no support as the negative DMI fell awkwardly to 4.67. The implications of this trend was that DOGE was solidly in a bull trap and had the potential to skyrocket past its tremendous increase.

For the Moving Average Convergence Divergence (MACD), DOGE’s position indicated a strong buyer momentum as the sellers’ strength (orange) remained below the buyers’ (blue). Especially, with the 12 to 26 EMA above the histogram’s midpoint, there was almost nothing that could pull DOGE back.

Take all I have to offer

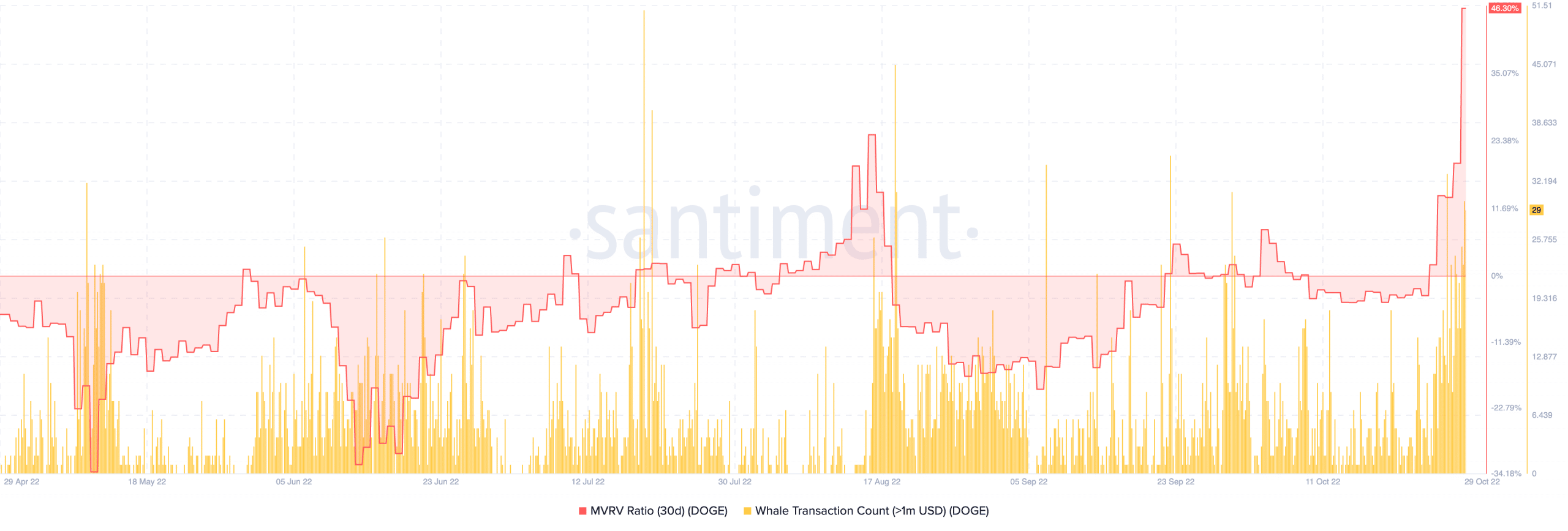

Per on-chain data, DOGE seemed to have stayed true to its profit-provision objective. This was revealed by the Market Value to Realized Value (MVRV) ratio. Based on data from Santiment, the MVRV was at a whopping 46.30%.

The information showed that the ratio had been on a non-stop increase since leaving the -3.10% spot on 24 October. At this rate, it was evident that DOGE investors had made almost twice their investment if they had bought the bottom before the rally. With an increasing MVRV ratio and an unending whale involvement, DOGE might extend its bullish stay.