Lure fools into crappy Altcoins for profit

Let’s go over the enterprise mannequin of Coinbase and different crypto Tweets of the day.

This Tweet Thread is courtesy of Sam Callahan.

- Permit me to share an article I wrote that appeared into how sh*tcoins carry out after being listed on Coinbase. After digging into it, I stay extremely crucial of Coinbase’s questionable itemizing insurance policies and advertising and marketing methods. TL;DR – Coinbase is the woooooooorst

- I used to be motivated to put in writing this after Coinbase beneficial “High 10 Picks” to their prospects that did not embrace Bitcoin regardless of Bitcoin outperforming 99.9% of sh*tcoins long run. They even beneficial AXS over BTC two weeks AFTER its Ronin Bridge suffered a $625 million hack.

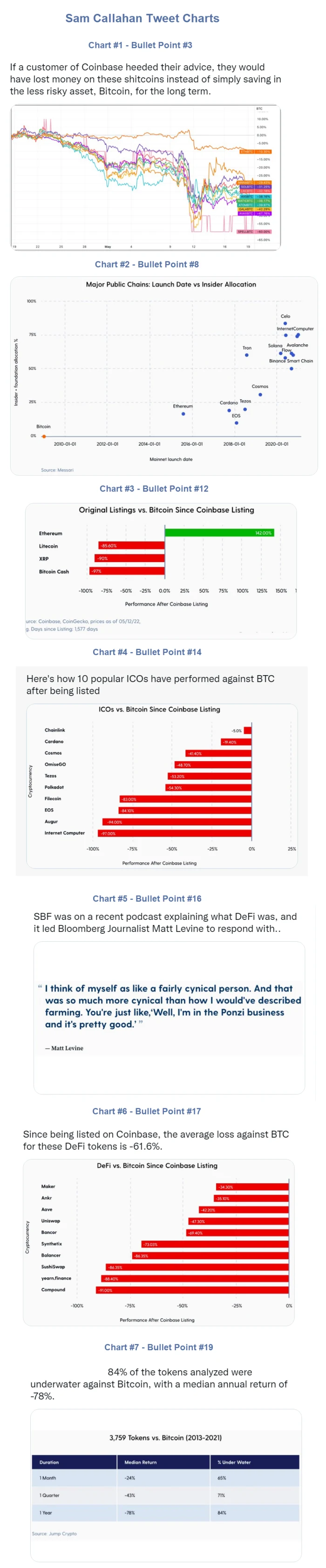

- Since being beneficial by Coinbase, these “prime 10 picks” are down a mean of -37% towards Bitcoin. If a buyer of Coinbase heeded their recommendation, they might have misplaced cash on these sh*tcoins as an alternative of merely saving within the much less dangerous asset, Bitcoin, for the long run. [Mish Comment: Chart 1 Below]

- Coinbase’s advertising and marketing is extremely skewed in direction of sh*tcoins which are riskier and fewer safe than BTC. Their training round BTC is atrocious. They do not need their purchasers shopping for and holding BTC cuz they need them to commerce themselves into oblivion & accumulate these candy tx charges.

- It is essential to notice that Coinbase additionally makes cash off of itemizing charges. They continually push the sh*tcoins they record on their unsuspecting purchasers who find yourself dropping their life financial savings considering they’re shopping for the “subsequent Bitcoin” Coinbase promoted LUNA.

- In 2017, Coinbase had 4 cash exterior of Bitcoin listed on their platform. Quick ahead to at present, and Coinbase provides 161 cryptocurrencies. Most of them I’ve by no means even heard of. (Pawtocol…anybody? lol) Apparently, enterprise has been good within the coin itemizing enterprise.

- It is essential to grasp the sport at play right here…when a sh*tcoin is created, early buyers usually make investments, a improvement crew is shaped, and a % of the cash are issued to those insiders at extraordinarily low costs.

- This insider allocation often happens within the type of a “pre-mine.” That is an aptly named time period to explain cash which are given to early buyers & the crew earlier than most people has the power to mine or purchase them. That is just like a startup issuing fairness to buyers. [Mish Comment: Chart 2 Below]

- After the launch, if the coin beneficial properties in reputation and is listed on a big trade, the VCs and different insiders then have the chance to dump their holdings on retail merchants who’re bought the narrative that the sh*tcoin is “the following massive factor” or is “higher than Bitcoin.”

