Ethereum Price (ETH/USD) Has Declined By Over 13% Since The Transition| FXMAG.COM

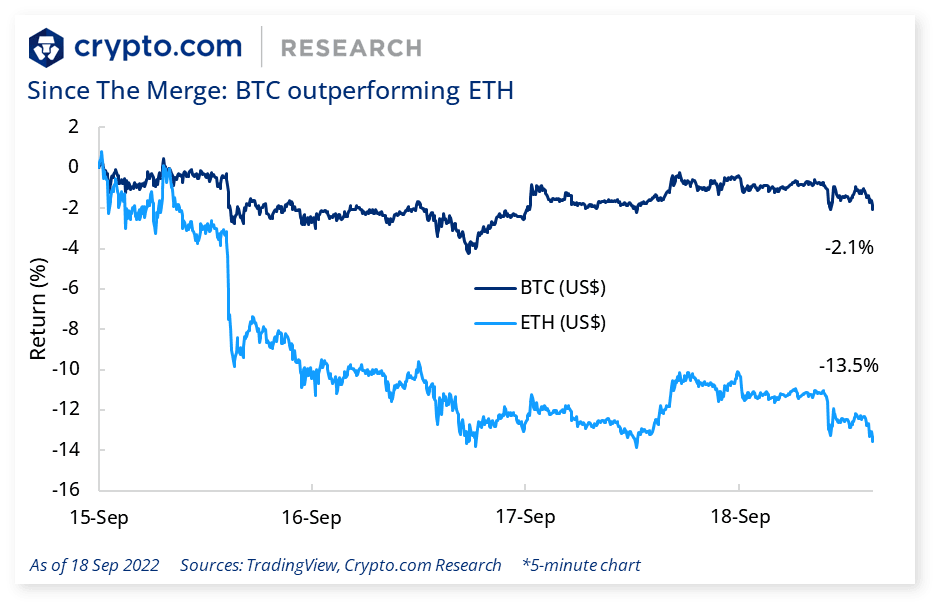

ETH’s The Merge was completed. ETH is down 13.5% since The Merge; BTC is outperforming. U.S. Aug inflation at +8.3% YoY, higher than expected.

