Yearn.Finance (YFI) Token Spikes 100% in Week: Possible Reasons

One of most expensive cryptocurrencies of latest DeFi euphoria is pumping again amid bearish recession

Contents

YFI, a core native cryptocurrency of high-performance DeFi aggregator Yearn.Finance, demonstrates rocketing performance despite an accelerating bearish recession in crypto.

YFI spikes 46% in less than 12 hours

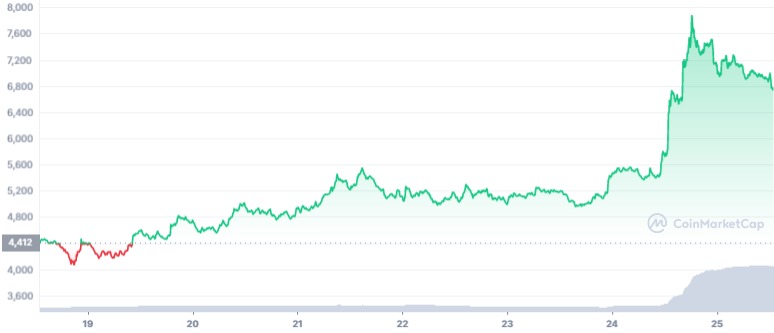

On June 18, 2022, the YFI price dipped below 22-month lows and almost plunged to the $4,000 level. However, after reching the bottom, the asset started rallying.

The most impressive phase of the rally started yesterday, on June 24, 2022. The YFI price jumped from $5,400 to almost $8,000 in a matter of hours.

It allowed YFI to erase its losses in the last three weeks: for the last time, YFI was over $8,000 in early June. However, YFI remains one of the worst sufferers of Crypto Winter: it has lost over 92% since its all-time high.

In the last six months, the YFI price plummeted from $40,000 to $4,000. By press time, YFI is changing hands at $6,724 on major spot trading platforms.

Yearn.Finance radically changes its compensation policy to keep protocol sustainable amid recession

On June 21, 2022, Banteg, a core contributor of Yearn.Finance, published a proposal that may have catalyzed the rally of YFI’s price.

Per this proposal, Yearn.Finance is ready to adjust its compensation model for full-time contributors amid a bear market. The platform can implement 10,000 DAI + $10,000 worth of YFI per month per person, flat compensation level.

Previously, 23 Yearn.Finance full-timers shared 45% of the exchange’s net profit and 2,000,000 DAI/month floor pool for periods when KPIs were not reached.

The reduction is set to make the Yearn.Finance spending model healthier and keep its stability in a bear market. In all, the reform results in a 6.17x reduction in compensation spending.

Also, Banteg announced that the Yearn.Finance treasury has $18.1 million in cash in reserves to guarantee “two years of runway saved up” for its team members.