Guide to Decentralized Finance “DeFi”

Decentralized Finance, “DeFi,” is a technological motion in the direction of cheaper and open entry to monetary companies (reminiscent of borrowing and lending) by eliminating or lowering the prices and dangers that comes with centralized intermediaries reminiscent of banks.

According to the decentralization ethos of cryptocurrency, DeFi goals its revolutionary scopes at conventional monetary sector silos, searching for to disintermediate the complexities and powers of centralized monetary entities.

Nonetheless, DeFi has its justifiable share of challenges in its makes an attempt to satisfy its bold mission.

The next article explores the conceptual drivers of the potential and dangers of DeFi, and what anybody searching for to achieve literacy on this quickly creating ecosystem ought to have in mind.

A Deeper Have a look at DeFi

DeFi is an amalgam of assorted platforms and protocols aiming to copy current monetary companies, utilizing some kind of cryptocurrency or blockchain to take action.

Opposite to the business’s identify, the initiatives in DeFi aren’t utterly decentralized. Nonetheless, they do share just a few commonalities: restricted centralization, open & permissionless, interoperable with different initiatives, and sometimes constructed with the aim of plugging into different DeFi sensible contract platforms.

In essence, there isn’t a single firm that goals to change into (or at the least has a dominant maintain on) the one-stop store for all issues decentralized finance. (but)

Consider the current DeFi ecosystem like a big selection of interoperable LEGO items:

A non-custodial Ethereum pockets app like MyEtherWallet connects with a decentralized lending system like Aave, the place customers may be paid curiosity to lend crypto, in addition to borrow crypto. Equally, they will join an Ethererum pockets like MetaMask to a decentralized alternate (DEX) like Uniswap and swap between numerous token pairs.

All the above features are executed on an automatic, interoperable, and decentralized ecosystem by sensible contracts– no human approval or steering is required.

Once we conceptualize the DeFi lasagna, we take a look at 4 core components:

- A public base layer with a digitally native token (i.e., AAVE, UNI, COMP, and many others.)

- An open-source software program protocol that codifies the agreed upon guidelines (“tips on how to combine with our service”)

- Good contracts that implement the monetary logic and execution of transactions as soon as particular circumstances are met.

- Stablecoins which can be backed by reserves held at banks (or algorithmically decided.)

Since DeFi protocols are deployed on a public blockchain, customers can monitor all transactions and interactions transparently. As such, a whole military of “yield farmers” has emerged, searching for to seek out outsourced positive factors on lending swimming pools throughout numerous protocols and tokens.

The Dangers of DeFi

That is under no circumstances a complete listing of all dangers related to DeFi. Nonetheless, it’s not a lot of an overgeneralization to assert most of DeFi’s dangers are rooted within the decentralized nature of the blockchain.

On the one hand, DeFi gives to automate the execution of monetary companies and cut back dependencies on people. From what we’ve seen in its nascent levels, it accomplishes this pretty nicely. The disintermediation of conventional intermediaries reduces excessive charges and the boundaries to entry, passing the worth to members.

Nonetheless, the absence of centralized intermediaries additionally reduces oversight and management, which have considerably protected the normal monetary ecosystem from going awry.

In different phrases, in case your Wells Fargo checking account is hacked, you could have a cellphone quantity to name, and there are safety mechanisms in place to get better your funds (or in any other case make you entire.) Nonetheless, in case your DeFi lending pool will get rug-pulled, you’re left with mainly zero recourse.

DeFi’s dangers embrace:

- Operational dangers rooted in underlying blockchains. If one thing occurred to the underlying blockchain, like Ethereum’s, any decentralized app (like a DeFi app) can be put in danger.

- Good contract vulnerabilities. If one of many underpinning sensible contracts is written incorrectly or is in any other case exploitable, the DeFi funds are vulnerable to being hacked or locked. Good contracts take away human beings from the equation, and each efficiencies or vulnerabilities may be amplified.

- Scalability challenges. For instance, nearly all of the DeFi ecosystem runs on the Ethereum blockchain, which can be infamous for top fuel charges.

