5 Reasons To Invest in Altcoin | Top 5 Altcoins of 2022

If you’ve just started investing in cryptocurrency, you might be tempted to stick with Bitcoin (BTC). It was the first cryptocurrency, and it is by far the largest. Because it leads the market, it is widely regarded as the most secure option. But have you ever wondered why Altcoins are so popular?

Throughout 2022, a number of altcoins experienced price surges that set records, and several of these coins found themselves propelled into the top-tier cryptocurrency projects after emerging from relative obscurity. Many investors are pondering which altcoins will continue the momentum they established this year and offer even greater returns in the upcoming years as we get deeper into the second half of 2022.

What Are Altcoins? Let’s Take a Glance

Altcoins (alternative coins) refer to all cryptocurrencies other than Bitcoin. They get their name from the fact that they are alternatives to Bitcoin and traditional fiat money.

The first altcoins appeared in 2011, and there are now thousands of them. Early altcoins sought to improve aspects of Bitcoin such as transaction speed and energy efficiency. Recent altcoins serve a variety of functions depending on the developers’ objectives.

Because altcoins make up such a large portion of the market, every crypto investor should understand how they operate. In fact, some altcoins are bridging the gaps that Bitcoin has. That is why altcoins are so valuable.

Continue reading to find out what altcoins are used for, their benefits and drawbacks, and much more.

Uses of Altcoin In the Cryptocurrency Market

The premise of altcoins is the same as that of bitcoin: to use the blockchain as an incorruptible, distributed public ledger that allows and records transactions only if there is consensus that the transaction is legitimate. However, many altcoins have used this premise to achieve different goals or to improve the potential shortcomings of Bitcoin.

Many altcoins are used to accomplish something within their respective blockchains, such as ether, which is used in Ethereum to pay transaction fees. Some developers, such as Bitcoin Cash, have created forks of Bitcoin and re-emerged in an attempt to compete with Bitcoin as a payment method.

Should You Have Altcoins in Your Crypto Wallet

There are over 5,000 different Altcoins solving different crypto problems that can provide you various options to diversify your portfolio. The utility factor of an altcoin is something to look for. Altcoins with greater utility, such as Ethereum’s ether, have a better chance of survival. Investing in altcoins can be entertaining and potentially lucrative—but it’s still a good idea to limit your altcoin investments to no more than you can afford to lose.

Your understanding of cryptocurrency and your investment objectives will determine whether altcoins are a good investment for you.

How Does an Altcoin Work?

Working of Altcoins as well as functionality is similar to Bitcoin. A private key is used to transfer funds from one digital wallet to another, and a blockchain acts as a recording ledger, permanently recording the transaction so that it cannot be altered. The blockchain is protected by mathematical proofs that validate transactions in blocks. Altcoin just differs in the case where what type of crypto solution they are providing to the user depends.

Types of Altcoins In The Crypto Market

Stablecoins –

Cryptocurrencies known as stablecoins are those which track the value of another asset. The majority of the largest stablecoins imitate the value of the U.S. dollar by being tied to it. The coin’s issuer will take steps to fix any price fluctuations. Stablecoins are typically not chosen as a cryptocurrency investment because they are designed to keep their value constant. Stablecoins are used instead to send money or save money. Stablecoins can also be lent out or used in certain savings protocols to earn interest.

Security Tokens –

Tokenized assets provided on stock markets include security tokens. Tokenization is the conversion of an asset’s value into a token, which is then distributed to investors. Any asset, including stocks and real estate, can be tokenized. The asset needs to be held and secured for this to operate. If not, the tokens wouldn’t have any value because they wouldn’t stand for anything. Because they are intended to function like securities, security tokens are subject to Securities and Exchange Commission regulation.

Mining-based –

This kind of cryptocurrency uses mining to confirm transactions and increase the available quantity of coins. Mathematical equations are solved by mining equipment. Typically, a block of transactions is verified by the first miner to solve the equation. Blocks that are verified by miners earn them cryptocurrency rewards.

Staking-based –

Staking is a technique used by these cryptocurrencies to confirm transactions and increase the number of coins. A staking-based cryptocurrency offers holders the option to stake their coins, which commits them to be utilised for transaction processing. A participant is selected by the cryptocurrency’s blockchain technology to validate a block of transactions. Participants earn cryptocurrency incentives in exchange.

Top 3 Altcoins to Invest in 2022

Ethereum

There are literally thousands of cryptocurrencies that have emerged in the previous several years, including Ethereum. Ethereum, the creation of its eight co-founders, debuted in 2015. The individual unit is known as Polygon (MATIC)ether, whereas the cryptocurrency or platform is called Ethereum

Ethereum administers and tracks the currency on a decentralised computer network, often known as a distributed ledger or blockchain. A blockchain can be thought of as a continuous record of all cryptocurrency transactions that have ever occurred. The network’s computers verify the transactions and guarantee the accuracy of the data.