- These VCs and groups usually do not care concerning the product or “innovation” of the sh*tcoin. The purpose IS to get listed on an trade. The product IS to dump tokens, that have been produced with 0 value, onto retail buyers and 1000x their funding with 0 work. What a product!

- I name this the “The Insider Trade Dump”. This technique has been used beneath many various names reminiscent of ICOs, DeFi, and NFTs, however the consequence stays the identical — the insiders get richer, and the outsiders lose their life financial savings. Do not consider me? Let’s dig into it

- First, let us take a look at how the unique 4 cryptos listed on Coinbase have carried out towards BTC since being listed. All have been marketed as rivals to Bitcoin. Since being listed, 3 of the cash are down >80% towards Bitcoin. Solely ETH has outperformed (we’ll get to this later). [Mish Comment: Chart 3 Below]

- Subsequent was the ICO craze. Regardless of most of those ICO cash having little to no liquidity and even working merchandise, Coinbase listed them on their platform anyhow. They appeared previous the crimson flags and as an alternative noticed it as a chance to gather itemizing charges and develop its product.

- As soon as the cash have been listed on Coinbase and the early investor lock-up intervals ended, these insiders had a big platform to dump their positions on unsuspecting buyers & walked away with huge income. This is how 10 common ICOs have carried out towards BTC after being listed. [Mish Comment: Chart 4 Below]

- As you’ll be able to see, each single considered one of these ICOs have underperformed BTC since they have been listed on Coinbase. A majority of those hyped ICO tokens are deeply unfavorable towards BTC, with a mean drawdown of -58%. And but, Coinbase nonetheless hardly ever markets BTC to purchasers…bizarre.

- Subsequent was the DeFi craze. Coinbase was fast to record & market these tokens regardless of the heightened operational, safety, and regulatory dangers that got here with them. SBF was on a latest podcast explaining what DeFi was, and it led Bloomberg Journalist Matt Levine to reply with. [Mish Comment: Chart 5 Below]

- This is how these DeFi cash have carried out towards BTC since being listed on Coinbase. After being closely pushed on their purchasers, these DeFi tokens are utterly rekt towards BTC. Since being listed on Coinbase, the typical loss towards BTC for these DeFi tokens is -61.6%. [Mish Comment: Chart 6 Below]

- The purpose right here is that Coinbase should hate their purchasers or one thing. It is a platform that gives exit liquidity for insiders to dump their nugatory tokens. As soon as a token will get listed on Coinbase, a majority of the upside has already been made by insiders by way of backroom offers.

- It is not simply me cherry-picking right here. Leap Crypto carried out a research that analyzed the efficiency of three,759 tokens towards BTC over the 8 years between 2013-20021. It concluded that 84% of the tokens analyzed have been underwater towards Bitcoin, with a median annual return of -78%. [Mish Comment: Chart 7 Below]

- Moreover, I analyzed all 161 cryptos which have been listed on Coinbase and in contrast their efficiency towards Bitcoin since itemizing. The median efficiency towards Bitcoin after their itemizing is -67.3%, with a median days since itemizing of 274 days. (Learn that once more please)

- This information is proof that BTC and different cryptos shouldn’t be thought of comparable. BTC has distinctive properties that enables it to carry its worth over time. Each different crypto in addition to Bitcoin is best considered a digital penny inventory. You will not hear this from Coinbase although.

- Again to ETH…from its time of itemizing, it has really outperformed Bitcoin. However the information above highlights how continued demand for Ethereum has been pushed by its switching claims from being a platform for ICOs, to DeFi, after which NFTs (which practically all underperformed Bitcoin).

- At first, ETH was not marketed as a long-term funding however slightly was promoted as “digital oil”. Most ETH holders did not maintain their ETH long run, however as an alternative traded their holdings for different cryptos that have been spawned on Ethereum throughout these numerous speculative crazes.

- If Ethereum is, in the long run, merely a platform for retail buyers to lose cash on different digital belongings, I’d count on its demand and worth to finally go the way in which of all issues that don’t produce any actual worth for the world.

- It’s essential to grasp what you personal and don’t personal in the case of Bitcoin and the remainder of the broader crypto business. It’s about time we separate Bitcoin from different cryptos and name out the irresponsible, questionable advertising and marketing and coin itemizing practices of Coinbase.

- What retail buyers desperately want in at present’s macroeconomic setting is a digital sound cash that may’t be inflated or censored. They should be saving in Bitcoin to protect their wealth — not playing on unregulated digital penny shares utilizing bucket outlets like Coinbase.

- /the top. If you’re sick of being exit liquidity for insiders and getting shilled sh*tcoins, then delete Coinbase and are available take a look at an actual Bitcoin corporations who will deal with you proper, like @swanbitcoin (Disclosure: I work there) I feel the evaluations converse for themselves.

Tweet Charts

Charts and pictures from Sam Callahan Tweet thread

A Studying Expertise

Thanks Sam!

Hopefully, readers will recognize your insights. I recognize the truth that Sam follows me (I simply discovered that out at present after deciding to submit the above Tweet thread).

Anybody who follows me has to know that I’m not a fan of crypos, together with Bitcoin.

However I particularly went after the plain fraud pretenders together with LUNA and DOGECOIN, the latter hyped by Elon Musk.

Maybe Sam feels the identical approach that I do and have commented on many instances. “I comply with plenty of individuals on Twitter I disagree with and study extra for them than I do with individuals echoing my ideas.”

Hopefully, the above Tweet thread by Callahan sheds lots of gentle on what is going on within the crypto area.

You Simply Do not Perceive!

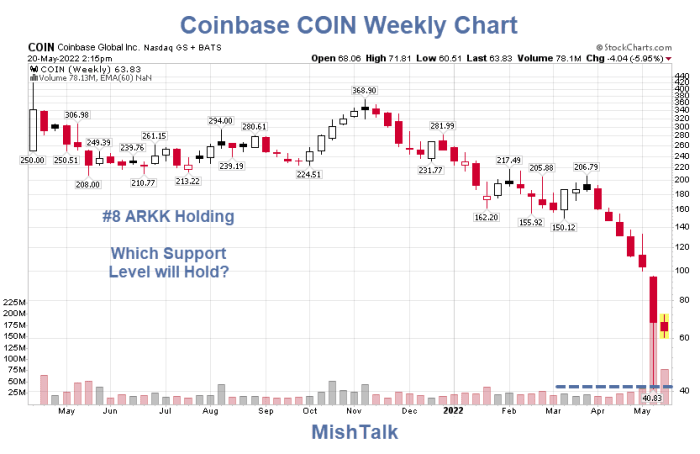

Coinbase Chart

Coinbase chart courtesy of StockCharts.Com, annotations by Mish

Coinbase is the eighth largest place of Cathie Wooden’s ARK fund. Will Coinbase even survive?

For dialogue, please see Cathie Wooden Offers Lesson of the Day: Do not Spend money on Fairytale Shares

The place is Bitcoin Headed?

I’ve frequented commented “I have no idea and nor does anybody else.” The identical applies Ethereum and all the remainder of the cash.

That mentioned, I think Dogecoin has a date with zero. It was began as a joke. It is now all the way down to $0.085 from a Musk-inspired hype excessive of $0.74.

Anybody who obtained in on the “Musk excessive” is down 88% with nearly no likelihood of restoration in my estimation.

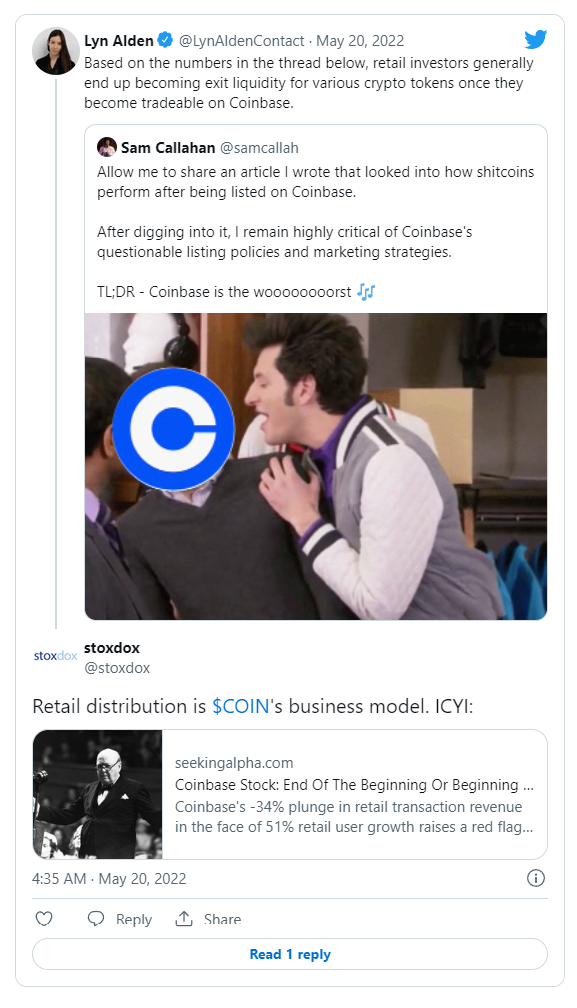

Extra Noteworthy Tweet Dialogue

Retail Distribution is the Coinbase Mannequin

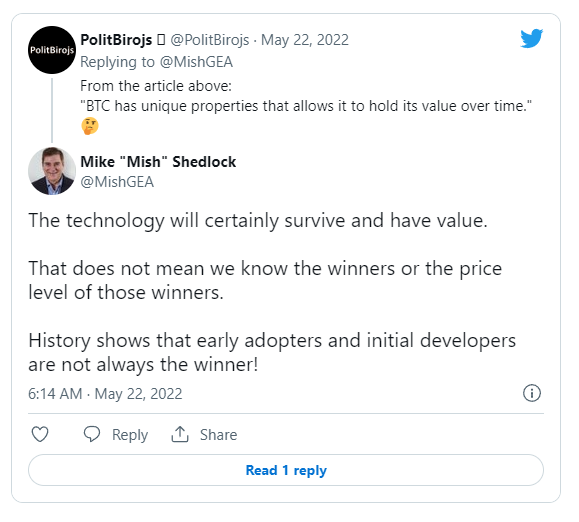

A Phrase Concerning the Future

Pretending to Know the Unknowable

Nobody is aware of the place these cash are headed or in what timeframe. But, daily individuals faux to.

The topic got here up once more at present.

“As soon as Ethereum turns into proof of stake formally and threat is generally eradicated ….“

AND threat is generally eradicated!?

Sorry, that is both ignorance or a lie. I see comparable statements about Bitcoin on a regular basis.

Crypto Beginnings

Bitcoin launched in January of 2009. It has by no means seen any setting than countless Fed pumping, low curiosity rates, and excessive QE liquidity supporting all asset costs.

Liquidity additionally explains the rise of a whole bunch if not 1000’s of altcoins, all inherently nugatory.

Even when we give Bitcoin and Ethereum first mover benefit, nobody can probably understand how both will carry out in an inflationary setting wherein the Fed is mountain climbing and for the primary time stating an aggressive QT (Quantitative Tightening) coverage.

Coin Provide Delusion

Opposite to common fable, the provision of Bitcoins doesn’t lower when it halves,

A Bitcoin halving is when the payout for mining a brand new block is halved. This occurs after each 210,000 blocks (roughly 4 years).

Halving limits the rise within the variety of Bitcoins over time, however that doesn’t lower the provision. As a substitute, halving decreases the speed of enhance of provide.

The provision of Bitcoin is each coin ever mined minus these with misplaced keys.

Each second of daily events have to handle a easy set of questions.

Determination Time 100% of the Time!

- Holders: Do I maintain Bitcoin or would I slightly maintain one thing else?

- Potential Patrons: Do I purchase Bitcoin, one thing else, or nothing in any respect?

It is essential to grasp there’s nothing distinctive about Bitcoin.

The identical applies to the stock market, the bond market, forex merchants, even residence house owners.

Questions Abound

Do I wish to maintain this asset or one thing else?

