Solana: All That Glitters Ain’t Gold (Cryptocurrency:SOL-USD)

DNY59/iStock via Getty Images

Thesis Summary

Solana (SOL-USD) is a fast-growing layer 1 blockchain that could one day dethrone Ethereum (ETH-USD). In a previous article, I compared Solana and Ethereum and pointed out that Solana offers numerous advantages over the latter. However, there are a few key drawbacks to Solana and one which I find especially concerning.

Decentralization is a key crypto selling point, but one that Solana does not offer. With that said. Is decentralization worth sacrificing to achieve more efficiency? Will users/companies be comfortable building on a centralized network?

I hold Solana in my portfolio, but I am cautious about its future and have more money invested in cryptos where I see more long-term potential.

Too Good To Be True

Solana was founded by Anatoly Yakovenko and officially launched in 2020. Since then, it has appreciated at a very fast rate:

Solana Price (TradingView)

Launching at around $1, Solana reached over $250 at its peak but has since fallen to around $90, as the general crypto market has corrected. Solana’s ascent coincided with a general bull market in crypto, but this altcoin was one of the best performing, and it is unsurprising when we look at its technical specs.

Solana uses Proof-of-History, which allows validators to compute the passage of time. What this means in practice is that validators do not need to finish for blocks to be finished to validate more transactions. They can validate transactions as they come. Solana also uses a protocol called Turbine, which, like sharding, breaks blocks into smaller, more manageable bits of information.

All of this allows Solana to carry out up to 50,000 transactions per second, and according to its website, transaction fees average around $0.00025.

Solana has a very active developer community, and its native wallet, Phantom, has achieved a valuation of $1.2 billion. And we also have Solanart, a thriving NFT marketplace on the Solana blockchain.

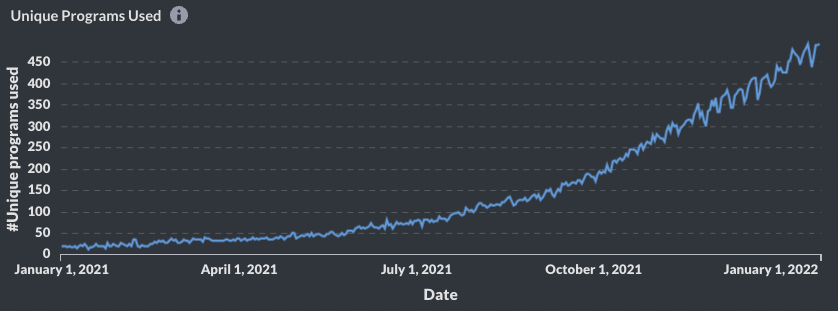

The growth in Solana’s popularity can also be appreciated through on-chain metrics:

Solana Activity (ChainCrunch Twitter)

Developers like Solana for obvious reasons, and there’s a lot of support for this crypto. But does that mean you should buy it?

Solana: All That Glitters Ain’t Gold

Let me start by stating that I do own Solana and intend to hold it over the next bull run. However, there are some key “risks” investors should be aware of.

First off, investors should know that Solana is inflationary. Solana’s supply inflates by 8% every year due to staking rewards. However, this inflation should be reduced at a rate of 15% per annum until it reaches 1% per year.

