UNI is on the Cusp of a Bearish Breakout

Uniswap price has moved sideways in the past few weeks, even as its TVL has diverged from other DeFi projects. The UNI token is trading at $5.13, where it has been in the past few days. The price is about 45% above the lowest level in May, bringing its total market cap to about $2.3 billion, making it the 34th biggest cryptocurrency in the world.

Uniswap is one of the oldest DeFi projects in the world. It is a protocol that enables people to swap, earn, and build decentralized applications. The platform was initially launched on Ethereum’s blockchain, but it has since expanded to other chains like Polygon, Arbitrum, and Optimism. Its Ethereum platform has a TVL of over $5.84 billion, while the rest have a TVL of less than $200 million. At its peak, Uniswap had a TVL of more than $11 billion.

The Uniswap price is rising after the recent governance votes in the network. Holders of the UNI token voted to deploy Uniswap V3 on Gnosis Chain, Moonbeam, and Celo. Still, historically, data shows that participants in Uniswap prefer Ethereum despite its high fees and slow speed.

Uniswap price prediction

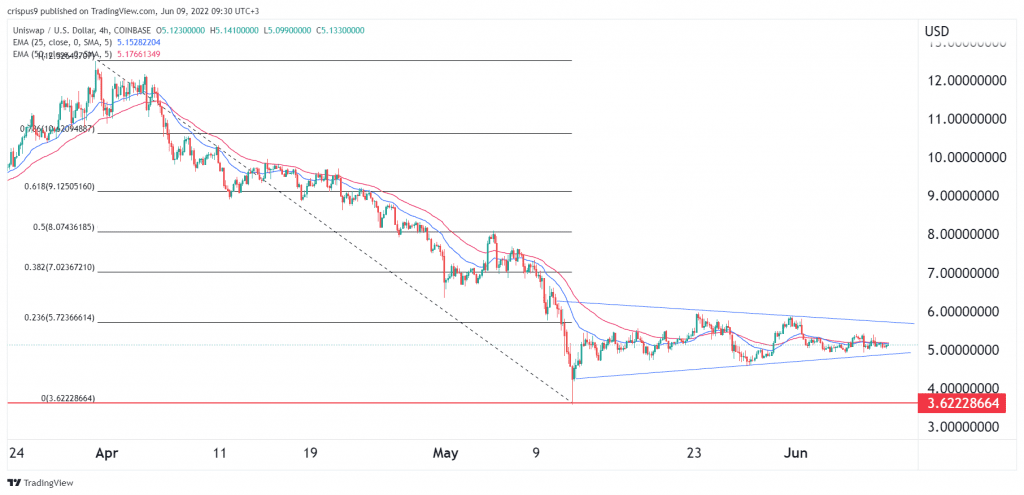

The four-hour chart shows that the UNI price has been in a tight range in the past few days. The coin is still more than 80% below its all-time high. At is consolidating along the 25-day and 50-day moving averages. A closer look shows that the coin has formed a symmetrical triangle pattern that is shown in blue.

Now, with the triangle nearing its confluence level, there is a likelihood that the coin will soon make a breakout. At this stage, it is a bit difficult to predict the direction of this breakout. But if you zoom out on the daily chart, we see that the coin has formed a bearish pennant pattern.

Therefore, there is a likelihood that the Uniswap price will soon have a bearish breakout. If this happens, the next key support level to watch will be at $3.6. A move above the resistance at $5.7 will invalidate this view.