What Binance’s latest update might mean for TRX investors

A major update came in for Tron (TRX) recently as Binance, one of the world’s largest crypto-exchanges, announced that it would support TRX staking on its platform from 27 October. Thanks to this update, users can not only stake, but also earn up to 6.1% annual percentage yield at launch.

Here’s AMBCrypto’s Price Prediction for Tron (TRX) for 2023-24

Attention @trondao community!#TRON is officially live for staking on #BinanceUS!

Stake your $TRX on the LARGEST on-chain #staking platform in the U.S today.https://t.co/QJqSQtkFa1 pic.twitter.com/uTa9o48o0P

— Binance.US 🇺🇸 (@BinanceUS) October 26, 2022

Customers can get paid weekly when they stake TRX and unstake anytime to access their funds with no unstaking period. According to the exchange’s official statement, Binance mentioned that the maximum TRX staking limit will be 700,000.

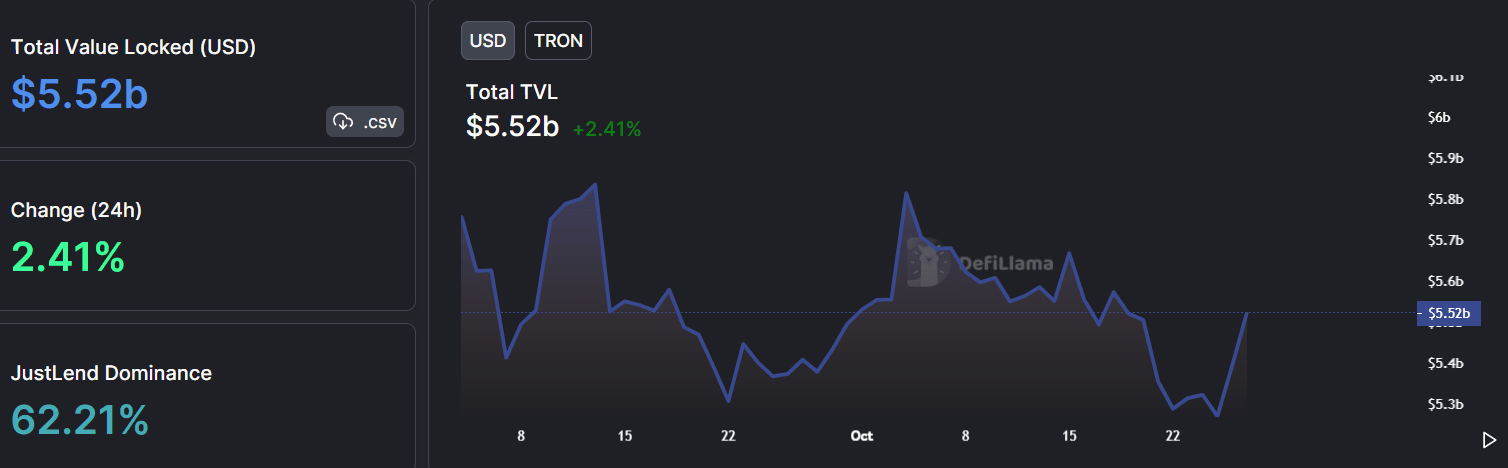

Interestingly, Tron’s TVL has gone down over the last few weeks, as per DeFiLlama’s stats. On the contrary, on 25 October, it registered an uptick and at the time of writing, it was up by 2.41% in the last 24 hours. Owing to this update from Binance, we can expect the value to grow further in the coming days.

That’s not all either as TRX has been on fire in terms of burns. In fact, it has been consistently burning huge amounts of tokens, which in the long term will help the coin increase its value. On 26 October alone, over 8.8 million TRX were burnt, with a net production ratio of -3,740,112.

25th October: #TRON burns more than 8,806,096 coins 🔥 with a net production ratio less than zero -3,740,112 🤯 pic.twitter.com/OFfOqvAXDC

— TRON Community 🅣 (@TronixTrx) October 26, 2022

And yet, TRX failed to meet investors’ expectations in this bullish market as it registered only single-digit 7-day gains. According to CoinMarketCap, at press time, TRX was up by 0.91% in the last 24 hours and was trading at $0.06352 with a market capitalization of over $5.85 billion.

TRX must buckle up

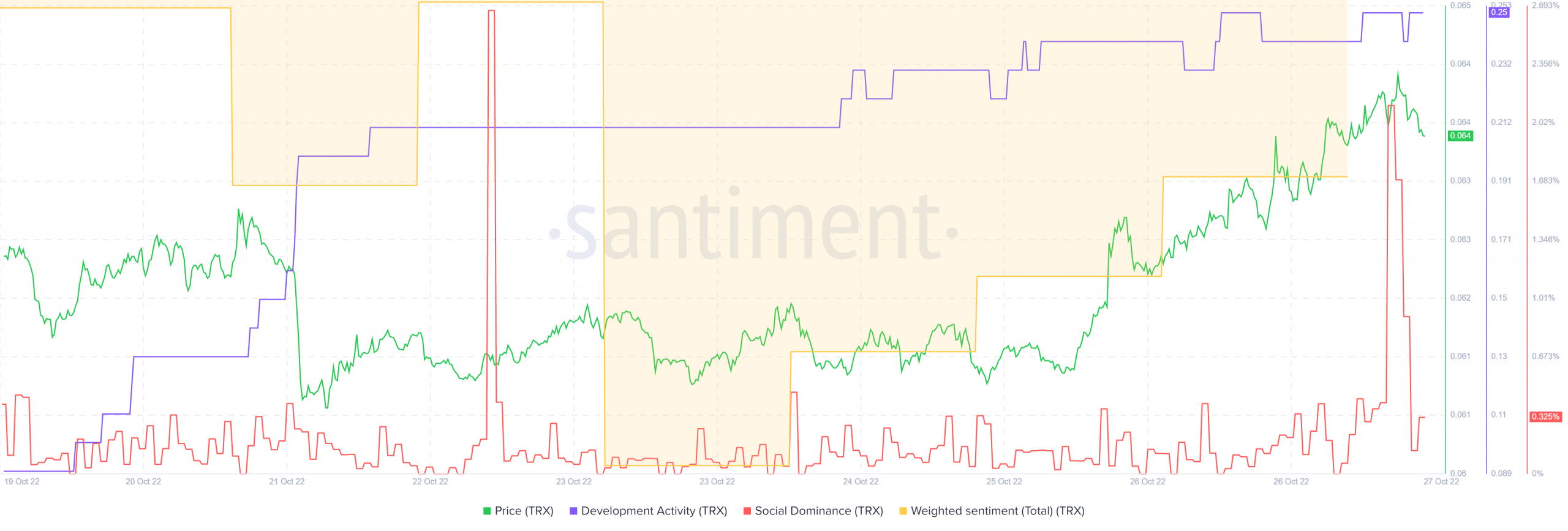

Surprisingly, despite a sluggish performance over the past week, TRX’s on-chain metrics have been quite positive.

TRX’s development activity hiked over the last seven days – A positive sign. Additionally, social dominance and weighted sentiments also followed the same path and spiked recently, giving hope to investors for better days to come.

Here come the bulls

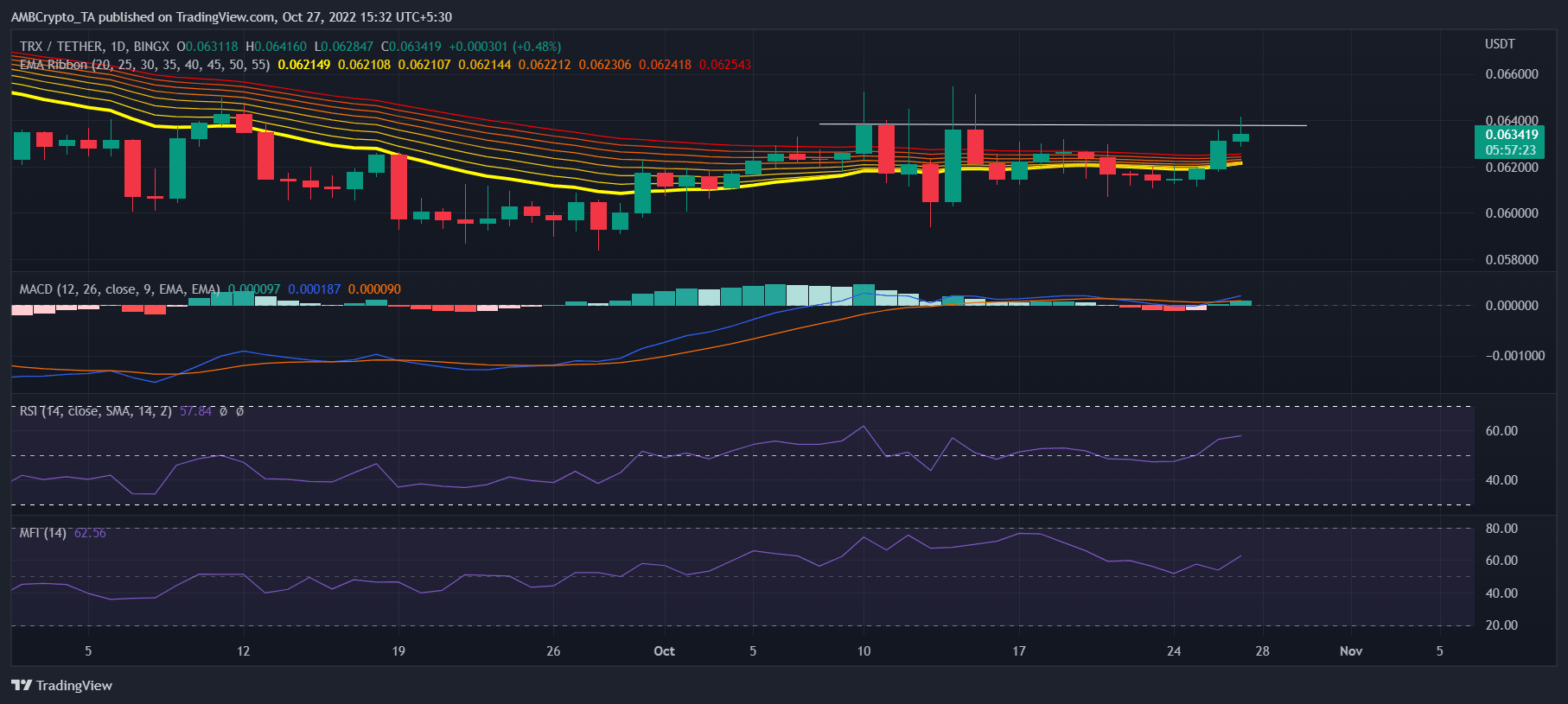

TRX’s daily chart looked quite bullish and indicated that the upcoming week might bring joy for TRX investors. For instance, the Exponential Moving Average (EMA) Ribbon suggested the possibility of a bullish crossover.

Additionally, the Relative Strength Index (RSI) and Money Flow Index (MFI) were both resting above the neutral position, which is yet another bullish signal. The MACD highlighted the bulls’ advantage in the market as a golden crossover happened recently.

Therefore, considering all the aforementioned metrics and market indicators, TRX investors can expect better days to come.