Not everything is about Bitcoin – a few words about altcoins

Everyone associates cryptocurrencies with Bitcoin, after all, it was he who started the era of virtual coins. Currently, in addition to the iconic BTC, there are over 10,000 altcoins on the network, but what are they actually?

The key to understanding the world of cryptocurrencies is getting to know it from the very beginning. So let’s take a look at how virtual currencies took their first steps. It all started in 2009, when the current king of crypto, Bitcoin, was emerging. For some time, no other blockchain project met the virtual money criteria. Back then, at that time, the name “cryptocurrency” meant the same as Bitcoin. Soon, however, due to the growing popularity and opportunities offered by blockchain projects related to currencies, other coins began to appear on the market. Namecoin, which was created in 2011, is considered to be the first successor to BTC. A little later, Litecoin also hit the network, which was supposed to be a similar, but better project than Bitcoin. This is how the first altcoins appeared. As you can guess, the combination of the words “alternative” and “coin” is simply a term for alternative coins to BTC. This is what we call every new coin created after Bitcoin, even if it runs on the same software.

The expansion of altcoins continues to this day, the development of blockchain technology makes it simple and quick to start your own coin. The possibility of having your own coin is used by start-ups and corporations, but there are also many private one-person projects. In this way, the crypto world has more than 10,000 alternative coins to date, and the number is constantly growing. Needless to say, many projects are fraudulent or have many fundamental bugs. There are also a lot of coins that were created, if only to take advantage of Blockchain technology and improve what works on average in Bitcoin. The creators focus on such aspects as – the speed of transactions between portfolios, the cost of mining currencies and adding new functionalities. More and more coins with different assumptions for BTC flowed into the world of cryptocurrencies and today many of them are a kind of competition for the prototype.

Delving into the subject of altos, we can distinguish three types:

- Mine altcoins – these are coins that are obtained by digging, most often through the proof-of-work system. They are the closest to Bitcoin.

- Stablecoins – I have already written a bit about “stable” coins in the article about Luna, but I would like to remind you that they are coins that have real security, e.g. in gold or fiat currencies, which in theory translates into security and price stability.

- Security / utility tokens – the so-called utility tokens. Security is a kind of security, it can represent a share, a voting right in a company, or a unit of value. Utility tokens, on the other hand, are used as internal means of payment in companies. They are used, for example, in loyalty programs or in remunerating company employees.

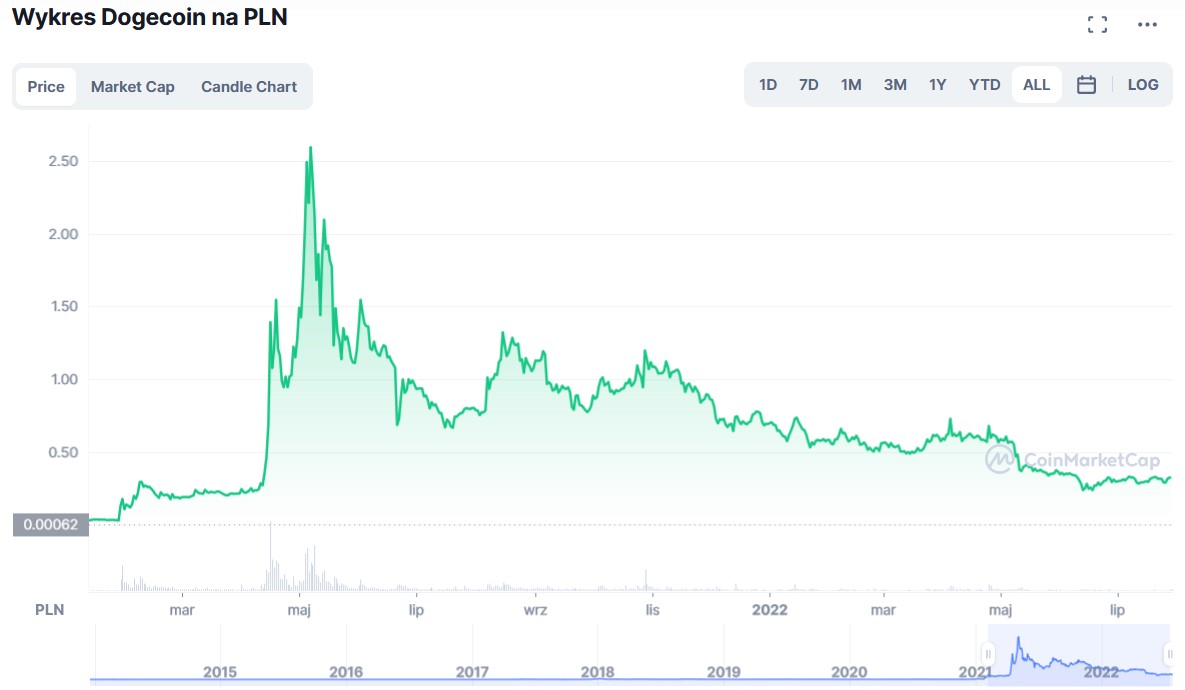

You can check altcoin prices on the CoinMarketCap website, while the assumptions of a given project related to a specific alternative coin should be found on the developers’ websites or on thematic forums. Acquiring alts is done just like in the case of BTC, we can buy them on the exchanges that support them or get them according to the rules of the creators – for example by digging them. Alt prices depend on the entire market, but also on individual events. A great example is DogeCoin – a currency based on a meme with a dog (more on that later), which, thanks to Elon Musk’s tweets, gained popularity, and its quotes jumped ten times in a month. The artificially inflated currency, however, fell just as quickly, but still remains at a higher level than at the very beginning. This shows how vulnerable some alts are to price manipulation. So before you start investing, it’s a good idea to sift your worthwhile business from potential scams or projects with no good future.

