Ethereum clears key threshold to open up immense bullish potential

- Ethereum hit a key milestone with the success of its Ropsten test merge, testnet has now transitioned to proof-of-stake.

- Developers ran the software looking for potential bugs and glitches before mainnet implementation.

- Analysts believe Ethereum price could test $2,000 before the weekend, reveal bullish outlook on the altcoin.

Ethereum price could hit $2,000 over the weekend, according to analysts bullish on the altcoin’s recovery. The successful Ropsten testnet merge has fueled Ethereum holders with positive sentiment.

Also read: Everything you need to know about Ethereum’s merge testnet upgrade

Ethereum merge now live on Ropsten testnet

Vitalik Buterin, the co-founder of Ethereum, has informed the community that the merge can go live as early as August 2022, if there are no issues. Buterin’s optimistic remarks follow Ethereum developers’ announcement of the success of the Ropsten testnet on June 9.

Paritosh, an Ethereum core developer, posted a Twitter thread offering a summary of the merge upgrade on Ropsten testnet. The testnet commenced two hours after the scheduled time, at 16:00 UTC, and the chain was at 99.2% participation rate, considered a healthy level.

Despite the help of the community, the participation rate dropped 13%, with a large percentage of the drop due to a configuration issue on the Nimbus team’s nodes. Developers fixed the issue and the chain continued working fine, offering an affirmation of its satisfactory performance.

The Nethermind team identified a bug shortly after the merge, and a simple restart fixed the issue. Developers identified another potential reason for failure, race conditions. Before implementing the merge on the Ropsten testnet developers had reviewed the possibility on a call and presented error logs. The fixes were quickly in place and the participation and proposal rate climbed up steadily to pre-merge numbers. There were no critical issues, the bugs that were identified could be resolved quickly.

One of the identified issues was client pairs that time out while building a block, and proposing them with zero transactions could affect the throughput of the Ethereum chain. However, this was a predictable error and developers are working on a solution for the same.

What’s next after Ropsten testnet merge

Developers will continue to monitor the chain over the next few weeks to ensure no client pairs go out of sync and called community members to sound alarms if they see dapps or tooling not working as expected.

Paritosh explained that Ropsten is the first existing testnet to get merged, where every client team is running an equal part of the network and nodes are set up in at least a dozen unique ways.

Paritosh asked Tim Beiko, an Ethereum core developer, when the merge will be implemented on the mainnet, in a tweet.

Beiko answered,

The network is stable, but there are some minor (known + expected) issues we are looking into. Overall, though, things are looking good.

Transition from Proof-of-Work to Proof-of-Stake

The merge is a long-awaited event on the Ethereum mainnet and it has faced multiple delays over the past few years. The upgrade is key to reduction in Ethereum transaction cost, one of the biggest hurdles in the decentralized altcoin’s adoption.

Post the merge, the Ethereum blockchain will migrate to the less energy-intensive and more effective Proof-of-Stake consensus mechanism where users, holders of the Ethereum network will be able to perform the tasks that miners on the network do currently. The transition is considered bullish for the largest altcoin network’s adoption as it would slow the issuance of new tokens, alongside burn it could result in a shortage of Ethereum supply. Typically, a shorter supply and lower Ethereum reserves across exchanges could fuel a rally in ETH.

The recent crypto market bloodbath hit altcoins like Ripple, LUNA, Solana, Avalanche and other of the popularly called Ethereum-killers. However, the arrival of the merge is considered as a bullish catalyst by proponents and it could push Ethereum price on the path to recovery through the “Triple Halving” narrative.

Ethereum Triple Halving and price drivers for the altcoin

The Triple Halving narrative is derived from the reduction of Ethereum’s issuance through the merge implementation and burn. First produced by Nikhil Shamapant, Triple Halving narrative implies that the transition to PoS could act as a catalyst and trigger a price rally in Ethereum. The reduction in supply that is expected to follow the merge is the equivalent of three consecutive Bitcoin halvings, therefore the name “Triple Halving.”

