Bank of America Warns of ‘Recession Shock,’ But Will Crypto Outperform?

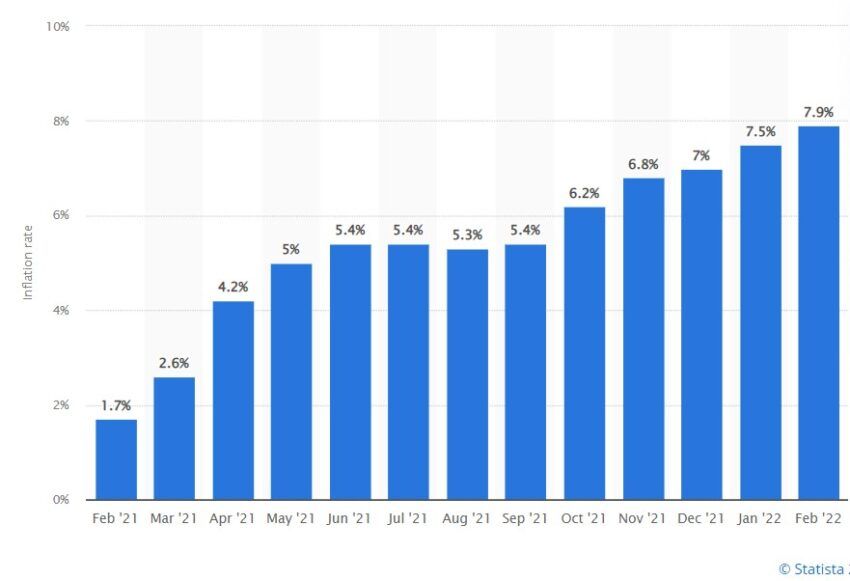

Bank of America strategists warned in a recent weekly research note that the U.S. economy could be heading into a recession, as the Federal Reserve tightens its monetary policy to help curb what it calls “surging inflation.”

On Wednesday, the Federal Reserve said that it will likely pull assets at twice the pace it did in its previous tightening exercise, from its $9 trillion balance sheet at its meeting in early May. According to sources, a large majority of investors also expect the central bank to hike its key interest rate by 50 basis points.

“‘Inflation shock’ worsening, ‘rates shock’ just beginning, ‘recession shock’ coming”, BofA chief investment strategist Michael Hartnett wrote in a note to clients, adding that in this context, cash, volatility, commodities and crypto currencies could outperform bonds and stocks.

Are we headed for another recession?

In the event the economy is headed in that direction of another recession, crypto is expected to outperform traditional assets along with the alternative asset basket. In other words, crypto and commodities will do better than stocks and bonds, as Hartnett outlined.

Yet, amid inflation concerns, we also need to recall the second half of 2021.

In pattern with last year’s recorded peak inflation levels, JP Morgan analysts had attributed the surge in crypto to the inflation fears back in October.

“The re-emergence of inflation concerns among investors has renewed interest in the usage of bitcoin as an inflation hedge,” a JP Morgan representative stated.

Given the inflation picture continues to look grim, a repeat episode isn’t out of the question, despite the record rally that Bitcoin and many other cryptocurrencies witnessed in October-November had tumbled by the end of December.

Will a rising stock-crypto correlation change the outcome?

However, what happens if the predicted recession and drop in the stock market also brings down the value of crypto?

As the Federal Reserve continues to tighten its monetary policies and tease a rate hike, stocks are showing a downward trend. Earlier this year, several analysts, including commentary from the IMF, acknowledged the highest ever correlation between the stock and crypto markets.

“Increased crypto-stocks correlation raises the possibility of spillovers of investor sentiment between those asset classes,” the IMF report stated.

If we look at the composition of the American investors, a recent survey by eMoney Advisor had found that 65% of citizens are actively investing. While 48% of these American investors have bought stocks, 43% are crypto investors in the second spot.

“The appreciation of these assets depends on the demand of the other investors in the system,” Celeste Revelli, CFP explained in the report.

This means, that even regulatory hurdles could be enough to deter investors from holding the novel asset class. Recently, Federal Deposit Insurance Corporation (FDIC) had also flagged risks of crypto and related activities to the U.S. banks.

Indeed, as regulatory uncertainty continues around crypto, the demand of a wider audience might remain limited, meanwhile, paying mind to the fact that the appreciation of the asset class cannot be guaranteed.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.