Zilliqa Price Prediction: Is Trend Reversing?

Today/’s trading session has broken the Zilliqa price’s three-day bear run, and prices are already up by 2 per cent.

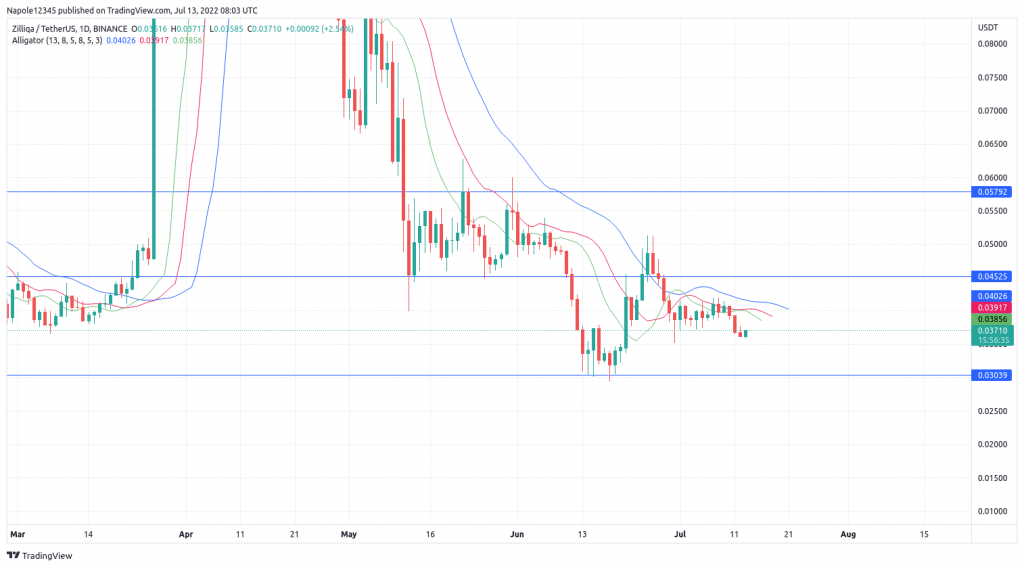

Zilliqa Long-Term Analysis

With today’s trading session being in a strong bullish push to the upside, it looks likely that the trend may be reversing to the upside. However, the current push to the upside is likely a price retracement. With prices moving aggressively for the past three trading sessions, a short-term move against the strong and aggressive bearish trend was expected.

Therefore, my Zilliqa trend analysis still expects the prices to continue with the bearish trend in the next few trading sessions. There is a high likelihood that we will see prices hit the $0.030 support level and possibly break and trade below it.

Long-Term Daily Outlook

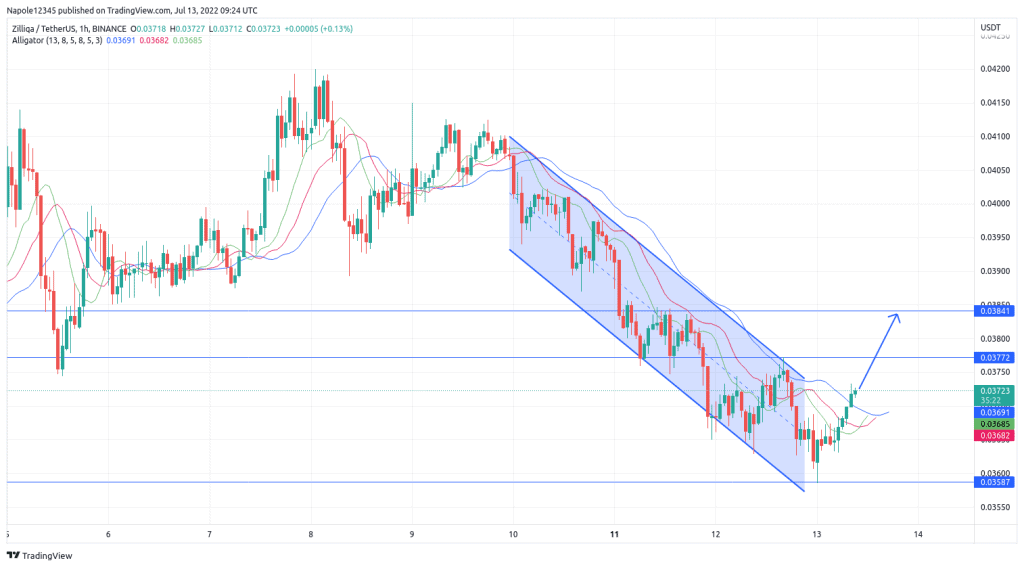

Intraday Trading Opportunities

Despite my long-term view that Zilliqa’s price will continue falling in the next few trading sessions, I expect today’s trading session to continue with its strong bullish trend. Looking at the 1-hour chart, we can see prices bottomed recently at the $0.035 price level. However, Zilliqa failed to push to the downside.

The result was that a new short-term support level was established, and a new move to the upside started. At press time, the bullish move has continued with its aggressive push to the upside. The bullish move also seems to have high momentum; therefore, it is likely to continue throughout the day.

Therefore, intraday traders have the opportunity to go bullish, with price expectations at $0.038. If enough momentum continues, there is also a high likelihood we may see prices rise and hit the $0.038 price level.

However, intraday traders should take note that once prices slide below the $0.036 price level, my bullish analysis will be invalidated. It will also mean a possible start to a bear market on the one-hour chart.

Zilliqa One-Hour Chart