3 Reasons AAVE Price Has Jumped and What to Expect

AAVE price has been in a strong recovery in the past few weeks as blue-chip tokens have bounced back. The token rose to $100, which is much higher than the year-to-date low of $46.09. This means that the token has risen by almost 120% from its lowest level this year.

AAVE is a leading decentralized finance (DEFI) platform that enables people to earn interest, borrow assets, and build applications. It is the third-biggest DeFi platform in the world after Maker and Lido. Aave uses Ethereum, Polygon, Arbitrum, Fantom, Harmony, Optimism, and Polygon platforms.

There are several reasons why the AAVE price has rebounded in the past few weeks. First, the rally has been in line with the overall performance of the cryptocurrency industry. Recently, most cryptocurrencies like ethereum, polygon, and bitcoin have all rallied.

Second, Aave price has rebounded because of the rising interest in blue-chip DeFi tokens like Lido, MKR, and UNI. Most of these coins have risen recently as investors predict the worst is now over.

Finally, investors have cheered the recent vote to introduce a yield-generating stablecoin known as GHO. 510k AAVE coins voted in favour of the launch, while just 12 of them voted against the proposal. GHO will initially be offered on Ethereum’s blockchain.

AAVE price prediction

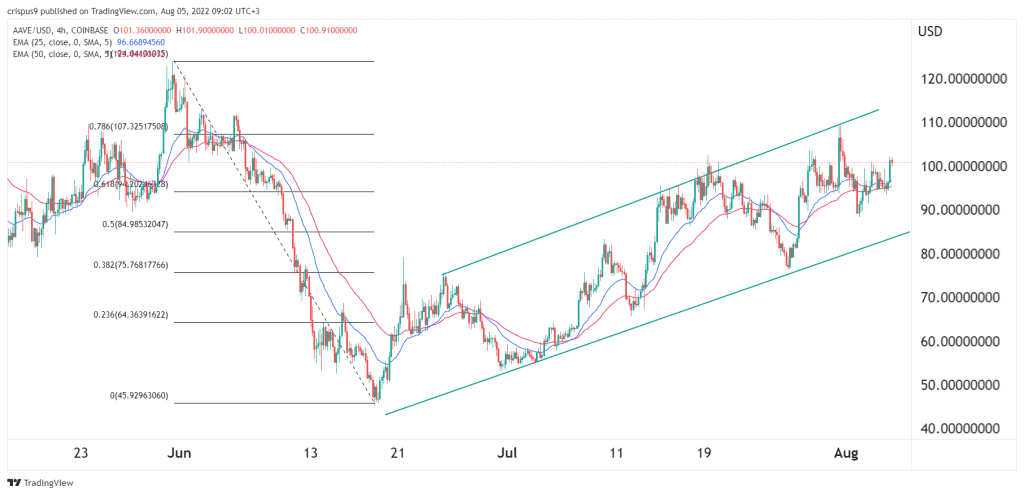

The four-hour chart shows that the AAVE price has been in a strong bullish trend in the past few weeks. As it rose, the coin formed an ascending channel that is shown in green. It is now at the middle point of this channel.

At the same time, AAVE has moved above the 25-day and 50-day moving averages. It has also moved between the 78.6% and 61.8% Fibonacci Retracement levels.

Therefore, the coin will likely continue rising as bulls target the upper side of the channel at $110. A drop below the support at $92 will invalidate the bullish view.