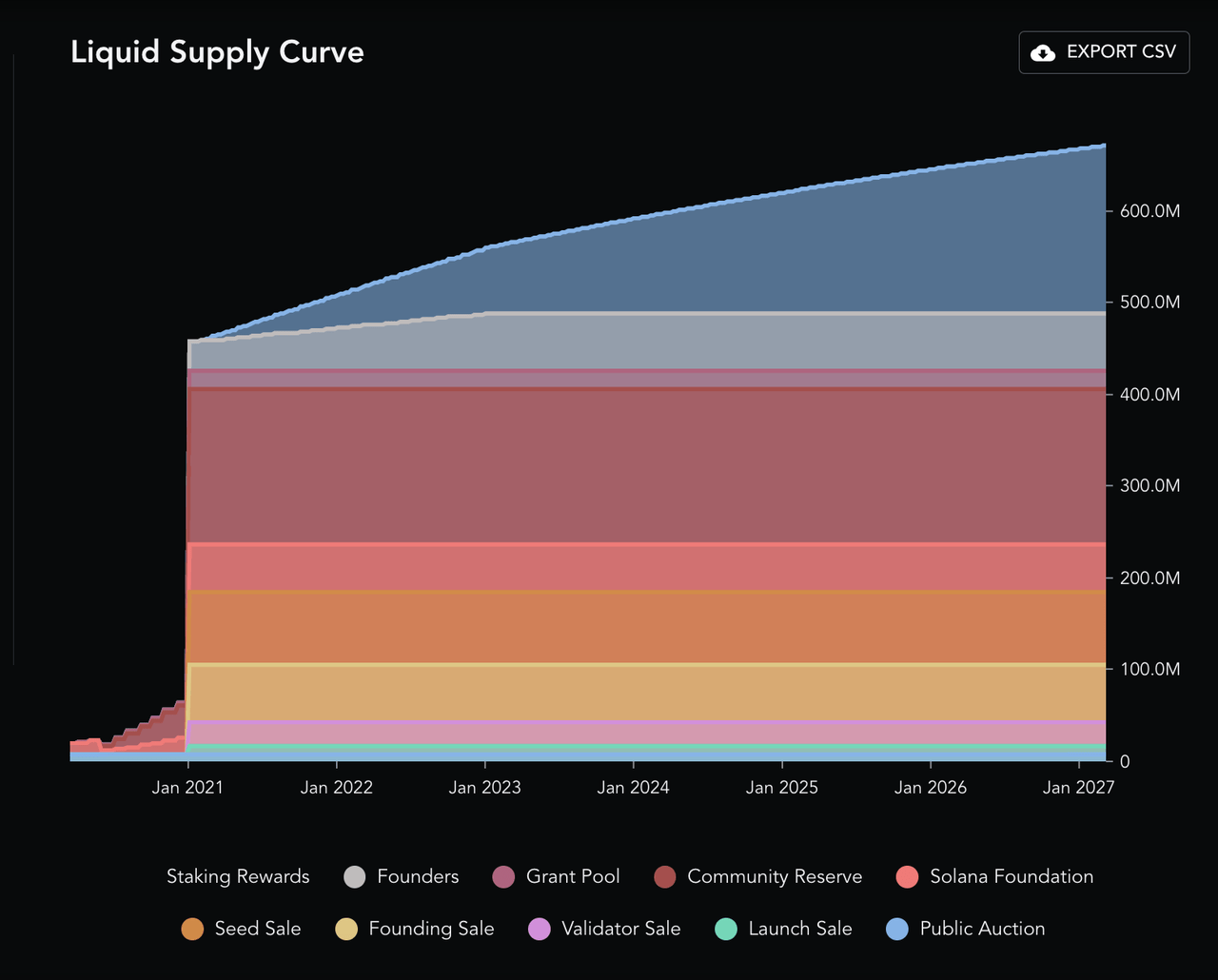

Most importantly though, the big concern some have with Solana is how centralized the network and token supply is:

Liquid Supply Curve (Messari)

As we can see above, most of the Solana supply is held by insiders and early investors. The “public auction” part of the supply, actually only represents 1.3%. Arguably, this could be evened out as stake rewards increase the supply, but the truth is that staking in Solana is not feasible.

Hardware costs for Solana are much higher than for other cryptocurrencies, meaning that running a node is more prohibitive. In this regard, so far, most validator nodes are run by insiders and early investors. As it stands snow, running a node on Solana is highly unprofitable, which has led the Solana Foundation to run a subsidy programme, effectively giving them more control over the network. Supposedly, a validator would need $1 million worth of SOL staked without subsidization just to break even when running a node on the network. And to make matters worse, 45% of Solana’s validators are hosted on 2 data centres. This poses a decentralisation and security problem. Solana has already suffered 4 major network incidents in the last few months.

Lastly, there is no on-chain governance Solana. Solana uses a delegated Proof-of-Stake mechanism, which again leaves the power in the hands of a few.

This high level of centralization means that Solana is not a “neutral” network. It is controlled and will serve the interest of a few. This doesn’t necessarily have to be bad. Arguably these people are still interested in seeing Solana succeed. Despite the high level of concentration of Solana tokens in the hands of early investors, it would seem that these tokens are being held, for the time being, showing that there is confidence in the long-term potential of the network.

Takeaway

The blockchain trilemma is no joke. Security, decentralization and scalability can’t fully coexist. Solana has given up on decentralization to allow for scalability. This doesn’t have to be bad, but I can see why some crypto investors dislike this. There’s no reason why a successful blockchain can’t be run by a corporation, rather than being fully decentralized. As long as it works, why would I care about decision-making and such? There is probably room for both types of ecosystems.

My biggest concern is perhaps security. Solana has had issues in the past, and the fact that validation is not profitable limits the potential for improving security. The fact that most validators are operated in two data centres is also alarming.

With that said, I own Solana. It’s not my favourite altcoins, but it is popular, and I expect it to reach much higher levels, something I discussed in depth in my marketplace.