Chart of the Week: The Merge…Crickets

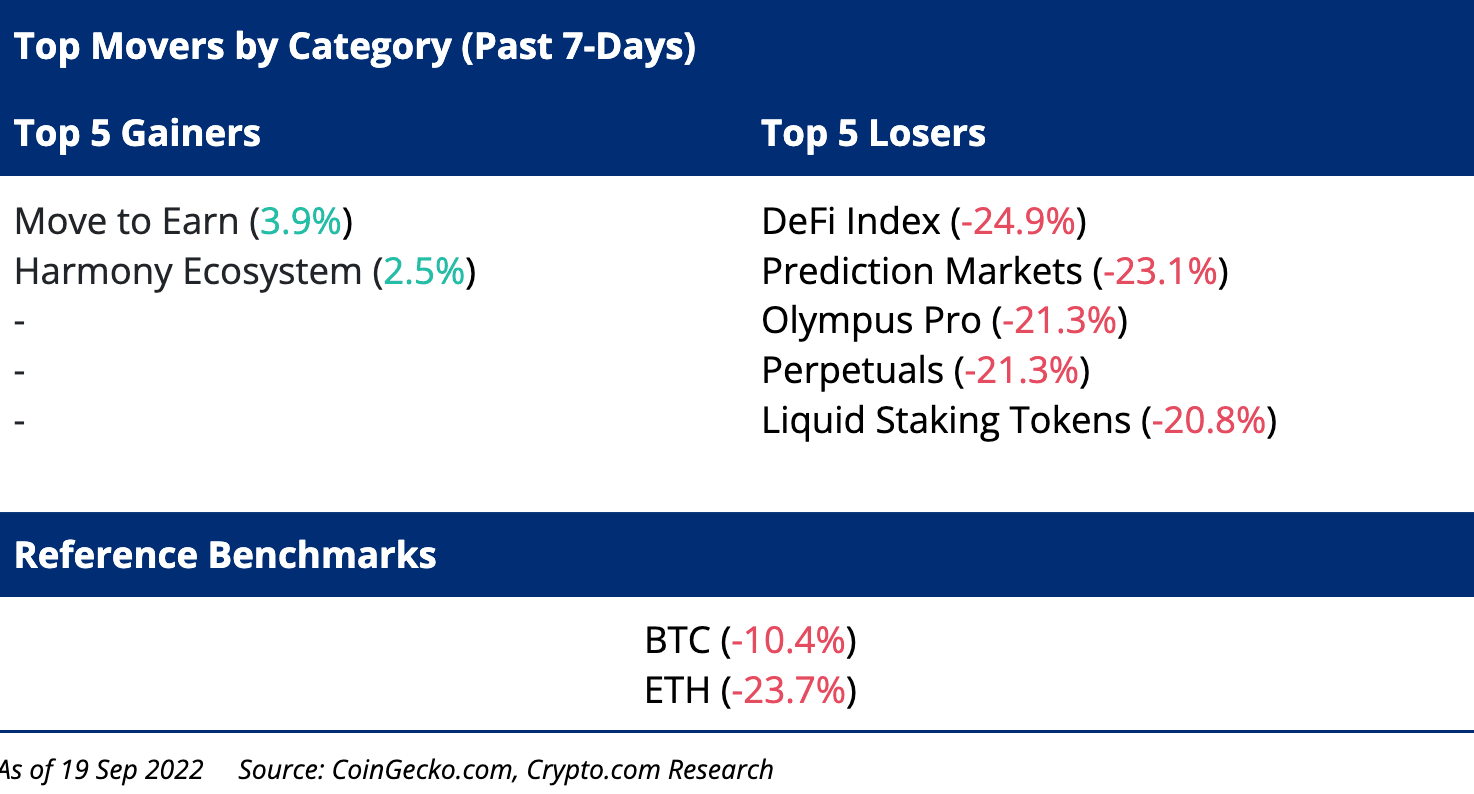

- Ethereum’s The Merge, one of the most anticipated events in the cryptosphere, was completed on 15 September. From a ETH price performance perspective however, it has been rather underwhelming, as ETH has dropped 13.5% since The Merge. Perhaps the prior substantial price surge since the June lows indeed made it a sell the news event?

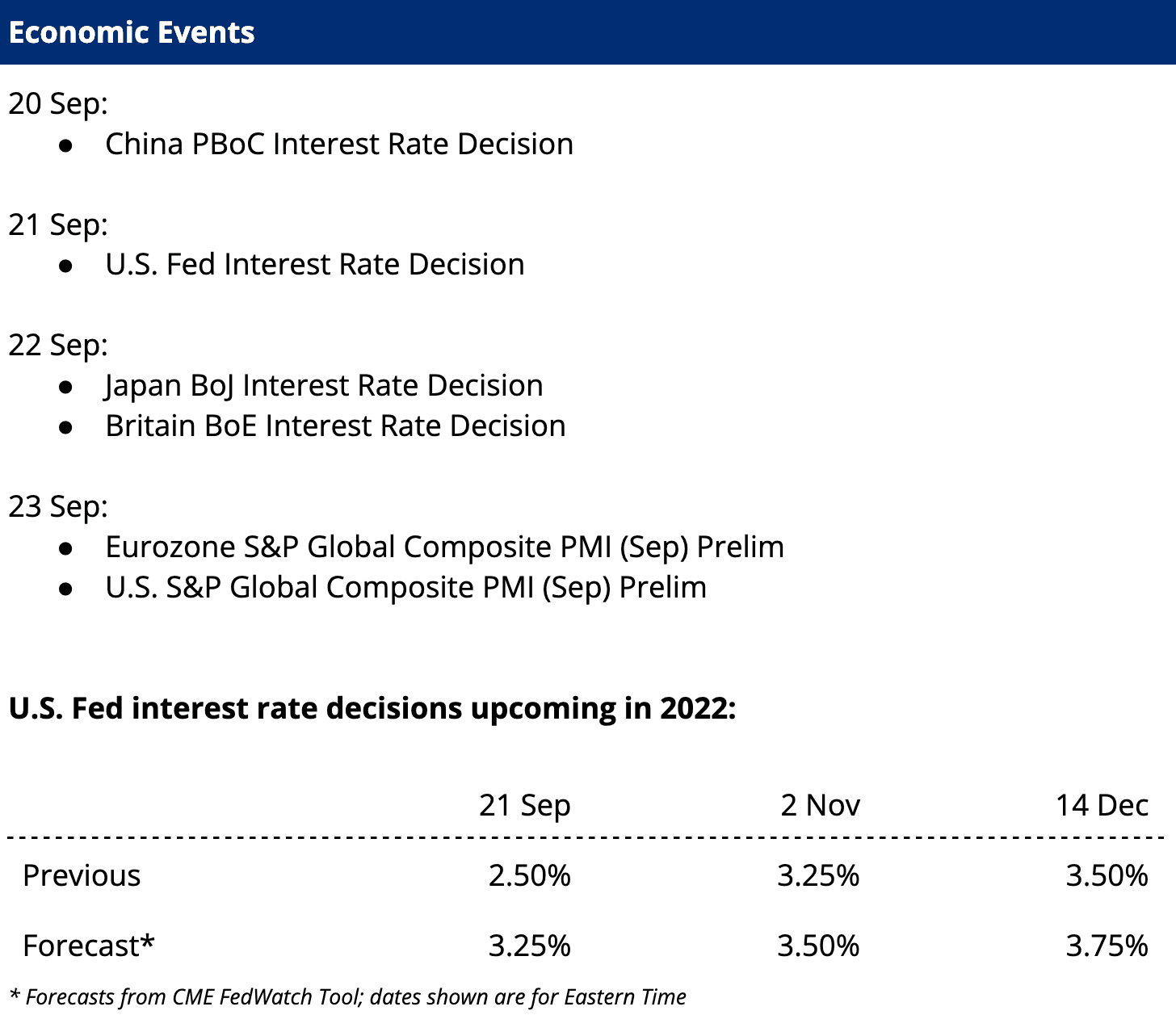

- Also, macro headwinds are perhaps proving difficult to overcome, with a higher than expected August U.S. CPI print (+8.3% YoY) last week and the upcoming Fed rates decision on 21 September. Read our recent Alpha Navigator report for more analysis.