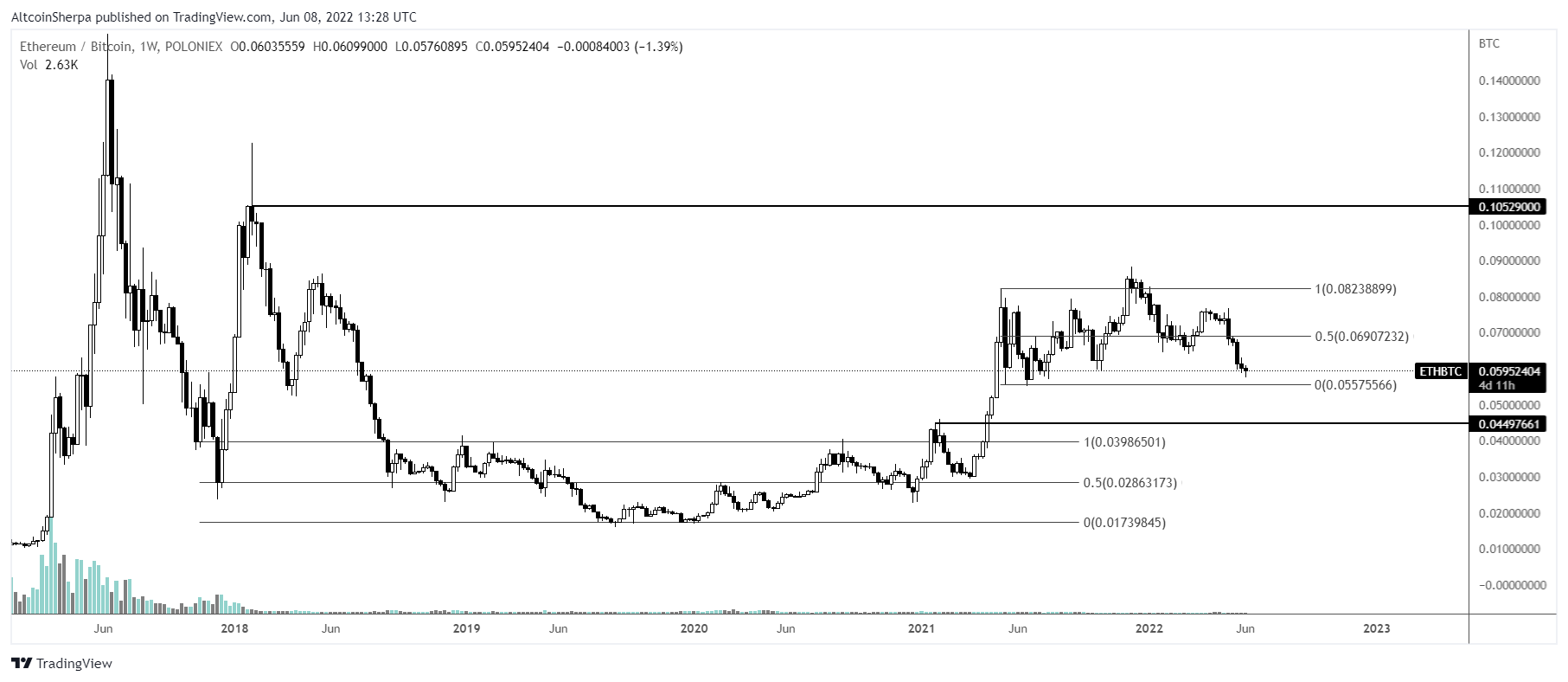

Analysts have evaluated the Ethereum price trend and revealed a bullish outlook. Delma Wilson, an on-chain analyst argues that $2,000 was the level where Ethereum price was rejected a few days ago. The altcoin could reclaim the same level over the weekend. @AltcoinSherpa, a pseudonymous crypto analyst, argued that Ethereum price could witness a short term relief following its recent slump.

ETH-BTC price chart

Tron price also shows huge bullish potential

FXStreet analysts recently evaluated Tron price and identified bullish potential. Analysts believe Tron price could witness one of the largest rallies of all time, for more information, watch: