The Turkish Lira Freefall And Bitcoin

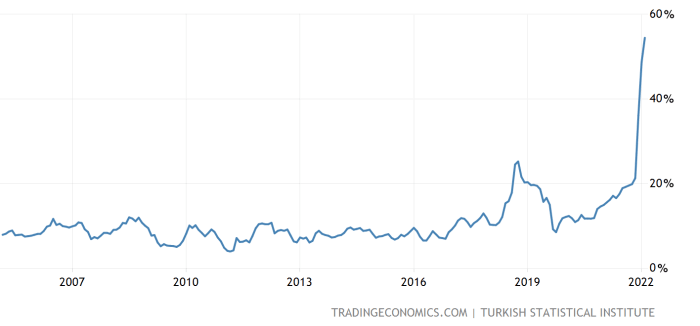

2021 was a rough year for the people of Turkey, as the country experienced rapid devaluation of its currency, the lira. Things haven’t improved in 2022 as the lira has suffered since Russia invaded Ukraine as sanctions and export bans have resulted in soaring commodity prices. According to official government reports, Turks are now suffering from 54.4% year-over-year (YoY) inflation, the highest in 20 years.

Annual Turkey Inflation Rate

The central bank estimates that inflation will only be 23.2% YoY by year-end, but that estimation was made assuming the price of crude oil would be around $80 per barrel. The outbreak of war has caused the price of oil to spike well above $100 at the time of writing. Soaring commodity prices from the war likely mean the central bank is underestimating year-end inflation. To put things into perspective, Russia and Ukraine supplied 80% of Turkey’s $4 billion grain imports last year. If the price of that one single commodity increases drastically, that alone could cause Turkey’s inflation rate to rise.

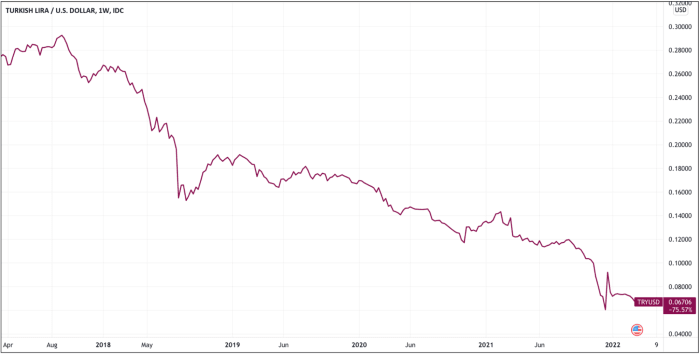

The purchasing power of the lira is tragically vanishing right before Turkish citizens’ eyes. But the truth is, this currency crisis has been developing for a long time now.

Over the last five years, the lira has lost 75.57% of its value against the U.S. dollar.

How Did Turkey Get Here?

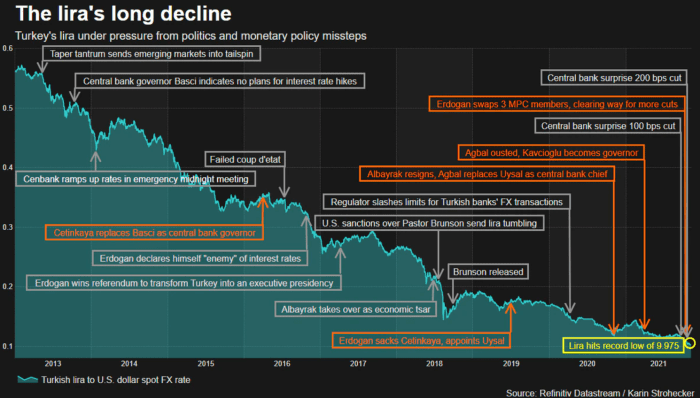

To put it simply, since 2012, Turkey has suffered from taking on a large debt burden coming out of the Great Recession, political instability that led to a failed coup d’état in 2016 and U.S. sanctions and tariffs on its steel and aluminum industries further damaged its economy.