Fund Flow Tracker

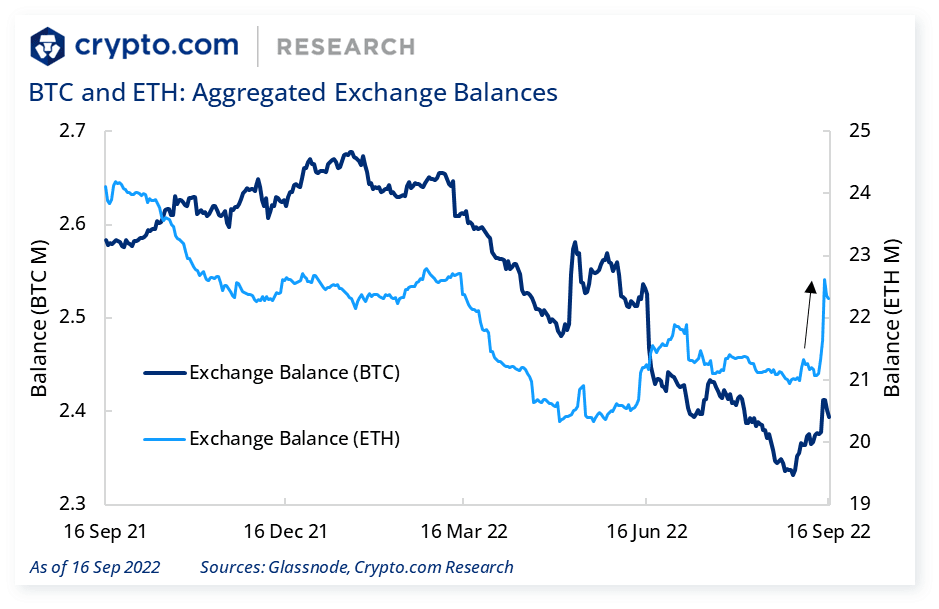

- The aggregated exchange balance for ETH spiked over the past week and marked the highest level since July 2022.

