Binance Coin Price Prediction Ahead of FOMC Decision

The BNB/USDT pair is trading higher by 3.21% on the day as the crypto market experiences slight gains ahead of the FOMC decision later today. The uptick marks the second straight day of gains by the BNB/USDT, but whether this will translate into bullish Binance Coin price predictions is another matter as the pair hits a resistance wall.

Furthermore, the interest rate decision could still impact the pair and cause it to lose its current gains if the Fed delivers beyond the market expectations. The crypto market has been susceptible to recent rate hikes by the US Federal Reserve, as these rate increases make risky assets unattractive. If the Fed delivers on a 75bps or 100bps rate hike this evening, the potential for a resumption of the downtrend is heightened, weakening the potential for bullish Binance coin price predictions.

The uptick in the BNB/USDT pair has been more of weakness on the part of the Tether stablecoin and to a lesser degree, traders covering their short positions ahead of the FOMC interest rate decision. Tether was forced to issue another rebuttal regarding its purported ownership of Chinese commercial paper notes as part of its reserve backing for the USDT stablecoin.

The company described the alleged exposure to Chinese commercial paper notes as “false information.” There have been recent concerns over China’s financial sector after protests broke out from Chinese citizens who have been blocked from accessing their funds from Henan Bank and other financial institutions due to a rumoured $6 billion fraud.

Binance Coin Price Prediction

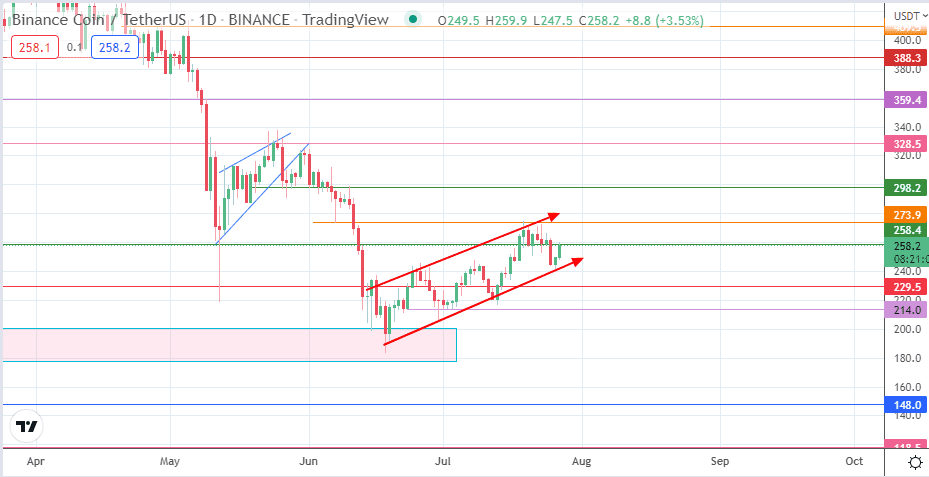

The BNB/USDT pair is now testing resistance at the 258.4 price level (24 July low). A break of this level targets the 273.9 resistance mark (19 July high). If the bulls succeed in uncapping this resistance, they will have clear skies to approach the 298.2 barrier where the 10 June 2022 high is located. Additional price targets are seen at 328.5 (24 May 2022 high) and 359.4 (27 February low and 9 May 2022 high).

Conversely, 229.5 (6/14 July 2022 lows) will become a new downside target if the uptick is rejected at the 258.4 price mark. Other downside targets come into the mix at 214.0 (the 23 June/1 July 2022 lows) and the demand zone between 200.5 and 177.0.

BNB/USDT: Daily Chart