- Regulatory dangers. Conventional centralized monetary organizations are required to carry and preserve all kinds of registrations, licenses, and practices to remain in good standing with their regulatory authority.

The Present State of DeFi

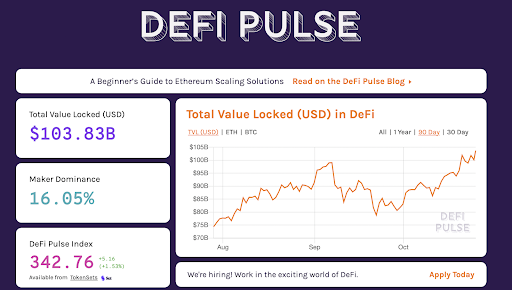

As of October 2021, in style DeFi leaderboard DeFi Pulse lists the whole quantity of worth locked in DeFi protocols at $103.83 billion– up about 5x from October 2020 and about 16x from October 2019.

With over $100 billion floating across the DeFi ecosystem being lent and borrowed, the DeFi ecosystem boasts a powerful argument for a substitute for conventional finance, but it surely’s removed from being a aggressive menace on its numbers alone.

With over $100 billion floating across the DeFi ecosystem being lent and borrowed, the DeFi ecosystem boasts a powerful argument for a substitute for conventional finance, but it surely’s removed from being a aggressive menace on its numbers alone.

JP Morgan, for instance, alone posted income of $129,503 billion in 2020.

Whereas DeFi has definitely appeared as a blip on the radar for macro gamers like JP Morgan, central banks, and monetary regulators, it’s hardly massive sufficient to pose a major menace to the present monetary system, not to mention global financial stability. Nonetheless, it’s not insignificant– DeFi’s development price prior to now three years alone is probably going serving to plot a dominant pattern for years to return.

Whereas initiatives constructed on the Ethereum blockchain dominate nearly all of DeFi, Ethereum isn’t the one DeFi ecosystem– Binance Smart Chain, Polygon, and Solano are amongst others.

Closing Ideas: Why DeFi Issues for Attorneys

In its try to take away people and centralized intermediaries as a lot as doable, DeFi itself introduces a brand new heap of complexities that should be tended to by each tranche, from the on a regular basis consumer to regulator.

DeFi’s development considerably will depend on its capacity to navigate the normal finance sector and, inevitably, the legal guidelines and laws that emerge.

It’s necessary to take into account that whereas DeFi initiatives search to decentralize, they themselves usually are not centralized– there’s at all times some particular person (whether or not named, pseudonymous, or nameless) linked to a venture.

As each innovation and regulation proceed to evolve within the sector, so will the necessity for correct authorized steering and illustration.

For instance, lending protocols Compound and Aave don’t have banking licenses in the USA. Nexus Mutual, a crypto insurance coverage product, doesn’t have an insurance coverage license in most international locations the place it gives its companies. DeFi instruments like yearn.finance may be construed as operating unlicensed investing funds.

DeFi’s numbers could pale compared to the normal monetary sector as we speak, and regulators could also be not sure of what to do with the quickly evolving area as we speak, however that gained’t essentially be the case tomorrow. Savvy founders can be eager to seek the advice of authorized professionals, and attorneys can be sensible to coach themselves on tips on how to serve the wants of what could possibly be a profitable new clientele.

rn

rn

Source link ","author":{"@type":"Person","name":"admin","url":"https://cryptonewsbtc.org/author/admin/","sameAs":["https://cryptonewsbtc.org"]},"articleSection":["DeFi"],"image":{"@type":"ImageObject","url":"https://cryptonewsbtc.org/wp-content/uploads/2022/03/decentralized-finance.jpg","width":1000,"height":580},"publisher":{"@type":"Organization","name":"","url":"https://cryptonewsbtc.org","logo":{"@type":"ImageObject","url":""},"sameAs":["https://www.facebook.com/jegtheme/","https://twitter.com/jegtheme","https://plus.google.com/+Jegtheme","https://www.linkedin.com/"]}}

Source link