Derivatives Pulse

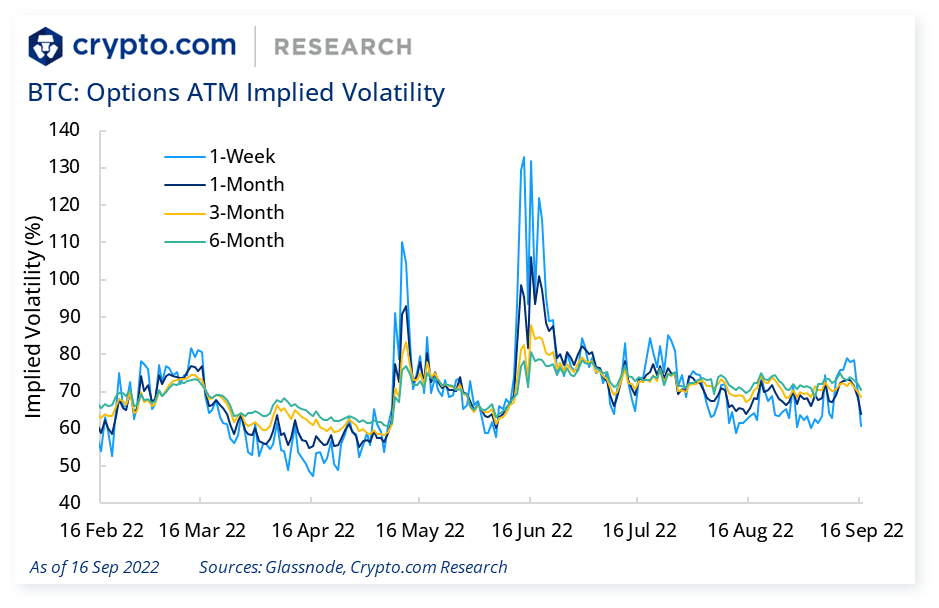

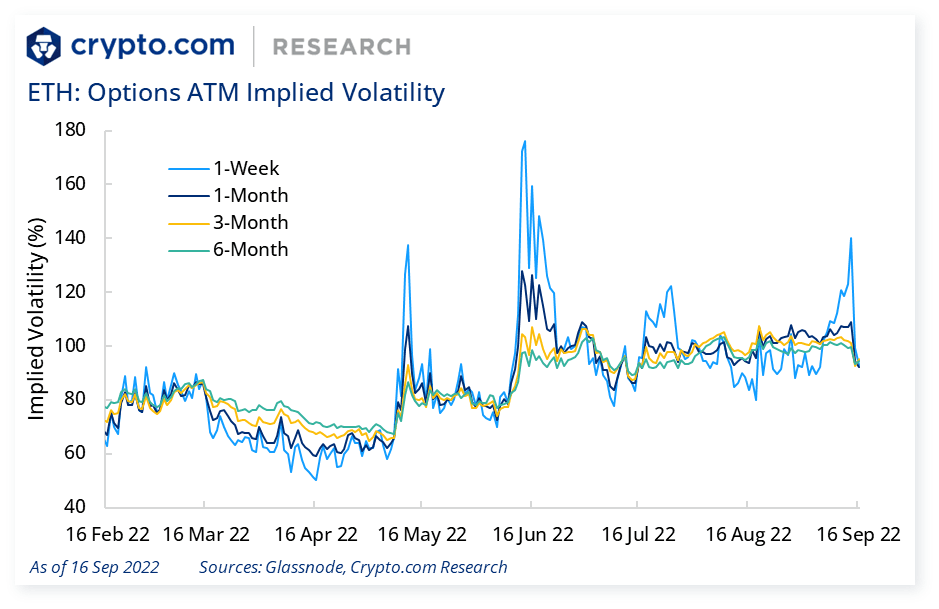

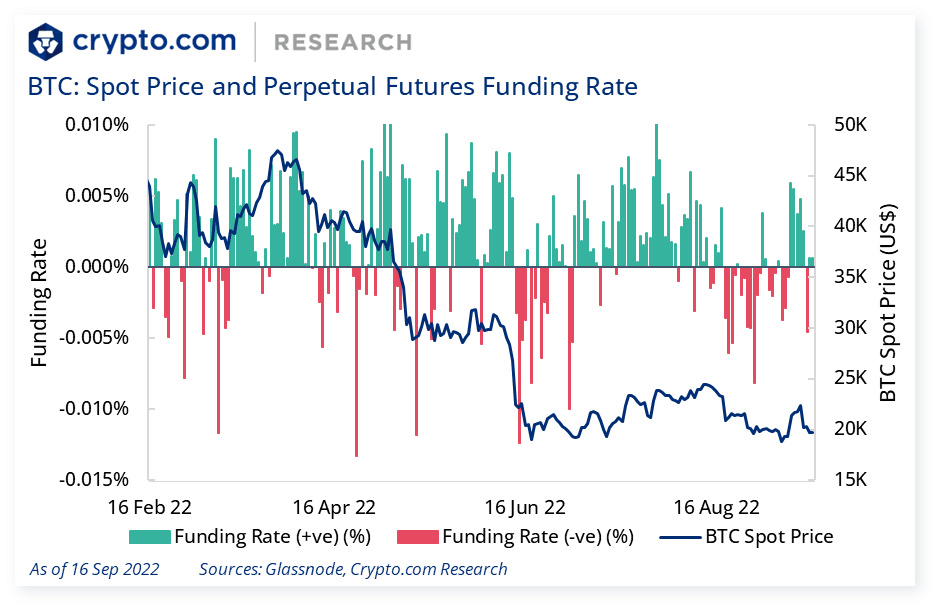

- Implied vols for both BTC and ETH dropped during the past week. 1-month implied vol currently stands at 63.9% (vs. 69.0% a week ago) and 92.3% (vs. 104.2% a week ago) for BTC and ETH, respectively.

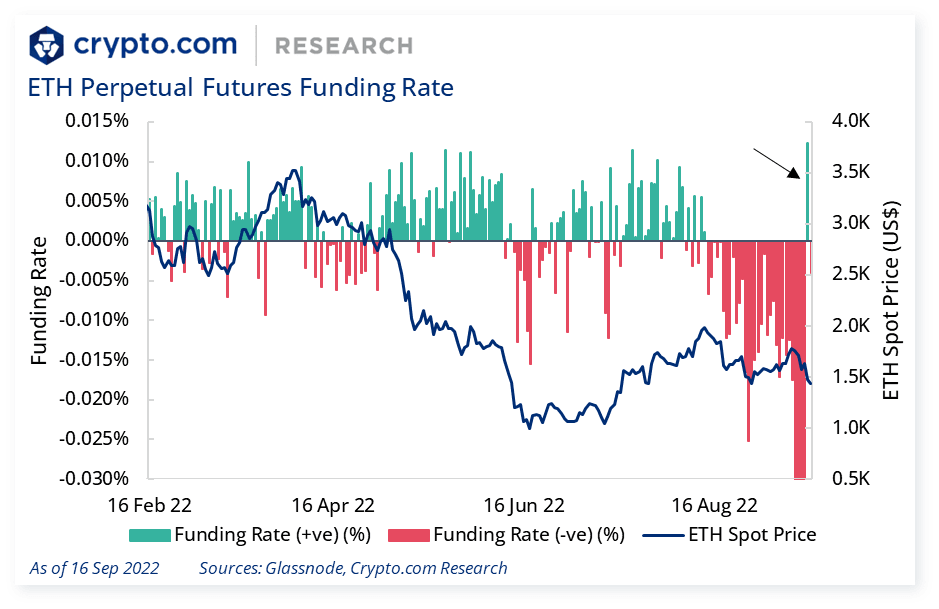

- ETH perpetual futures funding rates showed a positive print after a month-long streak of being in negative territory.

