The Federal Reserve Versus UN And OPEC – Bitcoin Magazine

“Fed Watch” is a macro podcast, true to bitcoin’s rebel nature. In each episode, we question mainstream and Bitcoin narratives by examining current events in macro from across the globe, with an emphasis on central banks and currencies.

Watch This Episode On YouTube Or Rumble

Listen To The Episode Here:

In this episode, CK and I cover a large chunk of the ongoing macro news. First, we covered New York Federal Reserve President John William’s speech on inflation, then the U.N. report demanding central banks change course and finally the OPEC decision to cut quotas by 2 million barrels per day (mbd).

Charts And Bitcoin Sentiment

Each week, CK and I lead off with a bitcoin chart to center our macro conversation from this perspective.

The daily chart from this week shows a slight bullish curl as it approaches the diagonal trend line. Several indicators are bullish, including more significant weekly and monthly signals.

On the weekly chart, the first ever weekly bullish divergence has locked in. This does not mean we can’t have further downside. If you look at the red columns on the chart below that signify weekly bearish divergences, you can see they often come in multiples. However, at the first sign of a weekly divergence, it does signal that we are very close to the ultimate reversal.

The sentiment in the Bitcoin ecosystem has started to shift from fear to being slightly more positive. If the price can capitalize here and break out, we could experience a sizable shift into bullish momentum.

In this section, CK and I also discuss a possible bitcoin decoupling from stocks. The correlation has been quite high recently, but bitcoin does offer some fundamentally different properties. As CK points out, bitcoin is not weakened by being exposed to a specific company’s revenues in a credit crisis. Where companies might face harsh credit conditions, bitcoin doesn’t. Bitcoin actually benefits from a flight away from credit risk.

How The Fed Defines Inflation

In this segment, I read several quotes from a recent speech by John Williams, president of the New York Federal Reserve. Most of it revolved around a funny definition of inflation, which Williams calls the “Inflation Onion.”

The first layer of this onion is commodity prices, the second layer is prices of products like appliances and vehicles. The innermost layer of the inflation onion is — wait for it — underlying inflation.

There we have it: Inflation is an onion of different layers of prices. At the root is supply and demand and underlying inflation. No mention at all of money printing or debasement. I think what he intends to portray is that inflation works its way through the economy. Prices of commodities trickle inward to products, in this case, which in turn trickle inward to things like rents and labor.

U.N. Tells Central Banks To Halt Rate Hikes

This week saw the release of the United Nations’ annual Trade and Development Report, in which they described the current status of the global economy and provided policy recommendations. Overall, I was surprised by the cogent nature of the report, getting many things right. They even used terms like “super-hysteresis” and shadow banking, ideas we’ve been talking about on “Fed Watch” for years.

We go through several quotes right out of the report and find ourselves agreeing with them multiple times. It is only when the U.N. comes to make recommendations that they lose us.

The policy choices are straight out of the World Economic Forum or communist playbook. They are full of phrases like “equitable distribution of income” and “redistributive policies.” What they want the Fed to do is to stop rate hikes that are disproportionately hurting emerging markets and instead use price controls and regressive taxation.

OPEC+ Reduces Quota By 2 Million Barrels Per Day

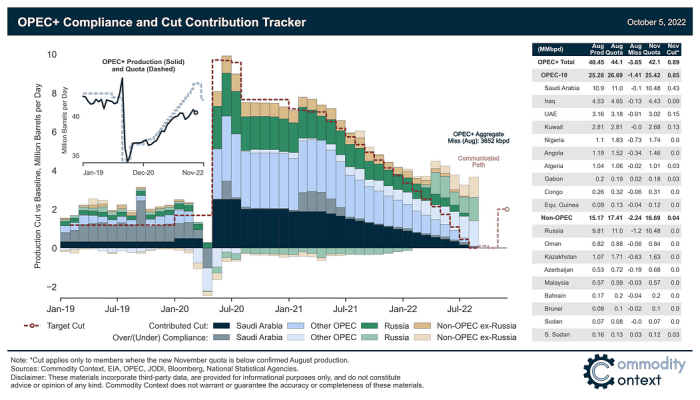

A lot of this story doesn’t make sense to me. OPEC+ had an in-person meeting on October 5, 2022 and decided to reduce their oil production quota by 2 mbd. However, this comes as they are currently producing 3.6 mbd below their current quota.

Source: Commodity Context

Under the voluntary production quota cut, OPEC’s total voluntary quota in November is 42.1 mbd, but their August production was 40.45 mbd. As it stands now, the reduction in the quota of 2 mbd, with current production levels, only shrinks OPEC’s shortfall. They will still have 1.6 mbd of room to increase production!

Some people are figuring the new voluntary quotas by country, which results in a 0.86 mbd reduction, mostly from Saudi Arabia, but the total is as stated above. I’ve been calling it voluntary because OPEC officials stressed that these quotas were voluntary.

Wait, what? How is this some sort of emergency? It’s not. CK and I speculate on exactly why we see all the fear-mongering headlines we do from this story and it boils down to election season timing and narratives.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.