Prices Likely to Hit The $9.4 Resistance Level

Today’s trading session marks the third consecutive day that Uniswap’s price has gained in the markets. The current price increase looks poised to continue and maybe a sign that the current long-term bearish market may be coming to an end. Uniswap, the peer-to-peer decentralized exchange, has recently been making market moves that are likely to push its prices higher.

This includes news of the Uniswap platform gaining ground after the recent introduction of Uniswap V3 which has allowed for the creation of hyper-efficient pools for stablecoins that operate at extremely high utilization rates. There has also been major investment on the platform such as the Swiss Index provider that boasts of Uniswap making up a third of the index.

Uniswap has also indicated that its platform will be able to withstand the recent executive orders by the White House aimed at cryptocurrency. This was announced on their official Twitter account where they explained why policymakers need to take the historic opportunity to build better financial services.

Uniswap Price Prediction

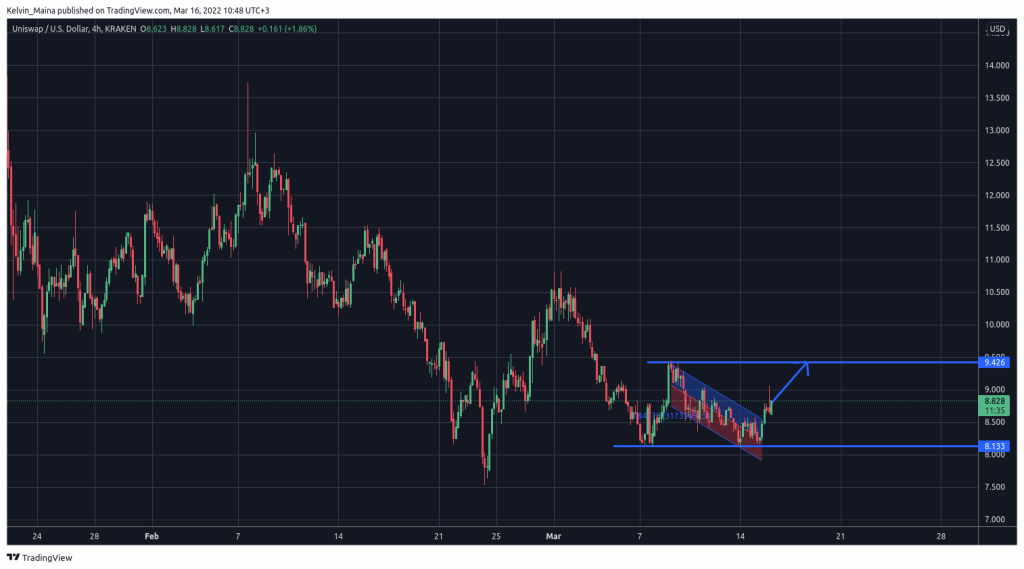

Uniswap is currently trading with support and resistance levels of $8.13 and $9.42 respectively. The cryptocurrency recently hit the support level and failed to break it to the downside. Currently, the prices appear to be on a bullish move on the 4-hour chart as shown in the Uniswap 4-hour chart below.

Based on the current prices of the cryptocurrency, which currently stands at $8.8, I expect the current bullish trend to continue. I also expect the prices to hit the recently set resistance level of $9.4 in the coming days. The prices also have the potential to go past the resistance level, and when that happens, it will mark the beginning of a new long-term bullish trend. However, if the prices reverse after hitting the resistance level at $9.4, then it will mean that the trend is still bearish. It will also invalidate my analysis beyond the resistance level and trigger a trend reversal.

Uniswap 4-Hour Chart