Asia vs Europe and the U.S.

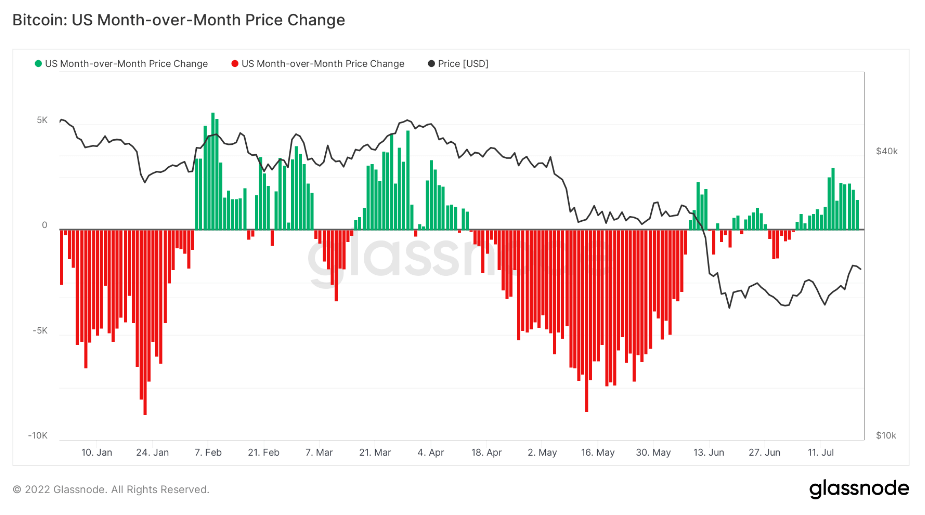

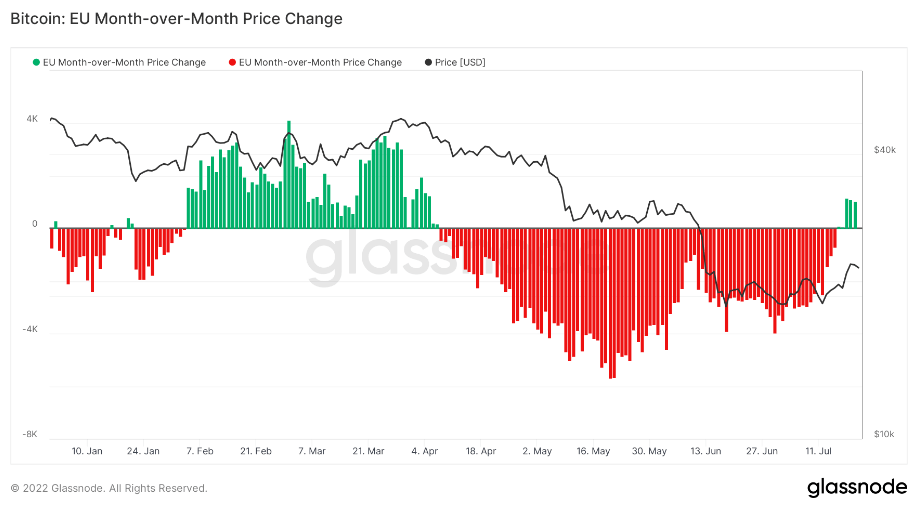

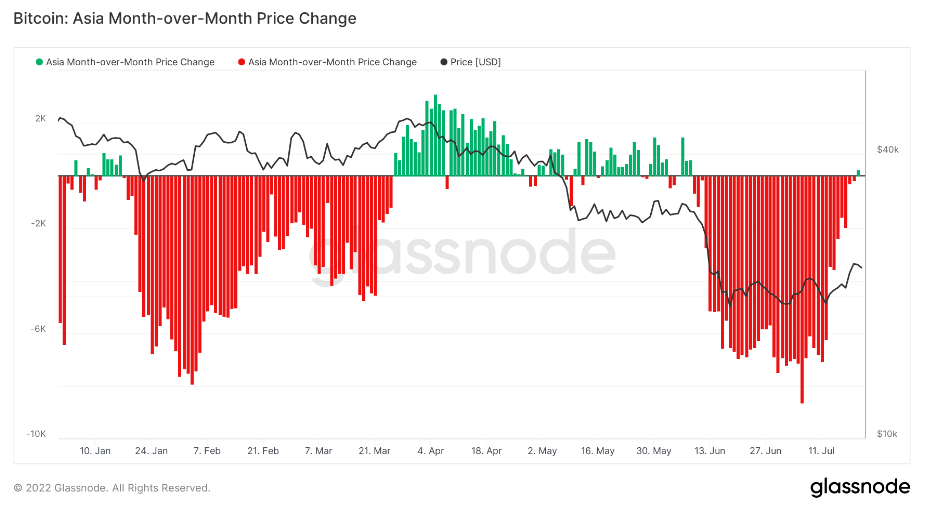

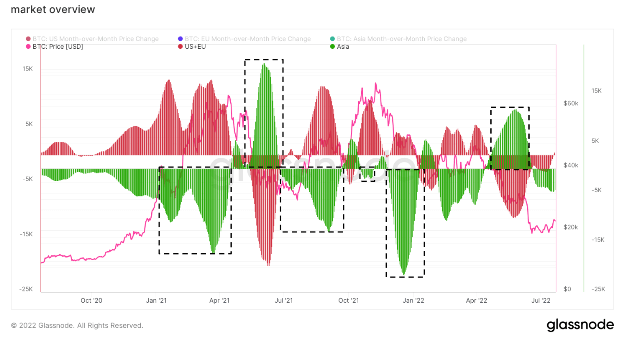

Getting a solid understanding of the global market requires zooming out of daily and weekly closes. One metric that provides a good perspective of the market’s overall health is the Month-over-Month (MoM) price change. This metric shows the 30-day change in regional prices set during U.S., E.U., and Asian working hours. These regional prices are usually determined by calculating the cumulative sum of each region’s price changes over a period of 30 days.

Analyzing the MoM price change for Bitcoin from October 2021 to July 2022 reveals several interesting trends.

At the beginning of May 2022, a trend began in Asia that indicated the region’s increasingly bullish sentiment toward Bitcoin. Highlighted in the black square in the graph above, the trend shows investors in Asia have been reaping the biggest gains in the crypto industry.

The chart above clearly shows that Asian investors have dominated the crypto market in the past two years and that most of the market’s smart money seems to be coming from the far east. Investors in Asia have been able to sell the early 2021 top and then buy the 2021 summer bottom, as well as sell the first pump of the summer’s lows.

When Bitcoin dropped to $40,000 in late summer last year, Asian investors were the first to buy the dip and the first to sell in November 2021 when Bitcoin reclaimed its all-time high.

In May 2022, trading volumes in Asia were the highest since last summer, when the region was taking advantage of lower prices at the expense of mass sell-offs in the U.S. and E.U. The Luna collapse and the subsequent insolvency of some of the industry’s largest players like Three Arrows Capital and Voyager have caused Europeans and Americans to become more fearful than ever when it comes to the crypto market. Miner capitulation and the broader macroeconomic outlook failed to make the situation better.

However, the Asian-led narrative seems to be changing rapidly.

Data for July 2022 has shown that accumulation is occurring outside of Asia as well, with the U.S. and E.U. markets beginning to accumulate collectively for the first time since the beginning of April. This could indicate that the West is beginning to see Bitcoin as a valuable asset in times of macro and geopolitical uncertainty.