Why Luna is Buying $500 Million Worth of Bitcoin for Its Stablecoin

Luna Foundation Guard (LFG) has bought over 11,700 BTC worth roughly $520 million so far this week to build a bitcoin reserve to support its stablecoin, TerraUSD (UST). While many in the Bitcoin community were quick to point out that the project is fundamentally different than those built upon on-chain bitcoin, such a significant purchase of BTC had undeniable impact on the Bitcoin ecosystem and, quite possibly, the price.

LFG is a non-profit organization based in Singapore that works to cultivate demand for Terra’s stablecoins and “buttress the stability of the UST peg and foster the growth of the Terra ecosystem.”

Terraform Labs, on the other hand, is a tech startup behind the development of Terra. The firm is currently in a legal battle with the U.S. Securities and Exchange Commission (SEC) as the watchdog alleges that Terraform Labs violated U.S. securities laws with its Mirror Protocol.

Bitcoin Magazine found LFG’s Bitcoin address after rumors online pointed at a $125 million deposit of USDT into Binance. From analyzing Binance’s Bitcoin hot withdrawal wallet, an address was spotted receiving roughly the same amount, in BTC, within a one-hour window. Terraform Labs founder Do Kwon on Wednesday confirmed via email that the address indeed belongs to LFG. As of March 25, LFG has deposited 11,759 BTC to that address over the past few days.

Earlier this month, Kwon said in a Twitter Space that Terra was planning to start acquiring bitcoin to form a billion-dollar stockpile of BTC as a reserve asset to back its main stablecoin, UST.

“$UST with $10B+ in $BTC reserves will open a new monetary era of the Bitcoin standard,” Kwon tweeted a few days later. “P2P electronic cash that is easier to spend and more attractive to hold #btc.”

What Is UST And Is It Needed?

At the core of Terra’s value proposition is the idea that Bitcoin has thus far failed its original objective — to become a peer-to-peer electronic cash system — and best functions as a reserve asset.

Terra’s white paper proposes a system of stablecoins — cryptocurrencies whose value is pegged to an asset such as a fiat currency or a commodity — to bring about the usefulness of a “stable currency” in Terra that it alleges could retain “all the censorship resistance of Bitcoin [while] making it viable for use in everyday transactions.”

However, this stepping-stone assumption — that bitcoin has failed and will never actualize as a P2P currency — is debatable. First, it can be argued that money historically follows a linear adoption phase wherein it progresses through different steps.

“Historically speaking, such a generally esteemed substance as gold seems to have served, firstly, as a commodity valuable for ornamental purposes; secondly, as stored wealth; thirdly, as a medium of exchange; and, lastly, as a measure of value,” wrote marginalist economist William Stanley Jevons.

While in its early days, bitcoin was mostly treated as a collectible item, it is now being seen more widely as a store of value, and its use as a medium of exchange and, eventually, a unit of account should follow, provided adoption keeps rising around the world. Moreover, developments like El Salvador recognizing BTC as legal tender and increasing P2P use of bitcoin in Africa are fast-tracking bitcoin’s progress as a currency and showcasing that BTC can and is already being used as money in the present.

Nevertheless, market appetite for a digital representation of U.S. dollars — the current de facto global money — is strong, a phenomenon that has helped spearhead the development of several stablecoins.

Centralized stablecoins lead the broader industry as the most popular options, with Tether’s USDT, Coinbase’s USDC and Binance’s BUSD heading the ranks, respectively. Terra’s UST, which proposes a decentralized alternative in which its one-to-one peg to the dollar is tentatively ensured algorithmically, currently trails in fourth in market capitalization.

Terra attempts to programmatically maintain UST’s dollar peg by burning $1 worth of LUNA on the Terra blockchain for every new UST created, thereby increasing or decreasing UST supply as needed. However, this setup’s sustainability is still debated.

Even Terraform Labs acknowledges in a blog post that “questions persist about the sustainability of algorithmic stablecoin pegs.”

Cryptocurrency hedge fund Galois Capital also echoed such concerns earlier this month.

“A late implosion of $LUNA would be catastrophic” as risk would spread “through the entire industry and send us into a cold, bitter and long winter,” Galois Capital tweeted earlier this month, calling LUNA the “biggest and most dangerous” example of a “doomed-to-fail” project.

Notably, Terraform Labs’ blog post mentioned above also discusses how there needs to be enough demand for Terra stablecoins in the broader cryptocurrency ecosystem to “absorb the short-term volatility of speculative market cycles” and guarantee a better chance of achieving long-term success.

Notably, the use of bitcoin as a reserve asset for UST does not make the stablecoin directly backed by BTC, as its peg is still related to the dollar, but only establishes an indirect peg. Terra intends to increase the demand for the alternative cryptocurrency by leveraging Bitcoin’s more well-established reputation as a vote of confidence for users, as a sharp drop in the demand for UST could risk the stablecoin’s ability to maintain its peg.

“Adding a BTC reserve helps the Terra protocol to scale demand more effectively by providing a separate backstop (from the Terra protocol) to volatile redemption periods with a hard asset,” a Terraform Labs spokesperson told Bitcoin Magazine. “It also confers more confidence in peg sustainability by users who want a decentralized stablecoin supported by a credibly neutral reserve asset like bitcoin.”

Bitcoin Reserves As A Release Valve For UST

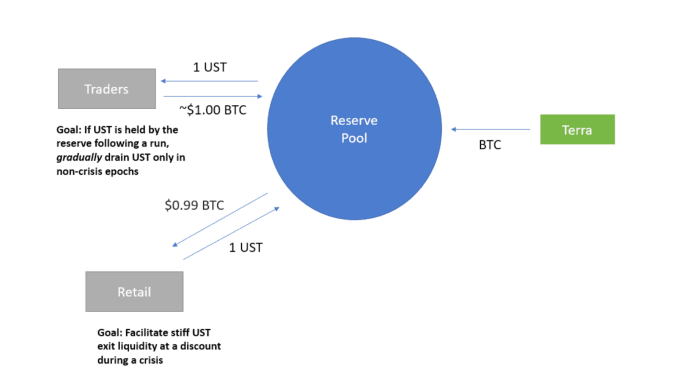

According to the current proposal, the idea is to construct a BTC reserve pool setup that can quickly support UST — and indirectly LUNA — in times of crisis when the stablecoin slides and ends up trading below its $1 peg.

During such a crisis, retail would then be given the opportunity — and presumably, economic incentive — to exchange their depreciated UST for an equal amount of bitcoin. The assumption is that Bitcoin’s enduring success over the years poses it as an attractive asset for investors seeking to “fly to safety” in the midst of a crisis. LFG would then supply them with the BTC they want at a discount, while getting UST back and thereby ensuring demand for the algorithmic stablecoin. (For example, if UST was trading at $0.99, an investor could send 1 UST to the LFG bitcoin reserves pool and receive $0.99 worth of BTC back.)

After the period of crisis ends, LFG assumes that UST would be back to its $1 peg, or even trade at a premium — above the $1 value mark. The foundation would then slowly replenish its bitcoin reserves by selling the UST reserves it accumulated during the crisis period in exchange for BTC. This assumes traders would be interested in making that arbitrage and exchanging their BTC for a then-appreciated UST.

A visual description of the minimum-viable product for the BTC reserve pool, according to Terraform Labs’ research paper. Source: Terra.

The paper outlines that the reserve pool will launch with around $2.5 billion worth of bitcoin in reserve and later grow through revenue obtained from seigniorage — minting and burning tokens on Terra.

LFG recently raised $1 billion to start allocating funds to its BTC pool in an over-the-counter, private sale of LUNA tokens to a cohort of venture capitalists, including Jump Crypto and Three Arrows Capital.

As Adam Back, cypherpunk and CEO of Bitcoin infrastructure company Blockstream, has noted, “VCs/institutional investors seems a bit like a private fractional reserve dollar, a pegged parallel currency that they hope tracks USD via marker” — an assessment Kwon doesn’t disagree with.

Bitcoin Reserves? More Like Synthetic BTC

According to the research paper, LFG’s pool will not be made up of actual BTC, but of wrapped BTC instead — a synthetic one-to-one representation of actual BTC that will supposedly be kept locked up and guarded on the Bitcoin blockchain.

This change is arguably required so the pool can operate natively on Terra on a smart contract basis for its liquidity needs as it arbitrages BTC and UST. Consequently, however, retail investors and traders who exchange value to and from LFG’s pool will deal with wrapped BTC instead of actual BTC. The paper details that the wrapped bitcoin will be likely implemented in the CW20 standard.

However, most of the details about the wrapping process, including custody, tradeoffs in its trust model, and its functioning thereafter are still unclear. Moreover, the process by which users who arbitrage UST for wrapped BTC will be able to get actual on-chain bitcoin is also unclear at this point.

“The actual specifics of wrapping native BTC are still under consideration (including bridging details) and more information will be released at a later date, but the goal is for a non-custodial, on-chain model of the BTC in the reserve,” the spokesperson said.

As such, those who seek investment in bitcoin as a permissionless and sovereign asset that serves as a decentralized alternative to fiat currencies or cryptocurrencies governed by powerful third parties should not confuse UST with BTC.