Here’s a helpful timeline of events to get a sense of what Turkey’s last decade has been like:

All of these events have culminated in what is unfolding today with the collapsing lira. Over the last two years, we’ve witnessed all of the telltale signs of what happens when a currency collapses and how a government and central bank attempt to save it.

The Central Bank of the Republic of Turkey (CBRT) and President Tayyip Erdoğan appear desperate in their efforts to try to combat soaring inflation and stabilize the lira. In the past year, we saw them attempt every tactic in the government playbook to fight inflation.

Here are eight ways that Turkish authorities have tried to combat inflation so far:

1. Implementing Price Controls

One example of this price fixing is with bread and Turkish bakeries. The Chamber of Bakeries fixed the price of bread, but now the bakeries are warning that bankruptcy looms as they are forced to adhere to the government’s price fixing while their sales are down.

2. Pleading With Turkish Citizens To Sell Gold/Dollar Holdings To Support The Lira

“I ask my citizens to invest their foreign currencies and gold in various financial institutions and bring those assets into the economy and production.” — President Tayyip Erdoğan, March 24, 2021, in a speech at the Congress of the ruling AKP

In a last-ditch effort to stop Turkish citizens from fleeing the lira and finding protection elsewhere, President Erdoğan has tried, on multiple occasions, to encourage them to hold on to their freefalling liras in the name of national pride.

The government recently announced a new gold conversion deposit account that promises “risk-free income” in order to encourage people to bring their “under-the-mattress” gold into the banking system.

3. Depleting Foreign Currency Reserves To Prop Up The Lira

In mid-January, the Turkish central bank’s foreign currency reserves dropped to their lowest level since 2002, to $7.54 billion dollars. This means that since November 2021, approximately 75% of the central bank’s FX (foriegn exchange) reserves had been sold off to support the lira. Since those January lows, Turkey’s FX reserves have surged back after the central bank made some swap deals with the United Arab Emirates.

Goldman Sachs estimates that the nation’s gross FX reserves fell around $20 billion in December 2021 alone due to central bank currency interventions.

President Erdoğan has been selling his country’s FX reserves at a rapid pace to prop up the falling lira.

4. Demanding Exporters Convert 25% Of Income To Liras

This measure is aimed at boosting Turkey’s currency reserves by forcing companies to keep some of their revenues from their sales abroad in liras. These actions are an attempt to stop companies from selling their liras for stronger foreign currencies.

5. Increasing The Minimum Wage By 50%

To ease public discontent, President Erdoğan increased the minimum wage by 50%, the highest raise in the 50 years. Higher wages definitely help those suffering on the ground, but there’s also a risk of higher wages leading to even more inflation, bankruptcies, and unemployment as businesses face increased labor costs.

6. Injecting State Banks With Capital To Boost Lending

Turkey’s Sovereign Wealth Fund recently injected $2 billion into two of the largest Turkish banks to help improve their balance sheets and stimulate lending to corporations.

It also followed that capital injection with an additional $1.6 billion injection into its largest lender, T.C. Ziratt Bankasi to “strengthen the capital of state banks and improve their lending power.”

The government is attempting to keep credit flowing in its banking system by injecting them with cash to make up for the eroding lira on their balance sheets.

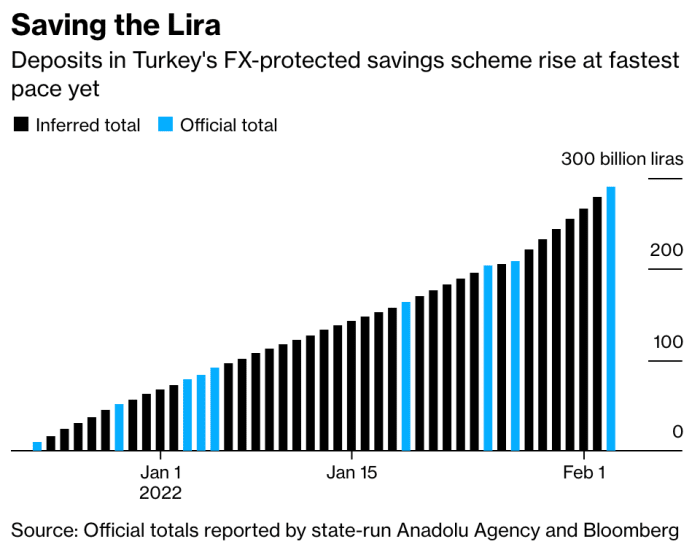

7. Providing State-Protected Lira Accounts

To combat investors hoarding dollars to protect themselves, the Central Bank of Turkey announced that they would support accounts that converted foreign currencies to liras. Essentially the central bank is offering protection to accounts that are converted to liras by covering any changes in interest rates or exchange rates from when the conversion happens.

This strategy has resulted in favorable results for the central bank as Turks have flocked to the protected lira accounts. Funds have steadily flowed into these “FX-protected accounts,” reaching 290 billion liras ($21.4 billion).

This new strategy has successfully resulted in local investors reducing their dollar and euro deposits by nearly $11 billion since the FX-protected accounts began back in December 2021. Time will tell if this savings scheme can continue to attract local investors to hold liras instead of other assets and foreign currencies.

8. Refusing To Raise Interest Rates Despite The High-Inflation Environment

Contrary to the traditional practice of central banks, President Erdoğan has not raised interest rates in response to inflation and instead has cut interest rates in the face of inflation.

In many cases historically, this has only led to more inflation. Additionally, he has fired multiple central bank governors whose policies started to raise interest rates. President Erdoğan fired four central bank policymakers in a two-month span back in the spring of 2021 alone.

Whereas other central banks are raising interest rates to combat inflation, President Erdoğan has refused to. He has kept its benchmark rate unchanged in spite of rapid inflation for the last two months.

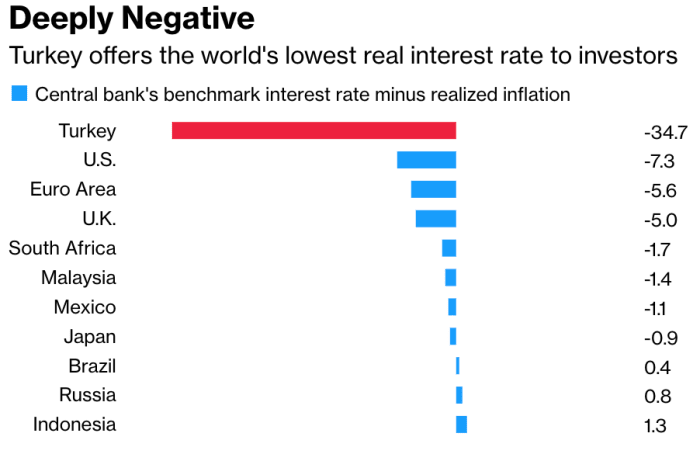

Turkey’s real yield now stands at negative 34.7%, the lowest amongst emerging markets by a large margin.

Turkey’s key interest rate, the one-week repo rate, remains at 14%, down 3% over the last year.

Despite all of these efforts by Turkish authorities, inflation continues to soar and the lira continues to lose its purchasing power. As of last week, Erdoğan is now blaming inflation, not on his policies, but rather “foreign financial tools” and bad statistics. Erdoğan recently fired the president of the Turkish Statistical Institute after his statistical analysis showed inflation was still on the rise.

All in all, this Turkish inflation train doesn’t appear to be stopping anytime soon. All of the central bank and government’s attempts to stem the inflation have done nothing to stop the lira’s freefall, and now a war has unfortunately broken out in their region, worsening the inflation picture even more.

A Fiat Crisis Unlike Others

From a Western perspective, it’s easy to look at what’s happening in Turkey and see just another emerging market on the other side of the world suffering a currency crisis like Argentina or Venezuela, but this is very different.

Turkey dwarfs those other countries in gross domestic production (GDP), population and global trade. We haven’t seen a country with an economy of this size go through a currency crisis like this in a long time, and we definitely haven’t seen a fiat currency of this size inflate like this in Bitcoin’s lifetime.

Today, Turkey has a population of around 84 million people. It is the 21st largest economy in the world in terms of nominal GDP, and the 11th largest economy in terms of GDP by purchasing power parity (PPP).

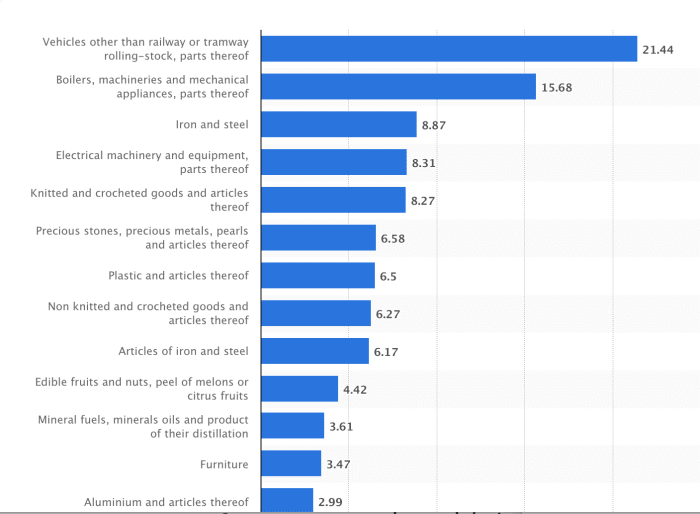

Recently, Turkey’s exports broke a record of over $225 billion dollars, and Turkey’s share in global exports surpassed 1% of total exports for the first time in history. Turkey currently is the sixth largest trading partner to Europe and the 32nd largest trading partner to the United States. Its main exports are vehicles, machinery parts, steel, iron and textiles.

Leading 20 Export Commodities Of Turkey In 2020, By Value (In USD Billions)

The point I’m trying to make here is that Turkey is not some small, inconsequential country. It’s a large, extremely important member of the global economy and a vital trade partner for all of Europe and abroad.

The rapid inflation of the lira is, therefore, one of the biggest opportunities yet for Bitcoin to prove its use case on the world stage as a censorship-resistant money that no one can debase – money that can find product-market fit specifically in countries like Turkey where the local currency is losing its purchasing power at an alarming rate. Sadly, for the people on the ground in Turkey, the red-hot inflation is starting to feel very real.

What’s It Like On The Ground?

From speaking with some friends and colleagues on the ground, it sounds like what you’d expect to hear in the early stages of a hyperinflationary event. Everyone is telling me how they and others are trying to find ways to protect themselves against the rising inflation, and that they are struggling to make ends meet.

The rising cost of living has made everything more expensive for the ordinary Turkish person. Grocery prices are rising almost daily, forcing grocery store chains to put quotas on items like flour, oil and milk.

There are multiple reports of food shortages across the country. Recently a two liters per family monthly limit was put in place on sunflower oil.

https://twitter.com/WallStreetSilv/status/1502819230357483523

The government denied these shortages only to later ban exports of oils and margarine due to “domestic demand issues and problems with price movements.”

Bread lines are becoming a more common occurrence, as The New York Times reports shows in this article.

At the start of the year, the state raised electricity and natural gas tariffs that some estimate could raise household energy costs by up to 130%. Mind you this was before the war between Russia and Ukraine caused oil prices to spike.

The rising inflation has also resulted in soaring rent prices across the country. Rent prices increased some 60% in some districts of Istanbul this year. Turkish students are struggling to afford rent and have taken to the streets to protest by sleeping in parks to highlight their struggles.

Another friend explained to me how restaurants in Turkey for the first time started requiring a minimum dollar amount before customers were allowed to sit down and also started charging customers by the hour to use a heating lamp due to the rising energy costs.

In addition to the rising cost of living, locals also have to deal with opportunistic foreigners. Foreigners from neighboring countries like Bulgaria have been crossing the border to take advantage of the lira’s struggles by using their stronger currencies to clear out grocery stores. They pack their cars full of goods they purchase for cheap and then return home with their bounty. Turkey’s wealth is being pillaged by foreigners, adding pressure on ordinary Turkish people who are already struggling to afford food, housing and other essentials.

https://twitter.com/1e9petrichor/status/1467634582526779405?s=20

All of these developments have led to anger and desperation amongst the people of Turkey. As their savings continue to evaporate, they have taken to the streets to protest against their president’s economic policies and their wages.

Over 13,000 Turkish workers from 61 companies have gone on strike demanding higher wages according to independent researcher Labor Studies Group.

Some of the strikes have been successful and received up to 30% real wage increases, but even that didn’t keep up with the rising cost of living.

Last month, thousands marched in Istanbul to raise their voice against the direction of their economy and their country. This is what happens when money dies. When people’s life savings are destroyed and they are finding it harder to afford necessities, the only thing left to do is take to the streets and demand change.

https://twitter.com/TheInsiderPaper/status/1467171867266101248

How Are The People Of Turkey Protecting Themselves?

Much to the dismay of President Erdoğan, the people of Turkey did not heed his call to sell all of their gold and dollar holdings to protect the falling lira. The Turkish people are instead seeking refuge from the inflating lira in various stores of value like real estate, gold, dollars and bitcoin.

An Istanbul-based research company, Aksoy Research, recently took a poll and asked the people of Turkey, “If you had an extra 10,000 liras, which one would you invest in?”

The results were only 11.4% of respondents said they would keep their savings in the lira. The rest of the poll results were the following:

- 39.6% said they would invest in gold

- 18.9% said they would hold dollars

- 14.3% said they would hold cryptocurrencies

This poll corroborates some of the stories I’ve heard and data I’ve seen that shows a rush to dollars and gold amidst the lira’s turmoil.

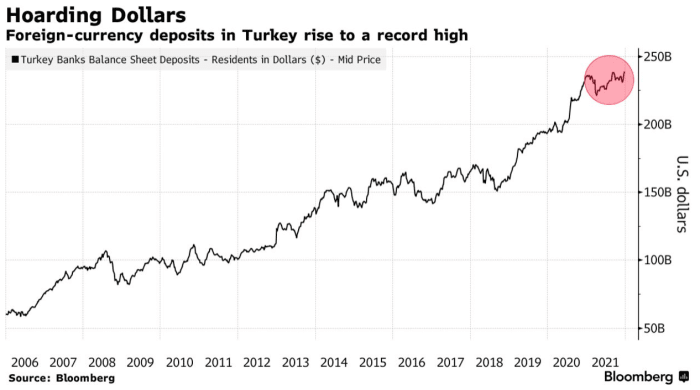

Foreign-currency deposits in Turkey hit a record high of $239 billion dollars at the start of the year.

This increasing dollarization in Turkey shouldn’t surprise anyone because dollars offer short-term stability for these individuals to pay their bills each month amidst the rising inflation. Turkey also imports most of its energy needs, which are priced in dollars, and also gorged on dollar-denominated debt coming out of the Great Recession. Both of these factors have contributed to the increased dollarization of Turkey’s economy over the last decade.

In Turkey, gold has been the preferred “under-the-mattress” protection from inflation for many generations. Gold has a central place in Turkish customs often given as gifts from births to weddings. Over the last couple of years, we’ve seen a gold rush occurring as Turks saw the writing on the wall with their inflating lira and sought refuge in gold.

Since 2020, Turkish firms and retail investors have more than tripled their gold holdings to $36 billion. This is in addition to the gold that Turkish households hold at home which their government now estimates to be around 5,000 tons of gold worth between 250-350 billion dollars.

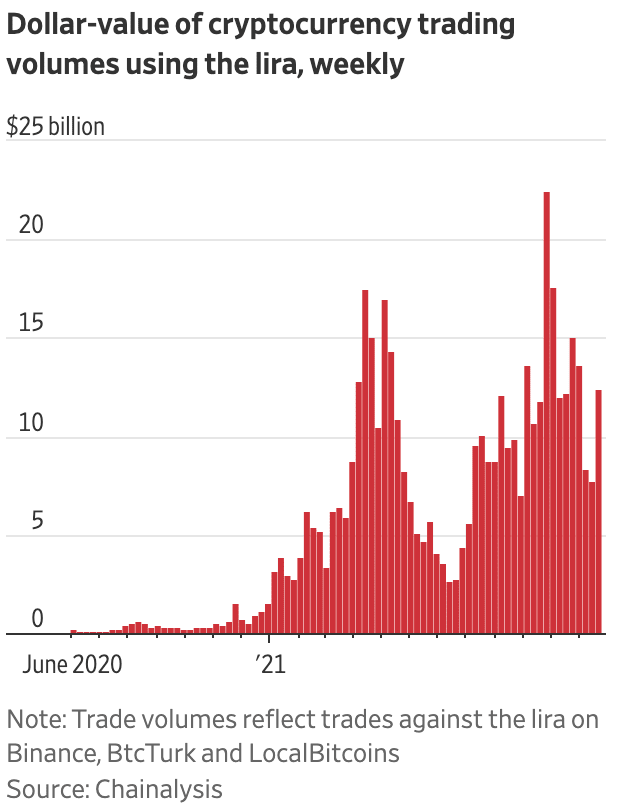

The rush to gold and dollars is to be expected, and lately, we’ve seen gold prices continue to spike in the Turkish market. However, one of the most interesting developments throughout this inflationary episode is that Turks are turning more and more towards bitcoin as a way to preserve their wealth against their currency’s debasement.

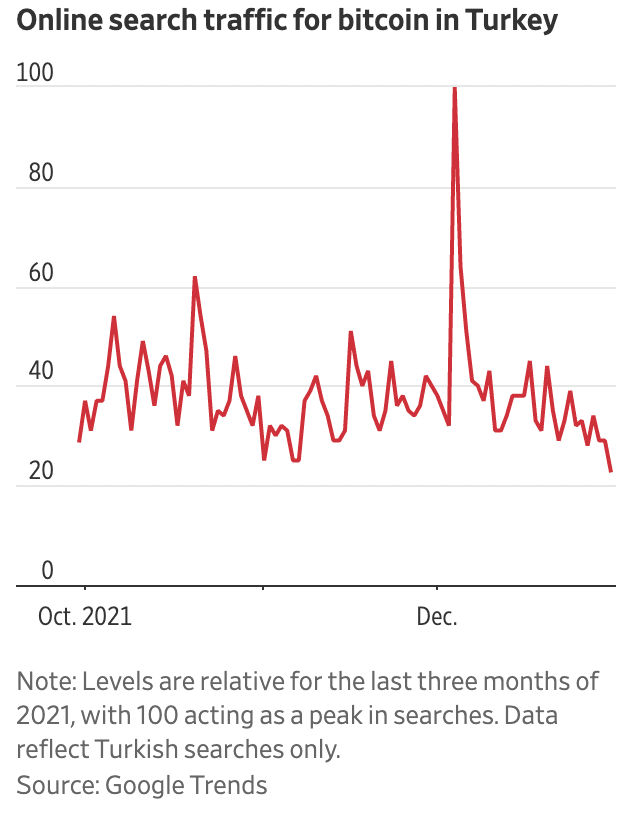

A report from the Wall Street Journal found that the dollar value of cryptocurrency trading volumes is up, and so too are online searches for “bitcoin.” Turks are beginning to embrace bitcoin and stablecoins, such as tether, as hedges against inflation in their time of need. Bitcoin is offering some people hope as they search for places to store their wealth outside the faltering Turkish banking system.

The Bitcoin Parachute

The fall of the Turkish lira is a prime example of why, 13 years ago, Satoshi invented Bitcoin. Embedded in the Bitcoin network genesis block, Satoshi sent a message that this creation was a possible solution to central banking and the easy money policies plaguing the world.

Today, we are seeing Satoshi’s vision be realized as Turks are starting to use bitcoin for its intended purpose — a non-governmental money that preserves wealth, and cannot be controlled or corrupted.

Before bitcoin, the people of Turkey would have had to resort to only using gold and dollars to protect themselves against their central bankers and government policies. Now a new solution exists that can be accessed by anyone with a smartphone and internet connection.

Unlike gold and the dollar, a Turkish individual does not need to trust a third party to gain access to this wealth-preserving asset. No longer do they need to have a bank account to protect themselves against inflation. On top of that, unlike gold and the dollar, bitcoin cannot be easily seized by authorities as we’ve seen countries do in the past during periods of financial crises.

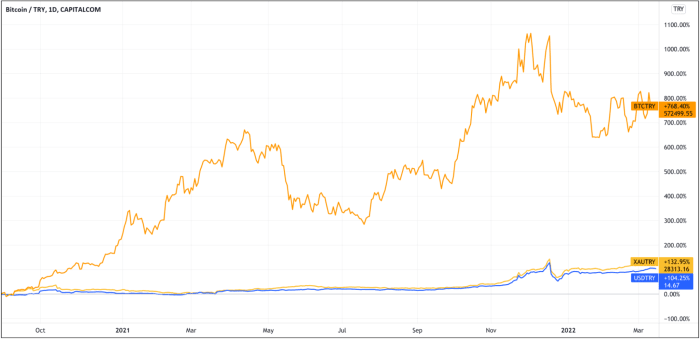

Bitcoin also has the added benefit of appreciating in value over time due to its inelastic supply and its network effect. Two years ago, if a Turkish citizen decided to save in bitcoin instead of gold, liras, or dollars, their purchasing power would have increased dramatically during a time period where the lira lost over 50% against the dollar.

For the last two years, bitcoin has outperformed the Turkish lira by 768.40% compared to the dollar (104.25%) and gold (132.95%):

As the lira has inflated, the good news is the people of Turkey understood how to protect themselves in part because older generations have suffered inflation like this before in the late 1990s. Turks have sought refuge from inflation in assets like real estate, equities, gold, dollars and, for the first time, bitcoin.

Back in November 2021, President Erdoğan famously declared war on bitcoin. The thought of a president declaring war against a decentralized digital ledger was comical, to say the least. Fast-forward to today, and it appears the Turkish president might already be waving the white flag in his war against bitcoin. After El Salvador President Nayib Bukelye visited with the Turkish President back in January, President Erdoğan advised the country’s ruling Justice and Development Party to closely examine bitcoin’s potential use and to organize an upcoming forum on the subject.

These recent developments give me hope for the people of Turkey. What lifts my spirits is knowing that bitcoin exists today as a parachute for them to escape their freefalling lira. Bitcoin is offering the people of Turkey a flicker of hope in dark times. It’s stories like the ones above that remind me of why I’ve dedicated every day of my life to making bitcoin more accessible to people all over the world suffering similar fates to those of the people of Turkey.

Today, I’m feeling optimistic. The sticker below, seen on the streets of Istanbul, says it better than I ever could:

Now that we’ve entered the age of Bitcoin, citizens all over the world have an alternative to turn to in order to protect their wealth against the detrimental effects of inflation.

This is a guest post by Sam Callahan from Swan Bitcoin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.