If somebody is keen to promote you a Bitcoin for $30,000, ask your self why. What’s it that they suppose they know that you simply suppose they do not.

Are the sellers “Bitcoin Whales” deciding to money out? Beginner larger fools who has had sufficient?

I do not know, and you do not both. But, the pretending goes on: “Bitcoin at all times will rise.”

Anybody who makes that assertion is a liar, a idiot, or a charlatan hoping you might be their larger idiot.

Money Is not Trash

Even in inflationary environments, money will not be trash.

- Money is down about 10% this yr to cost inflation (besides vs belongings).

- Bitcoin is down about 56%.

- LUNA is down about 100%.

- ARKK is down about 74%

- The Nasdaq is down about 30%

- The S&P 500 is down about 20%

The clear winner this yr is money. It can typically purchase extra of typically any threat asset even when it buys much less meals or gasoline.

A Phrase About Asset Bubbles and Inflation

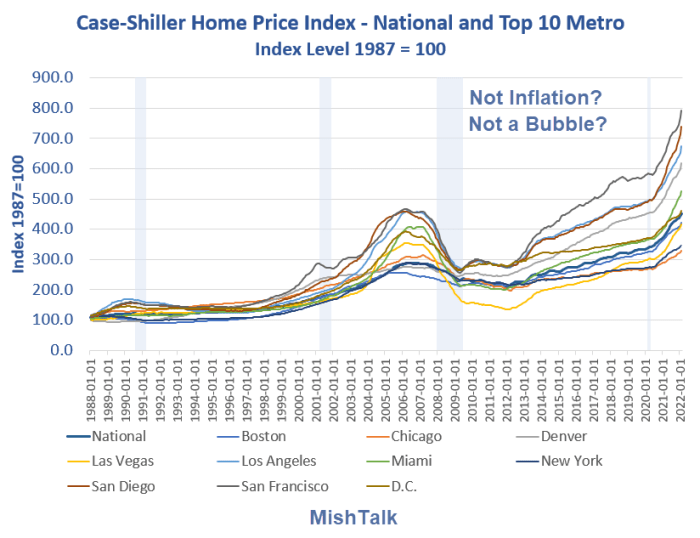

The Fed has no thought what inflation is or methods to measure it. Neither the Fed nor economists usually put belongings of their mannequin.

If that chart will not be a measure of inflation then what’s it? A tuna fish sandwich?

But when inflationary bubbles are the upside beneficiaries of Fed coverage, the draw back threat is a deflationary bust.

We’re in asset bubble deflation now.

High Thought of the Month: What Must Occur Earlier than Shares Backside?

Please think about High Thought of the Month: What Must Occur Earlier than Shares Backside?

Historical past suggests markets backside after the yield on the 10-year treasury notice drops considerably.

That has ominous implications for all asset courses, particularly the riskiest of asset courses.

And Bitcoin has typically been following the Nasdaq. There isn’t a motive to consider that stops, nor any motive to consider we’re near a backside in something.

Bitcoin Margin Calls, Waterfall Occasions, and Individuals Pretending to Know the Unknowable

“You simply do not perceive“.

Crypto advocates definitely perceive the inside workings of cryptos much better than me.

However most of them are naïve about provide and demand, bear market liquidity, the true driving drive behind cryptos (hypothesis), and what they consider they know that’s merely unknowable.

On Might 12, I mentioned Bitcoin Margin Calls, Waterfall Occasions, and Individuals Pretending to Know the Unknowable

On Might 14, I famous El Salvador’s bonds Promote for 40 Cents on the Greenback, What About Bitcoin Metropolis?

El Salvador has fashions. President Nayib Bukele tried to promote bonds backed by Bitcoin however there have been no takers. However he’s shopping for the cash.

Michael Saylor, CEO of MicroStrategy (MSTR) guess his firm on Bitcoin. El Salvador president Nayib Bukele guess the nation.

Each did so with Bitcoin above $30,000.

Curiously, Saylor blew up his firm as soon as earlier than and now smack within the midst of a liquidity crunch could achieve this once more.

To not fear, I’m informed “It can not occur” by charlatans pretending to know the unknowable.