Cronos Ecosystem Growth Can’t be Ignored

Altcoin prices have done well this week as investors have rushed to buy the dip. As a result, it is hard to find altcoins that have been under pressure this week. However, Cronos price has not been left behind in this week’s recovery and is trading at $0.45, significantly higher than its lowest level this week. This article will explore the key catalysts for the CRO price and what comes next.

What is Cronos and why is it rising?

Cronos is a relatively new name in the blockchain industry. The smart contract platform was previously known as Crypto.com Coin and is now one of the biggest brands in the sector. Cronos is a platform that has an Ethereum Compatible Virtual (EVM) machine that helps developers to build all types of apps, such as in DeFi and NFTs.

Cronos mainnet went live a few months ago and has become one of the fastest-growing platforms in the industry. According to DeFi Llama, 51 DeFi apps in the network have a combined total value locked (TVL) of over $3.4 billion. As a result, it has become the ninth biggest platform in the game in just a few weeks.

Cronos has some of the fastest-coming DeFi apps. Earlier this week, we wrote about VVS Finance and Tectonic, which are core part of the ecosystem. Other popular apps built-in Cronos are MM Finance and MM Optimizer. Other platforms in industries like NFTs, gaming, and the metaverse.

In addition to the growing ecosystem, the Cronos price is rising after Crypto.com and FIFA announced a major sponsorship deal. The multi-year agreement will see the company become a large sponsor in this year’s World Cup. As a result, it will lead to more demand for both Crypto.com products and apps within the Cronos ecosystem.

CRO price prediction

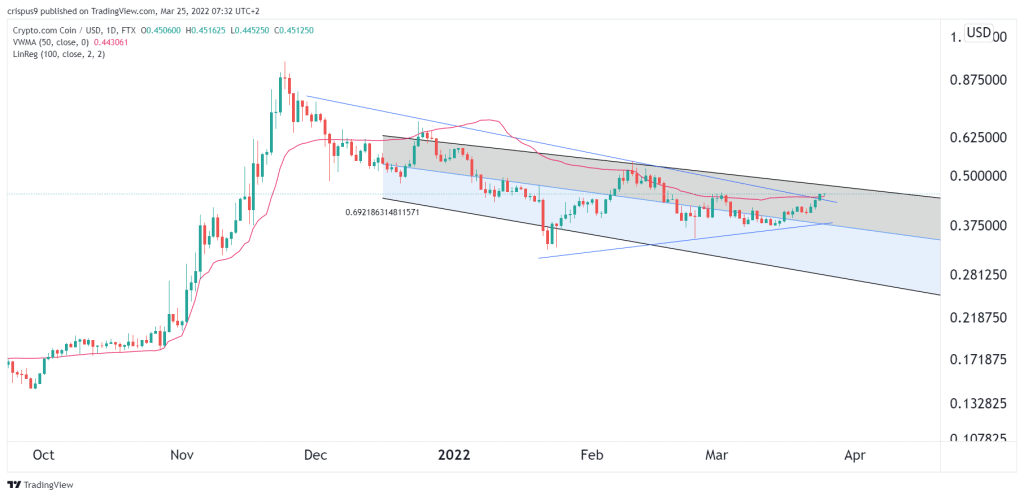

The Cronos price has been crawling back in the past few weeks. As a result, the coin has managed to move above the middle line of the linear regression line and is attempting to test the upper line. The coin has also passed the upper side of the triangle pattern, which is a bullish sign. It is also moving above the 50-day volume-weighted moving average.

Therefore, the CRO price will likely keep rising as bulls target the next key resistance level at $0.5. However, this view will be invalidated if it moves below the middle line of the regression line at $0.37.