Bullish Momentum Looks Weak at 298.2

The intraday uptick on the BNB/USDT pair could provide hope to limit bearish Binance Coin price predictions. However, the low bullish volume puts the bulls in a precarious position. Triggering some demand for the Binance Coin on the day is the news that the exchange’s incubation arm is launching a $500m fund to invest in developing new use cases for cryptos.

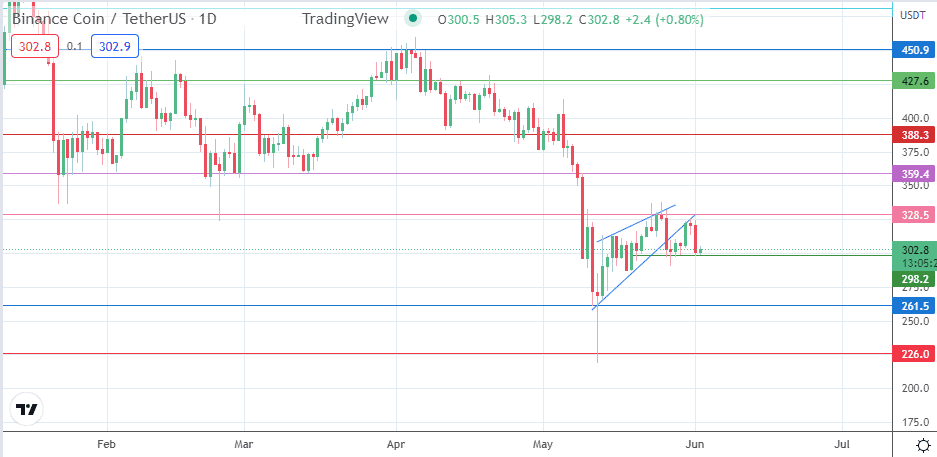

Projects that come up with new technologies to power Web3 will also be able to draw from the fund, which several global venture capital investors support. Bearish Binance Coin price predictions could hit the market if the current support at 298.2 gives way. The bearish pennant on the daily chart was completed when the 26 May candle broke below its lower border.

However, the 298.2 support level truncated further attempts at forcing a decline to the measured move’s completion point at 261.5. A bounce on this support followed, with the return move being rejected on 31 May. The 6.39% slide that followed in Wednesday’s trading has also met support at 298.2, with the bulls holding out so far, albeit with low volumes. Can the bulls muster enough momentum to drive bullish Binance Coin price predictions?

Binance Coin Price Prediction

The decline following the rejection of the return move to the bearish pennant’s lower border has stalled at the 298.2 support level (29 May low). The bears must take out this support to make a lower print, targeting the 11 May low at 261.5. This support is the completion point of the measured move from the pennant. Below this level, the lows of 25 March 2021 and 21 June 2021 form an additional price target to the south at 226.0.

On the flip side, an extension of the intraday bounce targets the 24 May high at 328.5. If the bulls uncap this new resistance level, the 359.4 price mark (14 March low and 9 May high) becomes a new upside target. 388.3 and the 400.00 psychological price barrier will come into the picture if the advance takes out the 359.4 resistance.

BNB/USDT: Daily Chart