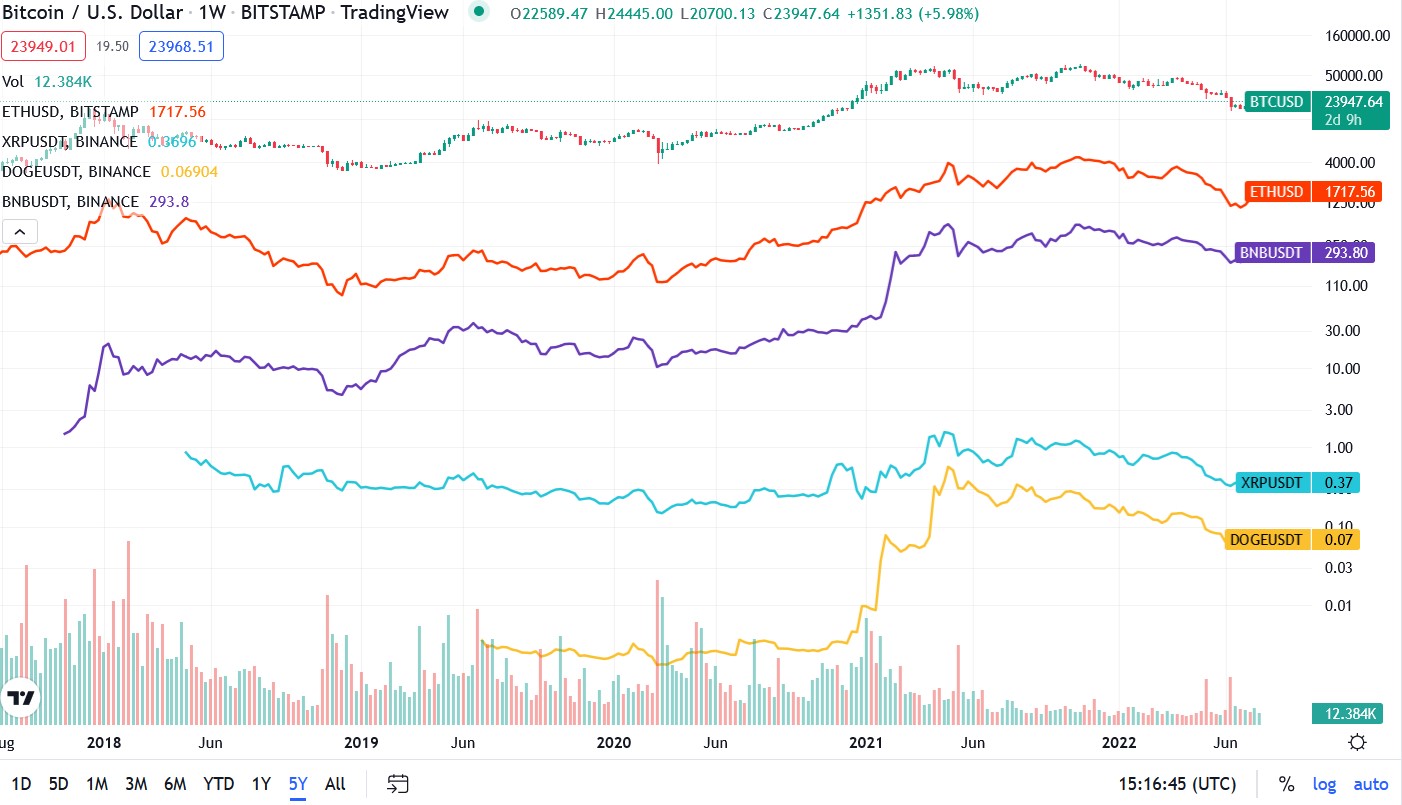

The above-mentioned example shows that on altars you can get rich very quickly … but also lose your investment just as quickly. But how do you predict the price behavior of individual coins? The first aspect is, of course, the behavior of the entire cryptocurrency market, so just look at Bitcoin, which has the largest market capitalization. As you can guess, when BTC rises, alts grow with it, and when BTC goes down as well. Moreover, the declines and rises in altcoins are often greater than those of Bitcoin itself. Due to the smaller size of the project, smaller capitalization and fewer investors, they are more susceptible to any changes. The law of supply and demand in the entire market is one of the many factors behind changes in stock market values. As I mentioned earlier, the price is influenced by external events, such as an investment in a project by an influential person, but also the events related to a given cryptocurrency, such as rebranding. Initially, many altcoins were based on practically the same assumptions as Bitcoin, but they improved its operation. Hundreds of such “Bitcoins 2.0” were created, with time there were also alts with completely different foundations that could actually influence the development of some technology related to blockchain. In this way, interesting and refined projects could count on faster price increases due to higher speculative value.

Having basic knowledge about altcoins, it is worth taking a look at projects that are gaining popularity and rethink owning them in terms of investments. Let me start with Ethereum – it’s also an altcoin, although its current size has made it clearly stand out from its competitors, standing above them. Together with Bitcoin, it excels in quotes and creates the market with it. I wrote a little more about ETH in one of the previous articles, so I invite those unfamiliar with the topic to catch up. Right after BTC and ETH, the next projects in terms of the amount of capital are Tether (USDT) and USD Coin (UDSC). Both cryptocurrencies are stablecoins, i.e., as I mentioned before, virtual coins that maintain a constant value. Today, however, we will skip stable currencies and deal with coins that you can mine or start trading with.

Currently, there are over 10,000 altcoins, so it is impossible to bring them all closer to you. On the other hand, it is simply not worth dealing with each of them, so in the following part I will briefly present some significant items on the market and present the profitability of their extraction, as well as the possibilities of selling them. How to check in the easiest way if a given alt is a project with a potential future? There are several criteria, but let’s focus on the two simplest aspects – market capitalization and availability on the largest crypto exchanges. In this way, we very quickly sift new and uncertain projects from the valuable ones. After such a simple analysis, several projects will emerge, i.e .:

- BNB

- Cardano

- XRP

- ETHEREUM

- DOGE

- POLKADOT

- SOLANA

- UNISWAP

The order is random, but all the above-mentioned altcoins have two things in common – relatively large capitalization (compared to other positions on the market) and availability on the largest exchange, Binance. Much appreciated items appeared on the list, but also the controversial Dogecoin. I have already said a bit about the coin with the image of the dog, but it is worth expanding on this topic. It turns out that the world of cryptocurrencies, just like emerging NFTs, is often a bit complicated. Doge coins are not characterized by any technical innovation, his strength is the community built around him. The mem cryptocurrency became popular on portals such as Reddit and Twitter, where users used it to pay with each other. The trend was expanded by influencers and this is what we have the success of the project, which did not quite indicate it.

Where to buy or excavate?

I recommend the adventure with buying cryptocurrencies only on proven exchanges. It is true that we will not find most altcoins there, but there is a good chance that those that are already there have passed the initial verification and it will be harder to find a Scammer project. In the Polish backyard, the most popular exchange is Zonda (formerly BitBay), while on the foreign one, the Binance exchange, which, as you can guess, has a much larger offer. In turn, the more niche the cryptocurrency, the harder it is to buy it, so watch out for suspicious small exchanges that offer all the weirdest creations. It may turn out that even if the altcoin you bought was a bull’s eye in terms of investment, the exchange you will use will take your funds. Let’s get down to mining, these should be started by simply checking how it can be done and downloading the appropriate software. As this is a topic for a multi-threaded article, let me not write here and encourage you to closely follow our portal in the future.

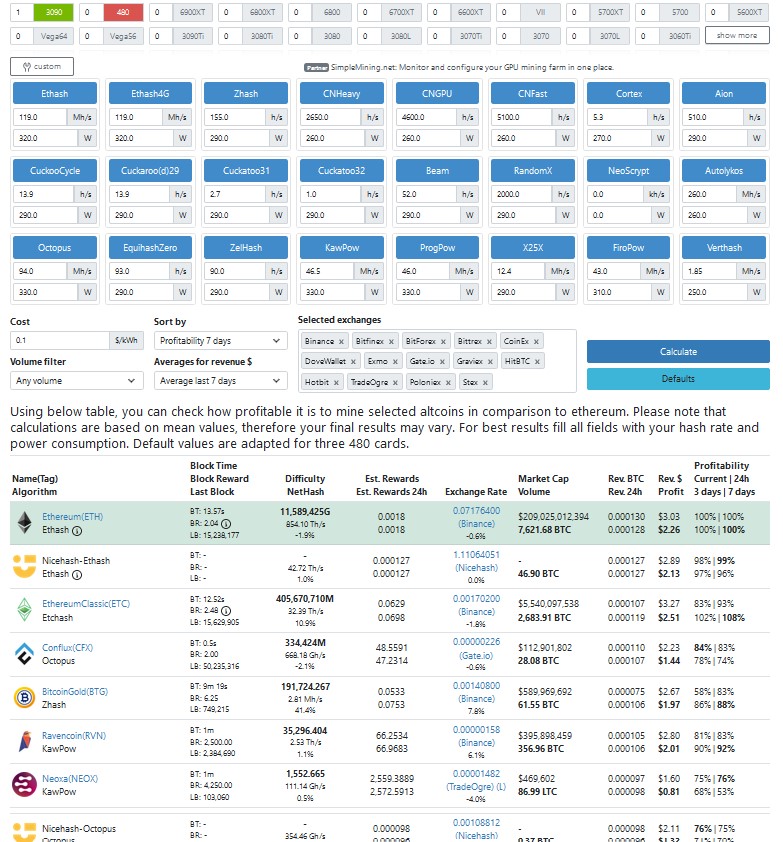

However, I will not leave you without anything, there are tools that calculate the profitability of mining individual cryptocurrencies. Let’s focus on altos that can be excavated using the computing power of graphics cards, and as a research attempt, let’s take a card from green – RTX 3090. Potential mining can be easily checked on the WhatToMine.com website, where you complete the specifications of your unit, and the program calculates for The rest of you. The website only takes into account those coins that are listed on popular exchanges. You also need to remember that real earnings may vary slightly as the prices of coins and the difficulty of mining them are constantly changing. I conducted my tests on one RTX 3090, the cost of electricity was USD 0.1 and the profitability of mining within 7 days. Of course, Ethereum comes first in profitability. Other alts, although less profitable at present, may turn out to be a good investment in the long run. As we wrote more than once, ETH is to switch to the proof-of-stake system soon, so GPU mining will no longer be possible. This means that miners of the crypto world will look for alternatives, and this in turn will lead to an increase in the popularity of other coins and an increase in their prices.

Altcoins are a very turbulent and often dangerous environment for users, but it is thanks to them that the entire cryptocurrency market can move forward. The basic investment principle in the area of altos is gaining knowledge. Never allocate your resources to projects that you have no idea about, because it can turn out to be disastrous. The Luna project was a perfect example of how the lack of correct information led to the loss of money of many thousands of investors. However, there are cases, such as Doge, ETH or XRP, which have gathered a lot of fans on the market and have increased many wallets. As a standard, I would like to remind you that our articles about cryptocurrencies are not investment advice, so use common sense in the world of cryptocurrencies. In the comments section, we invite you to discuss the altos, maybe you already have something? Are you going to buy something? Or maybe just Bitcoin?

.