VIX Index Prediction Ahead of Q2 Earnings Season

The VIX index has crashed to the lowest level since June 9th of this year as investors refocus on the upcoming earning season. The CBOE volatility index is trading at $24.65, about 30% below the highest point in June. At the same time, the CNN fear and greed index has moved back to the fear zone of 29.

Earning season ahead

The VIX index has declined, signaling that there is little volatility in the options market ahead of the upcoming earnings season. Important American companies like Morgan Stanley, Wells Fargo, Citigroup, PepsiCo, and UnitedHealth are all expected to start publishing their results this week.

These will be the most-watched corporate earnings because of the ongoing situation in the market. Investors will want to see the impact of the ongoing weak consumer and business confidence and the surging inflation on companies.

Most importantly, investors will also watch the interest income from the biggest American banks as the Federal Reserve continues hiking interest rates. The Fed has hiked rates by 150 basis points and hinted that it will continue tightening further.

The VIX index will also react to the upcoming American consumer price index (CPI) data. Analysts expect the data to show that consumer inflation surged to 8.8% in June. If this is accurate, it will be the biggest increase in over 43 years. These numbers will come a few days after the US published strong jobs numbers.

The CBOE VIX index is falling as American futures retreat. Futures tied to the Dow Jones and S&P 500 declined by more than 0.50% as the earnings season nears.

VIX index forecast

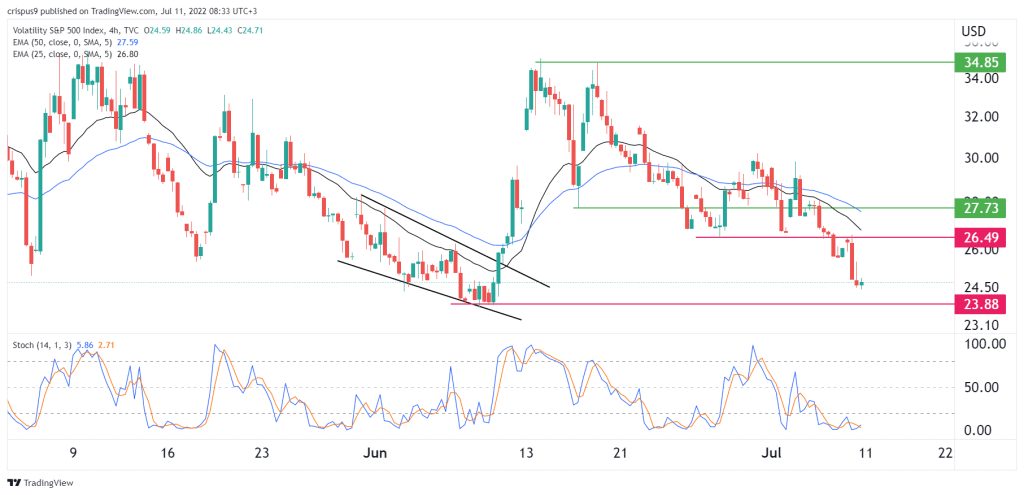

The four-hour chart shows that the VIX index has been in a strong sell-off in the past few days. In this period, the index has moved below the important support level at $26.50, which was the lowest level on June 28th. It has also moved below the 25-day and 50-day moving averages while the Stochastic Oscillator has moved below the oversold level.

Therefore, the outlook for the index is bearish, with the next key level to watch being at $23.88, which was the lowest level in June. On the flip side, a move above the resistance at $25 will invalidate the bearish view.