IMF notes volatality in financial markets due to crypto, adoption in Asia

The International Monetary Fund (IMF) has warned that large losses incurred on crypto trading may force investors to rebalance their portfolios which will cause volatility in financial markets in a recent blog post. The IMF added that the investors could also default on traditional liabilities (loans, leverage in margin trading) in the process of rebalancing.

“Crypto trading volume, and co-movement with equity markets, has surged in the (Asian) region,” read the post. The IMF specifically referred to countries like India, Vietnam, and Thailand where investors, retail and institutional alike, have embraced crypto assets.

The crypto sector remained insulated from the financial system before the pandemic, the IMF said, adding that Bitcoin and other crypto assets demonstrated little correlation with Asian equity markets, thereby diffusing “financial stability concerns”.

FREE READ of the day by MediaNama: Click here to sign-up for our free-read of the day newsletter delivered daily before 9 AM in your inbox.

What changed after the pandemic: Crypto trading witnessed a surge as scores of people around the world were stuck at home with no jobs and looking for a source of income. The provision of government aid coupled with low interest rates and easy financing conditions made it convenient for people to dabble in crypto. Most governments across the world resorted to direct benefit transfers and lowering interest rates to tackle stress caused by COVID-19.

“The total market value of the world’s crypto assets surged 20-fold in just a year and a half to $3 trillion in December. Then it plunged to less than $1 trillion in June as central bank interest rate increases to contain inflation ended easy access to cheap borrowing,” the IMF wrote in its blog.

Future at risk: The IMF cautioned that the financial system was able to weather these shocks in 2022 but it may not be insulated in future boom-bust cycles, adding that “contagion could spread through individual or institutional investors that may hold both crypto and traditional financial assets or liabilities”.

Why it matters: The IMF is an influential body which advises governments of 190 countries on economic matters. The post is also crucial because it sheds light on how the integration of crypto in the Asian financial system poses financial stability concerns in the absence of regulatory frameworks.

Correlation between Asian equity markets and crypto bellwethers

The IMF observed that the correlation between the performance of Asian equity markets and crypto assets such as Bitcoin and Ethereum has “increased”.

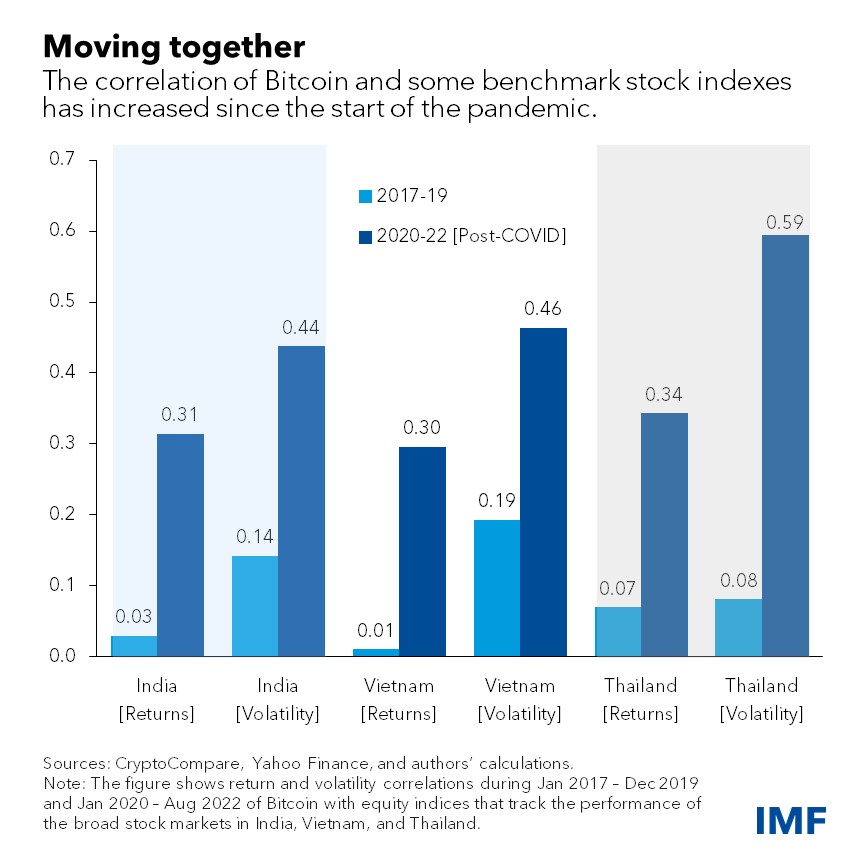

It also noted a significant increase in the “returns and volatility correlations” between Bitcoin and Asian equity markets since 2020, stating that the correlation was low before the pandemic.

The IMF cited the return correlations of Bitcoin and Indian stock markets which increased by “10-fold over the pandemic”. It also means that there is limited risk diversification benefits of crypto, it explained.

Moreover, the volatility correlations have increased by three-fold which would imply that there are possible spillovers of risk sentiment among the crypto and equity markets, as per IMF.

What is driving this trend: The IMF laid down the following reasons behind this phenomenon—

- Growing acceptance of crypto-related platforms and investment vehicles in the stock market and at the over-the-counter market,

- Growing crypto adoption by retail and institutional investors in Asia.

Link between equity and crypto: The IMF also found that the rise in crypto-equity correlations in Asia was accompanied by “a sharp rise in crypto-equity volatility spillovers in India, Vietnam, and Thailand”.

“This indicates a growing interconnectedness between the two asset classes that permits the transmission of shocks that can impact financial markets,” read the post.

‘Bitcoin has matured from an obscure asset class’

This is not the first time that the IMF has expressed concerns about how crypto assets are no longer on the fringe of the financial system. The IMF had released a post in January 2022 which spoke about the increase in the correlation of crypto assets with traditional holdings like stocks as an upward movement in their coincided with an upsurge in crypto asset prices.

While the August post deals with the link between crypto and equity markets in India, and other Asian countries, the January post dealt only with crypto assets’ link with American equity markets.

“The increased and sizeable co-movement and spillovers between crypto and equity markets indicate a growing interconnectedness between the two asset classes that permits the transmission of shocks that can destabilize financial markets,” the IMF had said then.

What did the post say: The IMF wrote that crypto assets were thought to help diversify risk before the pandemic and act as a hedge against swings in other asset classes because they showed “little correlation with major stock indices”.

- The IMF wrote that the increased co-movement could soon pose risks to financial stability especially in countries with widespread crypto adoption.

- It suggested adopting a “comprehensive, coordinated global regulatory framework to guide national regulation” in order to mitigate the financial stability risks.

Need for a regulatory framework

The IMF acknowledged that authorities in Asia were “sensitive” to the rising risks posed by crypto and have “dialed up their focus on crypto regulation”. It added that regulatory frameworks were on their way in several countries including India, Vietnam and Thailand.

Addressing data gaps: The IMF called for a joint effort to fill data gaps which prevent domestic and international regulators from “fully understanding ownership and use of crypto and its intersection with the traditional financial sector”.

- The IMF had touched upon some of these gaps in a post released in October 2021. They are as follows:

- The (pseudo) anonymity of crypto assets can open unwanted doors for money laundering, as well as terrorist financing, the IMF had observed then.

- The crypto sector falls under different regulatory frameworks in different countries, making coordination more challenging.

What should these frameworks contain: The IMF said that the frameworks should be “tailored to the main uses of such assets within the countries”.

- The guidelines should be clear on regulated financial institutions and seek to inform and protect retail investors, the IMF advised.

- It also added that crypto regulation should be closely coordinated across different countries.

How soon will India see a regulatory framework for crypto?

The IMF is right when it says that the Indian government is working on a bill to regulate crypto in the country but there is no clarity on when the bill will be promulgated into law.

The government announced recently that it was working on releasing a consultation paper which covers a wide range of issues thrown up by crypto assets. The paper is likely to reveal the government’s position on crypto assets and how it intends to regulate them.

A law will only become a reality once the government concludes with the consultation process.

The path to regulation is littered with treacherous turns as India’s central bank continues to bat for a ban as revealed by Finance Minister Nirmala Sitharaman recently. The ban was first introduced in 2018.

The Union government had listed the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, for introduction before the start of the winter session of the Parliament in December 2021. However, the bill was not introduced then as Sitharaman later clarified that the government was working on a new draft which would be presented before the Cabinet soon.

This post is released under a CC-BY-SA 4.0 license. Please feel free to republish on your site, with attribution and a link. Adaptation and rewriting, though allowed, should be true to the original.

Also read: