Apollo’s Moonshots: Clearpool has a good chance of becoming the “killer app” of DeFi 2.0

David Angliss, an analyst at Apollo Capital, Australia’s leading cryptocurrency investment firm, shares the fund’s regular take on what’s happening in the fast-moving and volatile cryptocurrency space.

It usually doesn’t take long for a new investment and utility narrative to grab the bulls in the crypto space by the horns, and a hot new one seems to be emerging – DeFi 2.0. Clearpool (Ticker: CPOOL) is one of the few buildings in the area that has really caught the attention of Apollo Capital.

The new wave of decentralized finance is focused on bringing previously untapped, undercollateralized lending opportunities to the crypto market. And that’s a big deal because over the next few years, it could potentially attract more than $1 trillion in capital flow from traditional credit markets to DeFi.

No “killer app” for DeFi 2.0… yet

Angliss told Stockhead that there hasn’t been a real “killer app” for undercollateralized loans yet, but that Clearpool “definitely has a chance,” along with other competitors like Maple Finance and TrueFi. (BNPL Pay is another promising DeFi 2.0 protocol that Stockhead has been investigating and is backed by Clee Capital with Australian VC.)

Clearpool is an Ethereum-based protocol that acts as an institutional lending service. It provides users with undercollateralized liquidity directly from DeFi. Until this recent advent of DeFi 2.0, borrowers had to put up more capital (e.g. 150%) than the loan itself as collateral, also known as over-collateralised lending.

And Clearpool is also introducing two new core concepts in DeFi – single borrower liquidity pools and tokenized lending.

“Clearpool benefits borrowers looking to leverage unsecured, unsecured, centralized lending,” says Angliss, “and offers lenders, essentially everyday DeFi users, the same revenue opportunities that institutional investors, VCs, and whales would typically have.”

What kind of return are we talking about for liquidity providers?