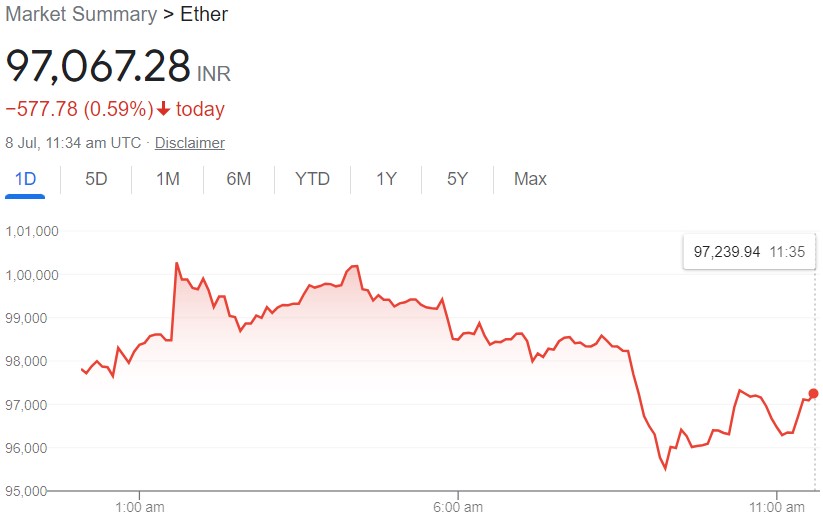

Latest Ethereum Price in India

Ethereum Price Today in India is ₹ 96,442 with a 24-hour trading volume of ₹12,13,11,62,93,876. In the last 24 hours, the ETH-INR price has increased by 2.84%. Ethereum CoinMarketCap rank is 2. The circulation supply of Ethereum is 11,95,98,691.392666ETH coins, with the maximum circulating supply being unlimited.

What does Ethereum Do?

Because Ethereum can be programmed, you can create applications that use the blockchain to store data or set restrictions on what your application may do. This produces a blockchain that can be used for anything and is general purpose. Since there are no restrictions on what Ethereum can achieve, the Ethereum network can support significant innovation.

Polygon (MATIC)

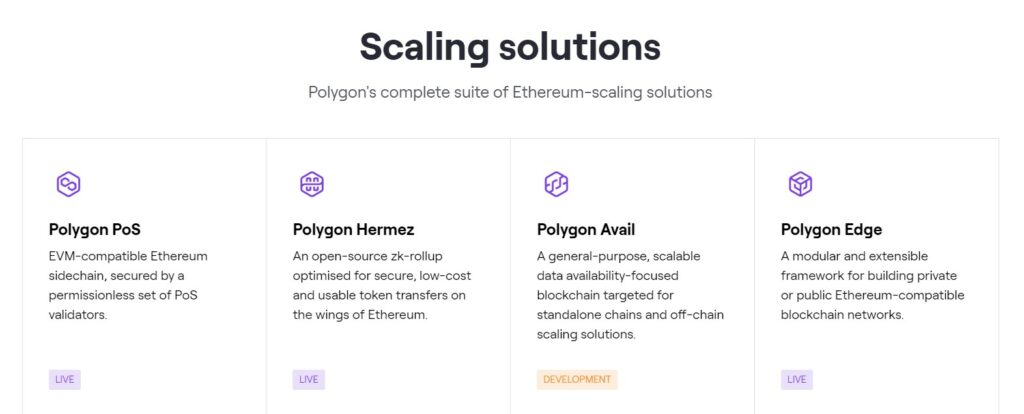

Polygon, previously known as MATIC network, is an interchain scalability solution that gives an infrastructure for creating blockchain networks that can interface with each other. It intends to bring the adaptability and scalability of alt chains along with Ethereum’s security, liquidity, and interoperability. Polygon is further looking forward to admitting two new roll-ups to its platform later on. One will distribute loads of off-chain exchanges together into a solitary trade, while the other will run on top of the Ethereum network to speed up transactions.

Polygon MATIC Price Today In India

Polygon Price Today in India is ₹ 44.55 with a 24-hour trading volume of ₹61,85,76,82,064. In the last 24 hours, MATIC-INR price has increased by 7.79%. Polygon CoinMarketCap rank is 19. The circulation supply of Polygon is 8,00,68,03,952.62 MATIC coins, with the maximum circulating supply being unlimited.

Solutions from Polygon MATIC

With Polygon, you can engage with a variety of well-known crypto apps that were previously restricted to the main Ethereum blockchain by “bridging” some of your cryptocurrency over to Polygon (via the official Polygon Bridge).

