Can Bitcoin transactions be traced? Are they anonymous?

What was the purpose behind the invention of Bitcoin? The answer can be found in a whitepaper supposedly drafted by Bitcoin creator/s Satoshi Nakamoto. The primary purpose of creating a ‘peer-to-peer’ digital currency was to have a payments system that could operate without a financial institution. The abstract of the nine-page whitepaper makes no mention of terms like privacy or anonymity.

But there is this one question about Bitcoin that has baffled everyone — can Bitcoin transactions be traced? The reason is that the world’s first cryptocurrency, invented almost 13 years back, is yet to become a mainstream mode of payment in any big economy. Instead, it has found its use as a speculative investment asset, and, sadly, also as a form of payment accepted by hackers and scammers. In the latter aspect, many assume that since Bitcoin only exists online, it can be easily moved without anyone knowing the identity of the transacting party.

Are transactions made using Bitcoin just anonymous or untraceable as well? There is a difference because if the transaction is traceable to its roots, it might become possible to lift the veil and expose the actual sender and beneficiary. Let us explore the subject of Bitcoin’s traceability.

Nakamoto’s whitepaper

The most reliable source to understand the subject could be the whitepaper that contains the very fundamental idea of Bitcoin. The document is tilted heavily in favour of Bitcoin’s use as ‘electronic cash’, with network timestamps to prevent any double spending. Nodes are to participate in the timestamping process, and any intermediary like a bank has no role. Even though the transaction recording process is a bit technical — nodes undertake a proof-of-work exercise — the whitepaper is pretty clear with respect to privacy.

Privacy is one of the sub-headers included in the short document — many other cryptocurrency whitepapers are very exhaustive — and it compares a Bitcoin transaction with deals on any stock exchange. When shares are traded on an exchange, the actual identity of the parties is not made public, and it is only the numerical value of the trade that anyone can know. Nakamoto’s whitepaper claims Bitcoin’s ‘new’ privacy model is different from banks’ ‘traditional’ model because the former separate actual identities from publicly available information about the transaction.

The concluding paragraph of the whitepaper speaks only about the utility of Bitcoin as peer-to-peer electronic money and the reliability of the network in recording transactions and preventing any double spending. Moreover, the document is quite old, and it was only in the later years that the anonymity and traceability of Bitcoin became a hot topic for debates.

Traceability of Bitcoin

The idea of having a transparent and peer-to-peer managed payments network fails if there is no traceability of transactions. Bitcoin movements can be easily traced back to the transaction wallets. Every payment is linked to a sender and a recipient wallet address, and an explorer for Bitcoin’s blockchain can enable the tracking of the wallets of the sender and receiver. On the other hand, there are some ways, like having a cryptocurrency mixer, which can help make the traceability of transactions difficult, but not impossible.

Last year, one episode revealed the traceability of Bitcoin. Colonial Pipeline — a leading pipeline system for carrying fuel supplies in the US — was hacked last year and the perpetrators demanded that ransom money be paid in Bitcoin. Colonial Pipeline Co. paid the ransom in Bitcoin. However, law enforcement authorities could trace the recipient’s Bitcoin wallet. The Federal Bureau of Investigation (FBI) was also in possession of the private key that could unlock the wallet.

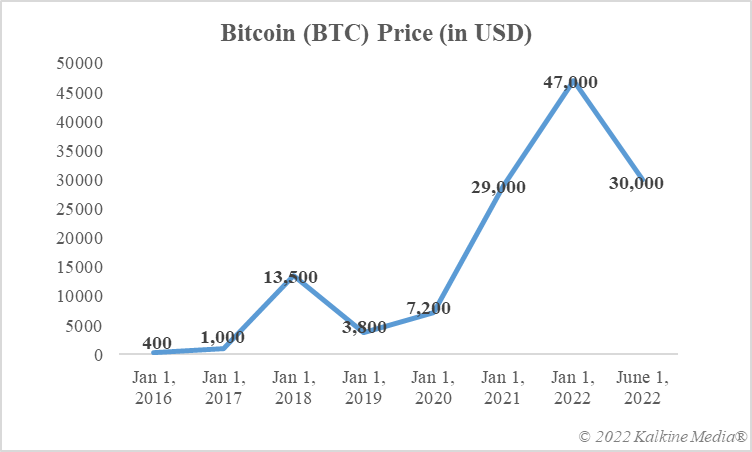

Data provided by CoinMarketCap.com

The anonymity factor

Traceability and anonymity are two different things when it comes to Bitcoin. Tracking the actual beneficiary can still be difficult even after the wallet has been traced. This is because the digital wallet can be availed without providing a name, bank account details, national identification number or such other details. This is the reason why it took many years before the actual perpetrators behind the infamous Bitfinex cryptocurrency hack in 2016 could be identified. The so-called ‘crypto couple’ could hide its identity, but when the stolen Bitcoin were converted to fiat money, it was caught.

Bitcoin is available as a speculative asset on many dedicated cryptocurrency exchanges. Many countries require these intermediaries to abide by Know Your Client (KYC) norms so that the actual beneficiary behind any cryptocurrency wallet can also be traced. That said, experts feel that multiple ways might exist that can help the beneficiary hide or forge their identity and escape detection.

Bottom line

Bitcoin’s privacy is discussed in Nakamoto’s wallpaper. However, the purpose of this privacy had nothing to do with promoting unlawful transactions. The cryptocurrency has been sought as a ransom payment in many cyberattack cases, including the Colonial Pipeline episode last year when the FBI could trace the recipient’s wallet and recover Bitcoin. The actual identity of the hackers behind the Bitfinex hacking episode is also now in the public domain. This means Bitcoin transactions have near-complete traceability in terms of the recipient wallet, with the possibility that the actual beneficiary can also be tracked.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.