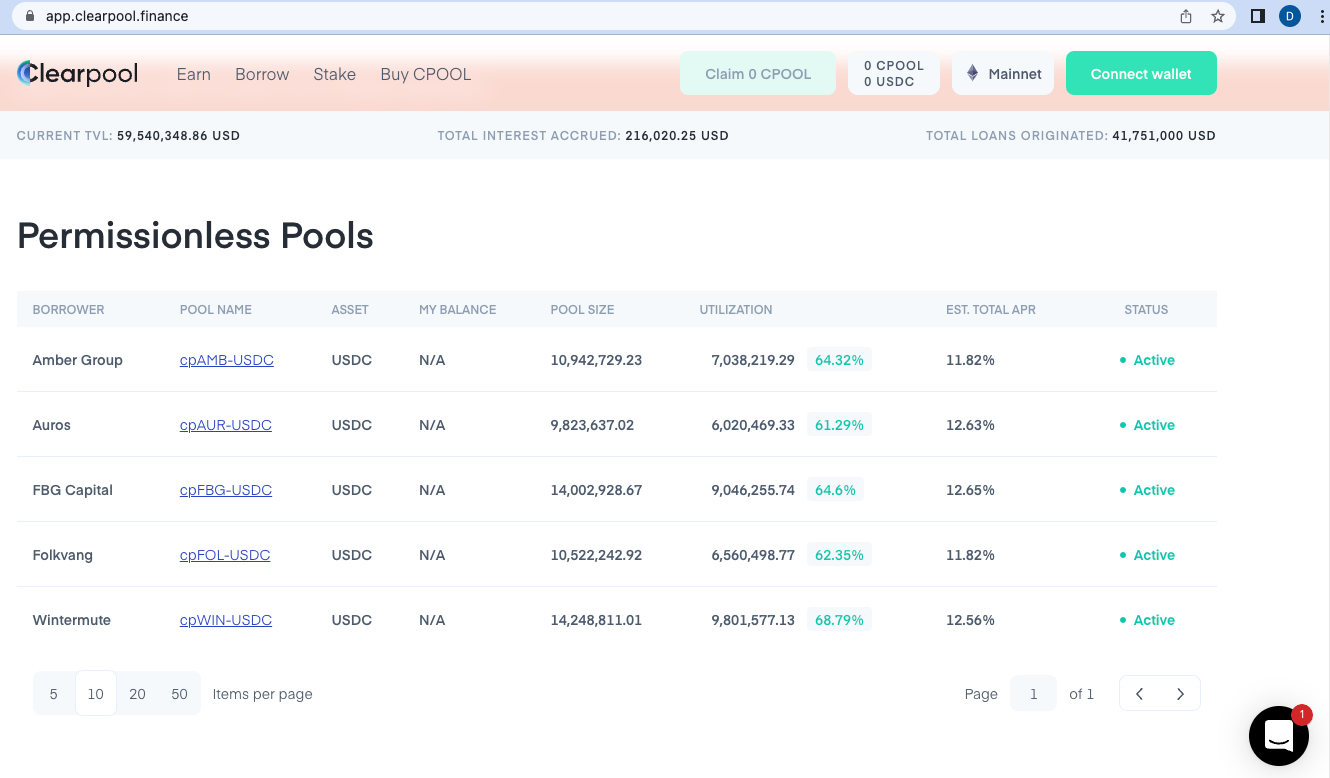

Judging by the yield farming liquidity pools shown to us by Angliss, the APR recovered from Clearpool loans ranged from around 12% to 17.5%*. And that’s pretty good in the current DeFi climate, which Angliss says has been in a bear market for a while, although LUNA and the Terra ecosystem have been stealing the show lately.

*Note: The current average APR of Clearpool Permissionless Pools has declined somewhat recently, in line with the declining market.

*Note: The current average APR of Clearpool Permissionless Pools has declined somewhat recently, in line with the declining market.

However, is there a chance that DeFi 2.0 protocols can bring back the heady days of even higher returns than this?

“It depends,” says Angliss. “A lot of people wrote off that it will never happen again. But if we get a strong catalyst, like the Eth 2.0 merge or more layer 2 token releases like $OP, Optimism’s native token…then the returns on Ethereum DeFi could easily push the returns back to the mid-20s, 30s , maybe 40s drift depending on risk tolerance.”

He adds that Apollo is “really excited about Clearpool’s Permissionless Pools” and reveals they are already using them for their two yield farming funds – Opportunities Fund I and II. And that’s because “because those returns are some of the best you can get in DeFi right now.”

🧑🏫 With 5⃣ Borrower Pools now live, here’s what you need to know about lending on the #Clearpool app!

🔎 When can I withdraw my money?

🔎 How is the interest rate calculated?

And many more questions answered!

Learn more 👇https://t.co/rPtPDyoZ3i$CPOOL #DeFi

— Clearpool (@ClearpoolFin) April 27, 2022

Clearpool’s investment thesis

All in all, what brings Clearpool into the ‘moonshot’ investment territory? Angliss helped us break it down as follows:

Low market capitalization

Clearpool’s market cap is currently about $10.1 million, with a fully diluted valuation of about $123 million. Angliss says that’s quite a ratio, but that, for example, Maple Finance (an Apollo favorite) has a fully diluted valuation of $538 million (current market cap: $302 million), while TrueFi’s is around $242 million US dollars (current market capitalization: USA). $112.5 million).

The result is that Clearpool operates in a similar territory and does similar things to those two competitors but flies comparatively under the radar.

Solving a unique problem

As mentioned above, unsecured lending is the missing link in DeFi, and Angliss says Clearpool is “one of the more exciting solutions for unsecured lending in DeFi right now.”

Proven with TVL

The project’s liquidity pools have only been operational for about a month, and the protocol’s TVL (Total Value Locked) number is now more than $59 million. “That’s very good,” says Angliss, “and is a great indication of acceptance.”

Serious borrowers

As you can see from the Permissionless Pools table above, Clearpool has very well-known borrowers participating, which strengthens and legitimizes the protocol. These are led by FBG Capital, a “premium VC and digital asset management firm” with one of the largest pools at this stage.

Strong team, great supporters

Apollo Capital met members of the Clearpool team including UK CEO Robert Alcorn. “They have a really strong mix of traditional finance and DeFi background and experience,” notes Angliss.

And they’ve managed to attract some serious backers, including Sequoia, Arrington Capital, and GBV, among others. “It brings robustness and is always a good sign of a project’s growth and longevity.”

Final Thoughts

“We’re 100 percent optimistic on that score,” confirms Angliss, concluding:

“I’m really impressed with how far the protocol has come in a very short time frame. It’s down 94 percent from its all-time high, has a working product, and little marketing at this stage. Once the market realizes that this is another Maple or TrueFi game, we could see a good price hike.”

The views, information or opinions expressed in the interview contained in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise held responsible for the financial product advice contained in this article.

![]()

SUBSCRIBE TO

Get the latest Stockhead news delivered to your inbox for free.

It’s free. Unsubscribe whenever you want.

You might be interested

Learn Crypto Trading, Yield Farms, Income strategies and more at CrytoAnswers

https://nov.link/cryptoanswers