Mooners and Shakers: Bitcoin and crypto market attempt recovery from messy weekend

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Okay, where were we? Ah yeah, Bitcoin and Ethereum grounded, with a nasty hangover, while the DXY takes off again. After a big weekend dip, all crypto flights remain delayed, but the voice on the tannoy says to please remain patient.

In case you missed it and were just enjoying your weekend like you probably should’ve, the entire crypto market shed about 100 billion US dollars over the weekend.

Does this mean the bears are now fully in control again? Plenty of those about, so maybe. The Crypto Fear & Greed Index, the market’s most popular sentiment tracker, would suggest so. This is quite a big dip for that metric as well, since some mild, building hopium around this time last week.

Nevertheless, the two bull goose cryptos, Bitcoin and Ethereum, have managed to break their fall on a tree branch or two on the way down, John Rambo from First Blood-style.

Let’s take a little look…

Top 10 overview

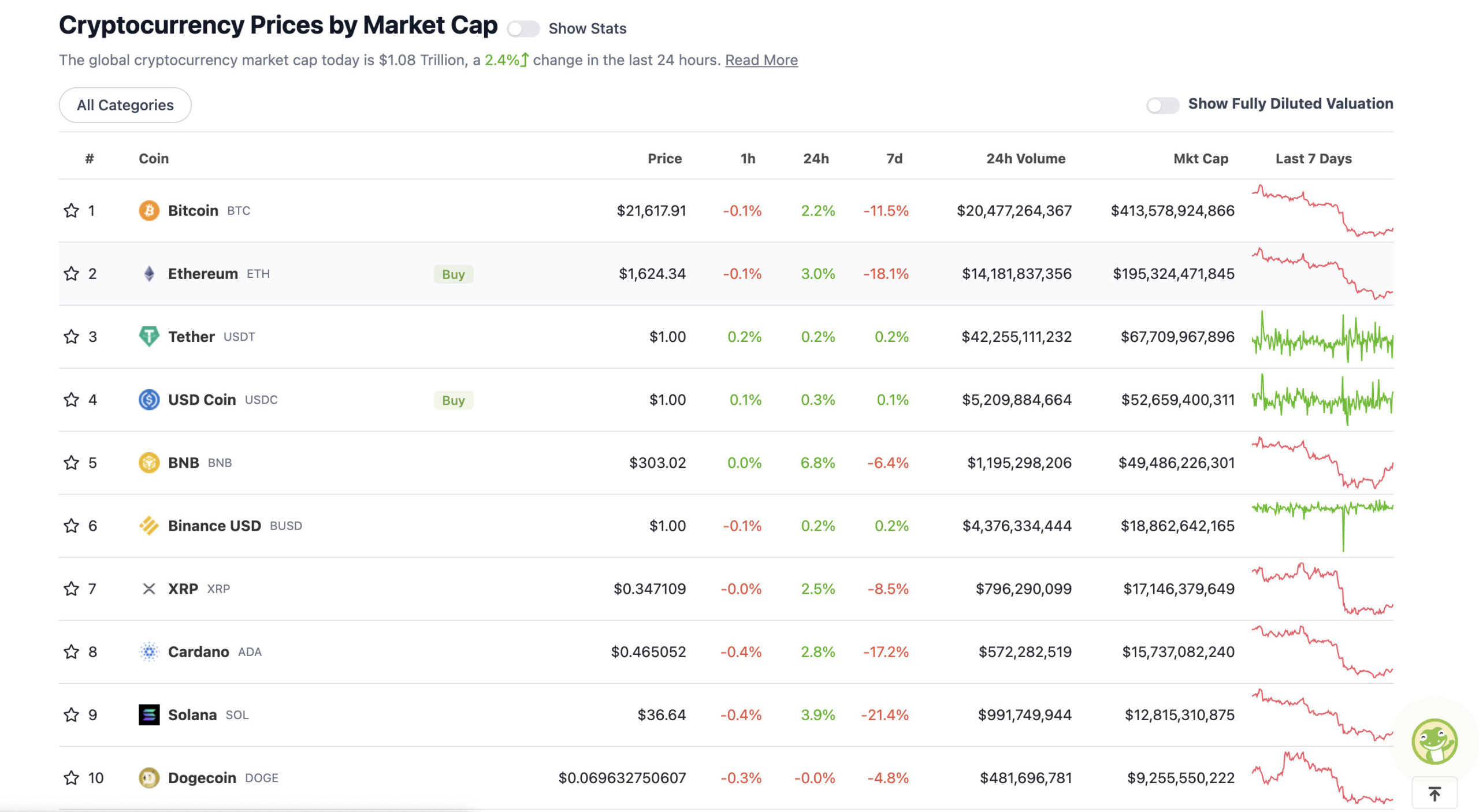

With the overall crypto market cap at US$1.08 trillion and up about 2.4% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Market pace setters Bitcoin (BTC) and Ethereum (ETH) have twitched toes yet again on their latest morgue slab. They’ve recovered somewhat into Monday (AEST) as another weekly close draws nearer in the eastern states of the US, where it seems to matter most on Crypto Twitter for these sorts of things.

Ah yes, the boring sideways action into the weekly #BTC close

— Benjamin Cowen (@intocryptoverse) August 21, 2022

The world’s favourite orange-coloured cryptocurrency dipped sharply to just under US$21k on Saturday, but found some support there and has been licking its wounds around the US$21.5k mark for the best part of a day now… at the time of writing.

Likewise, Merge-tastic (well, not yet) ETH did something similar with a US$1,550-ish local low, and a recovery to about the US$1,620 zone, where it’s sitting right about now.

Unreliable weekend price action? Crypto’s known for it. Then again, analyst Michaël van de Poppe described it as a “very organic dump” for Bitcoin, and, while factoring in the possibility of things heading lower, is still generally seeing a bottoming out in the market. Here’s what he tweeted yesterday…

No serious strength after this cascade on #Bitcoin.

Bounce is weak, no buyers stepping in, and $ETH / $BTC also continues to fall.

We should see another sweep and/or test of $19K before we reverse.

All in all, we’re very close to the bottom.

— Michaël van de Poppe (@CryptoMichNL) August 20, 2022

Meanwhile, another known long-time BTC bull analyst, the Kiwi on-chain data guru Willy Woo is also calling for an accumulation zone, signifying he believes Bitcoin is close to a bottom. Not everyone’s having it, though…

Is this accumulation in the room with us now?

— strikerv12 (@vainlithium) August 21, 2022

What with the US buck gaining strength again all of a sudden, Woo isn’t suggesting huge upside or a bull market any time soon, however. Perhaps more a prolonged, choppy consolidation, a la 2018, where the dollar-cost-averaging patient might ultimately be rewarded. Probably a big ask for the fair-weather moonlambo crowd.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.46 billion to about US$4441 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Lido DAO (LDO), (market cap: US$1.24 billion) +14%

• Synthetix Network (SNX), (mc: US$704 million) +8%

• Frax Share (FXS), (mc: US$454 million) +6%

• EOS (EOS), (mc: US$1.56 billion) +6%

• NEXO (NEXO), (mc: US$516 million) +5%

DAILY SLUMPERS

• Celsius (CEL), (market cap: US$948 million) -12%

• Huobi BTC (HBTC), (mc: US$823 million) -1%

• Stacks (STX), (mc: US$529 million) -1%

• Chain (XCN), (mc: US$1.95 billion) -1%

• STEPN (GMT), (mc: US$481 million) -0.5%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Some Ethereum “Merge” musings…

Even though The Merge has a mainnet date that’s less than a month away, there are still plenty of people doubting that it’s going to happen at all.

I’ll say it again – The Merge is not priced in.

— sassal.eth 🦇🔊🐼 (@sassal0x) August 21, 2022

Reminder: The #ethereum merge will not reduce gas fees 🙁

— Lark Davis (@TheCryptoLark) August 20, 2022

This will absolutely matter in a bull market.

The merge and EIP1559 will send $ETH to $10,000. pic.twitter.com/G5QBoppdvP

— McKenna (@Crypto_McKenna) August 20, 2022

Some NFT natterings…

Well, still a great investment for the mintershttps://t.co/nZ3XfzWWJq

— 0xGoGreen (@0xGoGreen) August 21, 2022

1/ Pudgy Penguins floor shoot up 400% in one of the worst NFT bear market.

The greatest comeback story. Here’s how it happens 🧵

— doubleQ (@xDoubleQ) August 21, 2022

Some relentless Bitcoin sales pitching from Saylor…

Imagine, everything there is and everything that will ever be, divided by 21 million.pic.twitter.com/P8WsjyugoB

— Michael Saylor⚡️ (@saylor) August 21, 2022

#Bitcoin is money controlled by no one and available to everyone. pic.twitter.com/kmEZr97OCV

— Michael Saylor⚡️ (@saylor) August 20, 2022

And apropos of nothing… but this somehow seems like a decent metaphor for crypto investing. (Just out of shot, FBI agent Johnny Utah watching on).

A stunning view: Sebastian Steudtner, a German surfer, rode a 115 feet tall wave at Nazare, Portugal 2018 pic.twitter.com/WatZfyE6mS

— Vala Afshar (@ValaAfshar) August 21, 2022

This is probably a better zoomed-in metaphorical reference, though…

Crypto investors trying to time the market

— Dr. Parik Patel, BA, CFA, ACCA Esq. (drpatel.eth) (@ParikPatelCFA) August 19, 2022