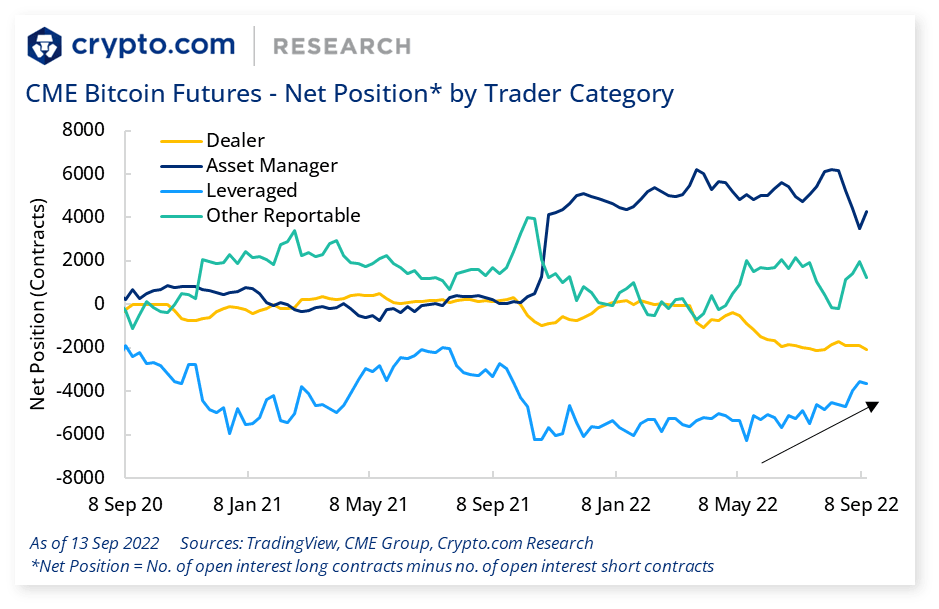

- Leveraged traders’ net-short position in CME Bitcoin futures continues to reduce and mark new YTD lows.

- Leveraged traders are typically hedge funds and various types of money managers, including commodity trading advisors and commodity pool operators. The traders may be engaged in managing and conducting proprietary futures trading, and trading on behalf of speculative clients.

- The asset manager category consists of institutional investors, including pension funds, endowments, insurance companies, mutual funds, and those portfolio/investment managers whose clients are predominantly institutional.

- The dealer category consists of participants typically described as the “sell-side” of the market. These include large banks and dealers in securities, swaps, and other derivatives. The other reportable category consists of traders mostly using markets to hedge business risk, and includes amongst others corporate treasuries.

Price Movements

News Highlights

- Crypto.com announced it has successfully renewed the National Institute of Standards and Technology Cybersecurity Framework and Privacy Framework assessments as audited by SGS, an internationally-recognised certification authority.

- Ethereum’s The Merge was finally completed on 15 September. Ethereum’s energy consumption is expected to drop by ~99.95% and its developers say the upgrade will make the network more secure and scalable too.

- U.S. CPI increased by 8.3% YoY in August, higher than market expectations, as rising shelter and food costs offset a fall in gasoline prices.

- A consortium of leading broker-dealers, global market makers, and venture capital firms announced the launch of EDX markets, a digital assets exchange. Backers include Charles Schwab, Citadel Securities, Fidelity Digital Assets, Paradigm, Sequoia Capital, and Virtu Financial.

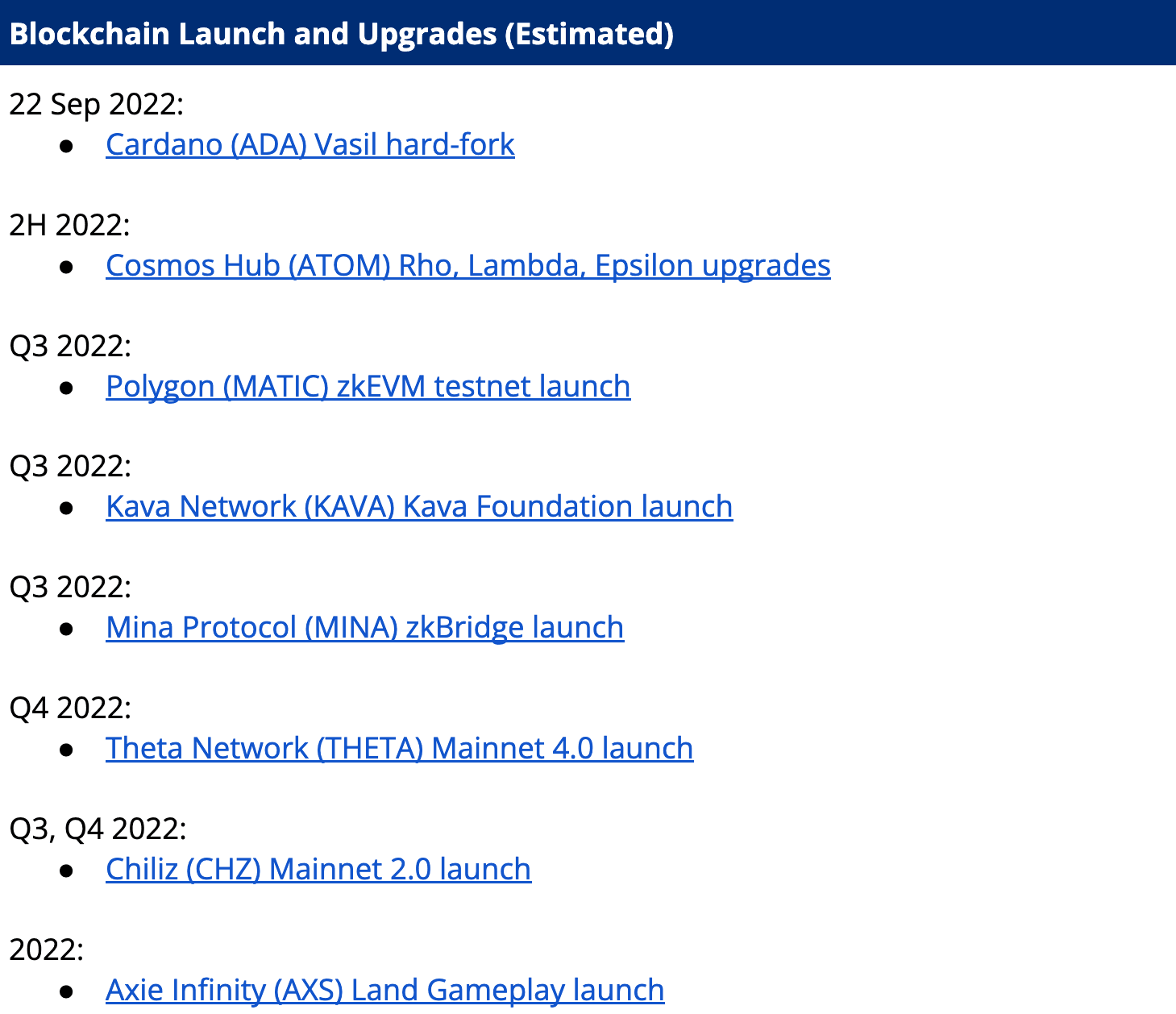

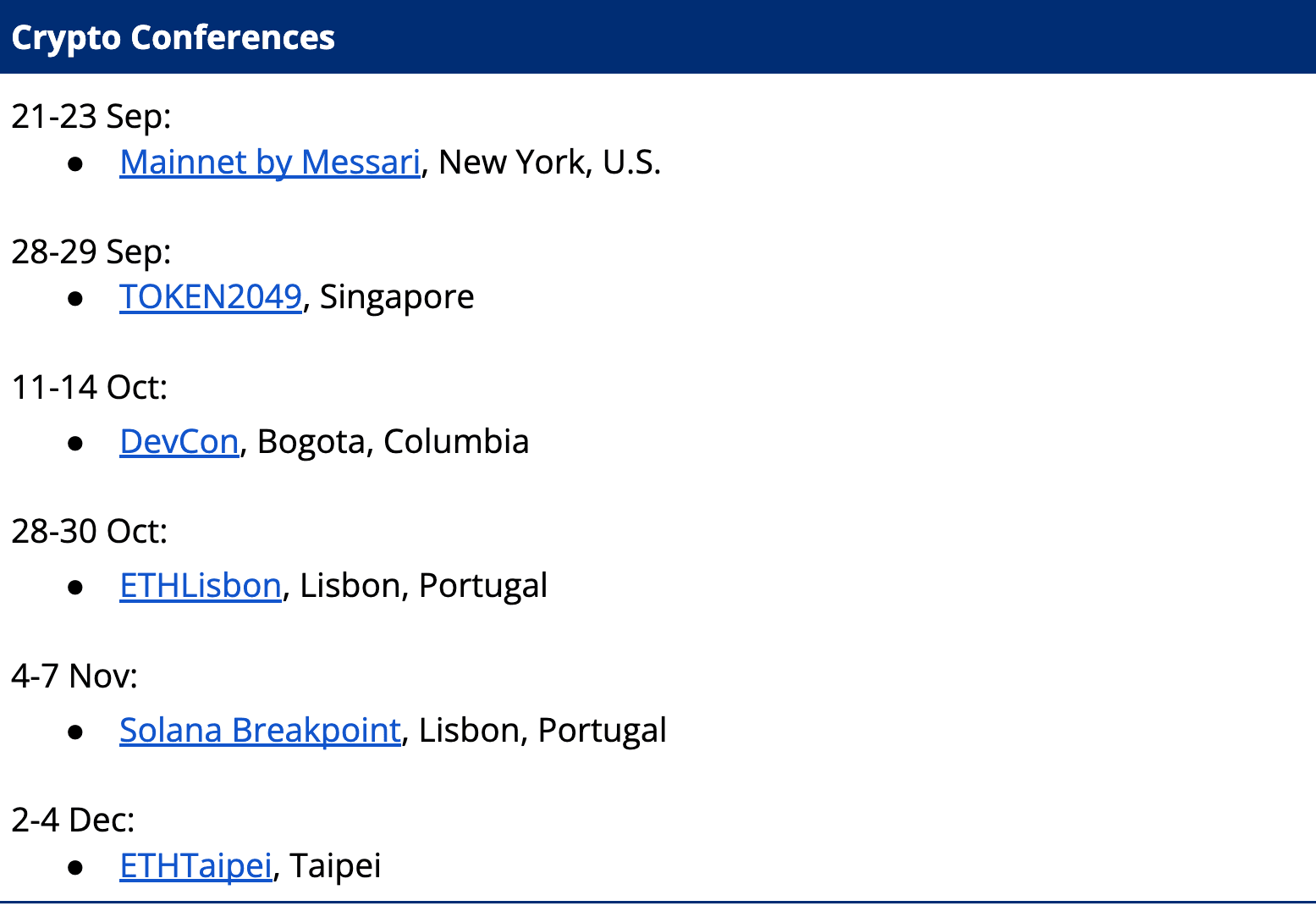

Catalyst Calendar

Author

Research and Insights Team

Get fresh market updates delivered straight to your inbox:

Be the first to hear about new insights: