Bitcoin Separates Money From The Government – Bitcoin Magazine

This is an opinion editorial by Ryan Bansal, a professional software engineer and author of a Bitcoin newsletter.

“The computer can be used as a tool to liberate and protect people, rather than to control them.” — Hal Finney

Technologies are just amplifiers, not arbiters of morality. By extrapolating from the above quote, it is within reason to claim that any technology can be both a tool for either tyranny or for freedom depending on whose hands are on the power lever.

The principle of checks and balances shows that in any kind of system that relies on concentrated power, that central institution becomes the honeypot for malicious actors. Also, keep in mind the democratic principle that more distributed decision-making is more robust and fair for any society. So it sounds like a no-brainer that the best way moving forward is to develop and adopt technologies with no single ultimate power lever?

Having said that, let’s now talk about one of the most important technologies of all: money. In the evolution of monetary technology from barter systems to seashells to metal coins to gold-backed banknotes and now a central-bank-controlled fiat digital currency, the power distribution has gone from being more decentralized to being more centralized to the point where governments have managed to establish a coercive monopoly on money.

Now, I think it is a fairly non-controversial statement to say: Government corrupts anything it touches. Sure, the convenience of digital money is unmatched, but it is also important to understand the other side of it, i.e., the counterparty risk, which means needing to trust a custody provider to secure your assets — along with the fact that the historical track record of keeping this trust is not great.

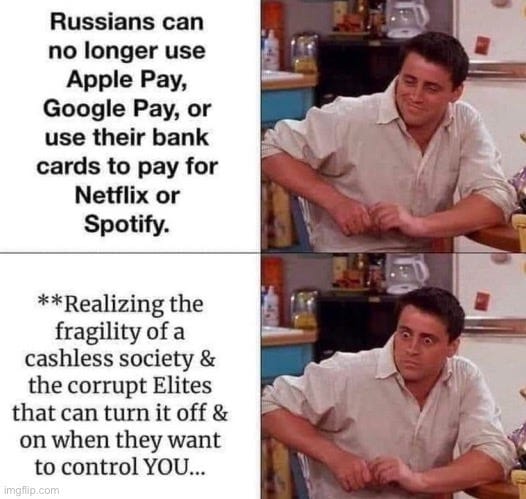

However fortunately or unfortunately, recently this breach in the contract has started to happen more widely and openly. Take for example a developed democratic country like Canada, freezing the bank accounts of its citizens for protesting against COVID-19 restrictions or a country like Russia putting restrictions on its people trying to withdraw their funds after the country invaded its neighbor. In a world run purely on physical cash, this kind of power to unconstitutionally violate private property rights would be impossible to execute.

Apart from the worsening financial censorship and geopolitical sanctions — which are a relatively recent phenomenon now that money has become almost fully digital — the corruption arising from the advent of fiat money and its problems goes further back to 1971. What do I mean? The plethora of metrics one can use to measure the health of an economy like index funds price-earnings ratios, Gini index for wealth inequality, consumer price index for inflation and cost of living, the ratio of income growth versus productivity growth, individual homeownership rates and many others have all gone haywire since the then President Richard Nixon decided to move away from the gold standard.

If you haven’t guessed the next move of governments by now, allow me to introduce you to central bank digital currencies (CBDCs). Think today’s digital money is bad enough as is? Now imagine what if it was also programmable?

You can say goodbye to any last sliver of financial autonomy. Before we know it, we’ll be living in a surveillance state with social credit scores, just like the Chinese citizens. If you’ve seen politicians trying to put a positive spin on them by randomly throwing around buzzwords, like “blockchain,” go back to the top of this article and read the first line again.

The problems that the government creates can be spoken of at great lengths, but let us move on to the solution: How to take the control of money out of the hands of politicians and give it back to the citizens?

“I don’t believe we shall ever have good money again before we take it out of the hands of governments.” — Friedrich Hayek

Imagine if our monetary system had the privacy and autonomy of cash; the convenience of being instantly and digitally transferrable all over the globe; all the while also retaining the properties of gold, i.e., nobody can steal your purchasing power over time by arbitrarily manipulating its supply only to serve their perverse political incentives?

Moreover, what if it was also running on an open-source codebase and used a public database making it globally accessible, completely transparent and fully auditable by anyone? Plus, what if it also allowed anyone with an internet connection and a computer the ability to weigh in on its monetary policy?

Finally, what if the proposed system was also decentralized in a way that it becomes impossible to stop, controlled or corrupted by anyone due to the lack of a single point of failure or by any central authority?

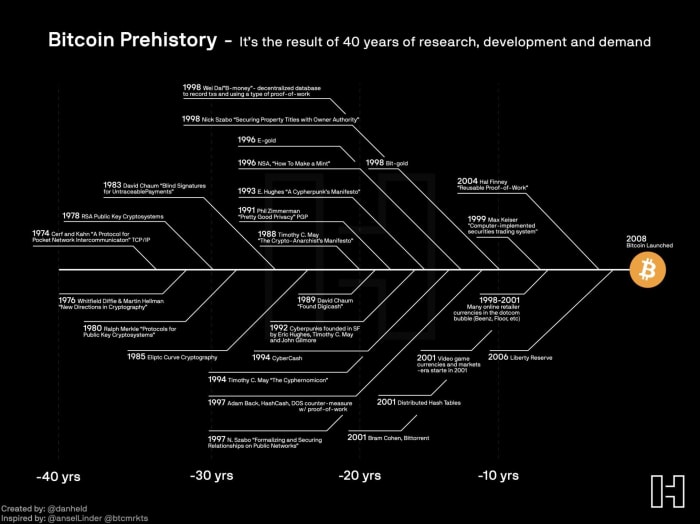

Sounds like a monetary technology on steroids, doesn’t it? Well, in 2008, a solution to these problems was proposed by someone using the pseudonym of Satoshi Nakamoto. I’d also like to highlight that it didn’t just come out of the blue, it has been in the making ever since the central bankers established control over the money. More precisely, it took almost 40 years of research and multiple failed attempts to engineer this masterpiece. The following visual is more tangible:

(Source)

I’d like to close by reiterating that the notion of separation of the money from the State may seem radical to you at first, but it is actually not. As I mentioned before, the monetary technologies we’ve used throughout most of our history were way more outside of the state control than current fiat money. In one way or another, the State managed to capture them. Gold is the best example of such a non-sovereign asset that people used as money for the longest time, but it had obvious attack vectors in the form of various physical limitations, i.e., hard to store, hard to secure and hard to move.

Historically speaking, there has been a tug-of-war between fiat and non-government monies. Therefore, the real issue at hand is not one of “if” money will separate from government control, but of “when.” With Bitcoin, I think the moment is finally here.

Now obviously if this article has not managed to fully convince you how Bitcoin was designed to be a truly democratic and inclusive monetary system and if you still insist on calling it a scam, I hope you’ll at least consider it is something worth taking a harder look at.

This is a guest post by Ryan Bansal. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.