Solana (SOL)

Solana is an open-source project that develops a brand-new, fast, layer-1 blockchain without authorization.

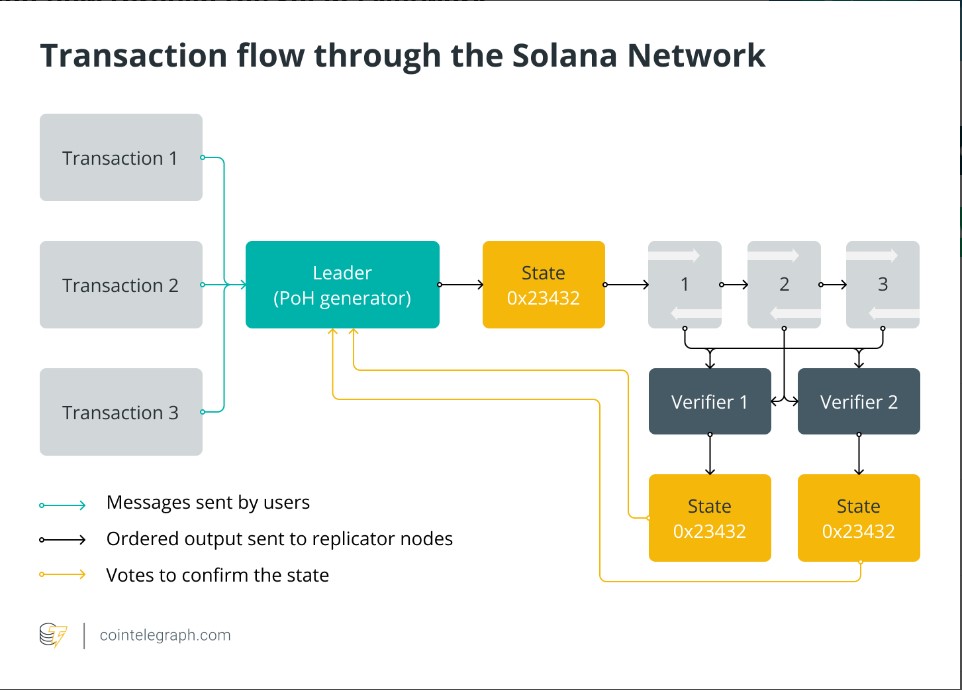

Solana was developed in 2017 by former Qualcomm CEO Anatoly Yakovenko with the goal of scaling throughput beyond what is generally possible on well-known blockchains while keeping prices low. A novel proof-of-history (PoH) method and a lightning-fast synchronisation engine, a type of proof-of-stake, are combined in Solana’s hybrid consensus model (PoS). The Solana network can therefore theoretically handle more than 710,000 transactions per second (TPS) without the requirement for scaling solutions.

The third-generation blockchain architecture used by Solana is intended to make it easier to create smart contracts and decentralised applications (DApps). The project supports a variety of non-fungible token (NFT) exchanges as well as decentralised finance (DeFi) systems.

Latest Solana (SOL) Price in India

Solana Price Today in India is ₹ 2,968.53 with a 24-hour trading volume of ₹1,07,66,52,38,195. In the last 24 hours, the SOL-INR price has increased by 0.38%. Solana CoinMarketCap’s rank is 9. The circulation supply of Solana is 34,38,06,006.861282 SOL coins, with the maximum circulating supply being unlimited.

How does SOLANA Coin Work?

Proof-of-history, a series of calculations that provide a digital record confirming an event’s occurrence on the network at any point in time, is the central element of the Solana protocol. It can be described as a data structure that is a straightforward addition of a cryptographic clock that assigns a timestamp to each transaction on the network.

The practical Byzantine fault tolerance (pBFT) protocol, an optimised variant of the Tower Byzantine fault tolerance (BFT) algorithm, is what PoH uses. It aids Solana in coming to a decision. The Tower BFT serves as an extra tool to validate transactions while maintaining the network’s security and functionality.

Where to Buy The Best Altcoins – BuyUcoin Crypto Exchange

There are a few things you need to have in place before you can start buying altcoins whether you’re new to the cryptocurrency industry or perhaps looking to diversify your portfolio beyond Bitcoin. To store your tokens, you’ll first need a wallet. BuyUcoin – India’s Most Secured Cryptocurrency Exchange in India that provides a BuyUcoin wallet to every user with 3 Layers of security.

Finding a marketplace to purchase and sell cryptocurrency is the next step after setting up a wallet. BuyUcoin is one of the oldest cryptocurrency exchanges in India that offers more than 100 altcoins to choose from with the best price in the market.

So what you are waiting for, just go to AppStore or play store and download the buyucoin app and trade your next altcoin.