Ruble-Denominated Bitcoin Volume Rises To 9-Month High

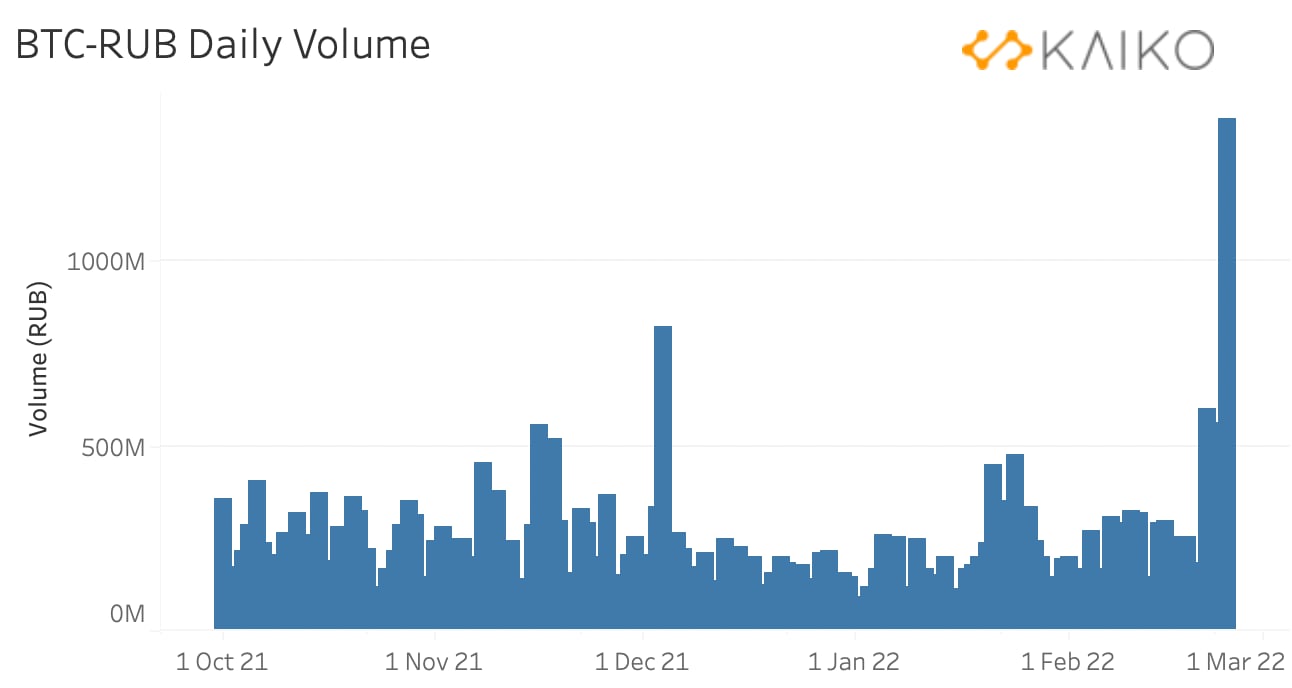

Bitcoin trading volumes through the Ruble have seen the highest numbers since May 2021. This is after western sanctions on Russia sent the Ruble plunging to a record low. Data shared by French crypto analysis firm Kaiko, showed that the Ruble-denominated BTC volume touched 1.5 billion Rubles on February 24, 2022.

“The activity was concentrated on Binance,” said Clara Medalie, research analyst at Kaiko, to CoinDesk. “Bitcoin-Ukrainian hryvnia volume has also spiked, but not as high as October levels. BTC-UAH only trades on two exchanges – Binance and LocalBitcoin,” she said.

According to Kaiko, a similar trend was also seen in tether-ruble and tether-hryvnia trading volumes. Tether (USDT) is a stablecoin pegged to the US dollar at a 1:1 ratio. This offers a fair amount of price stability in the otherwise volatile world of cryptocurrencies. Data shows that the USDT/RUB trading volume surged to an eight-month high of 1.3 billion RUB on February 24.

Also Read:

The Russia-Ukraine conflict has sent markets into a frenzy as uncertainty looms. The Russian Ruble crashed by 41 percent in one day and reached 117 against the US dollar. On the contrary, the price of Bitcoin has gained almost 20 percent, going from $34,610 to $43,545 in the last week alone.

Russians are scrambling to move out of the Ruble, fearing stricter sanctions from the US and the European Union. Bitcoin is being seen as a safe haven for investors looking to protect their funds against any further ramifications for the Ruble. The market capitalisation of Bitcoin also overtook that of the Ruble. Data from FiatMarketCap showed the Ruble slid down to 18th place in terms of market capitalisation as Bitcoin rose to take 14th place.

Russia has been trying to deal with the currency freefall by hiking the interest rate to 20 percent. Russian banks have also been directed to move 80 percent of their forex revenue to the domestic market. However, the Russian central bank cannot do much here as forex trade is covered by the western sanctions, and currency trades involving the Ruble have been halted.

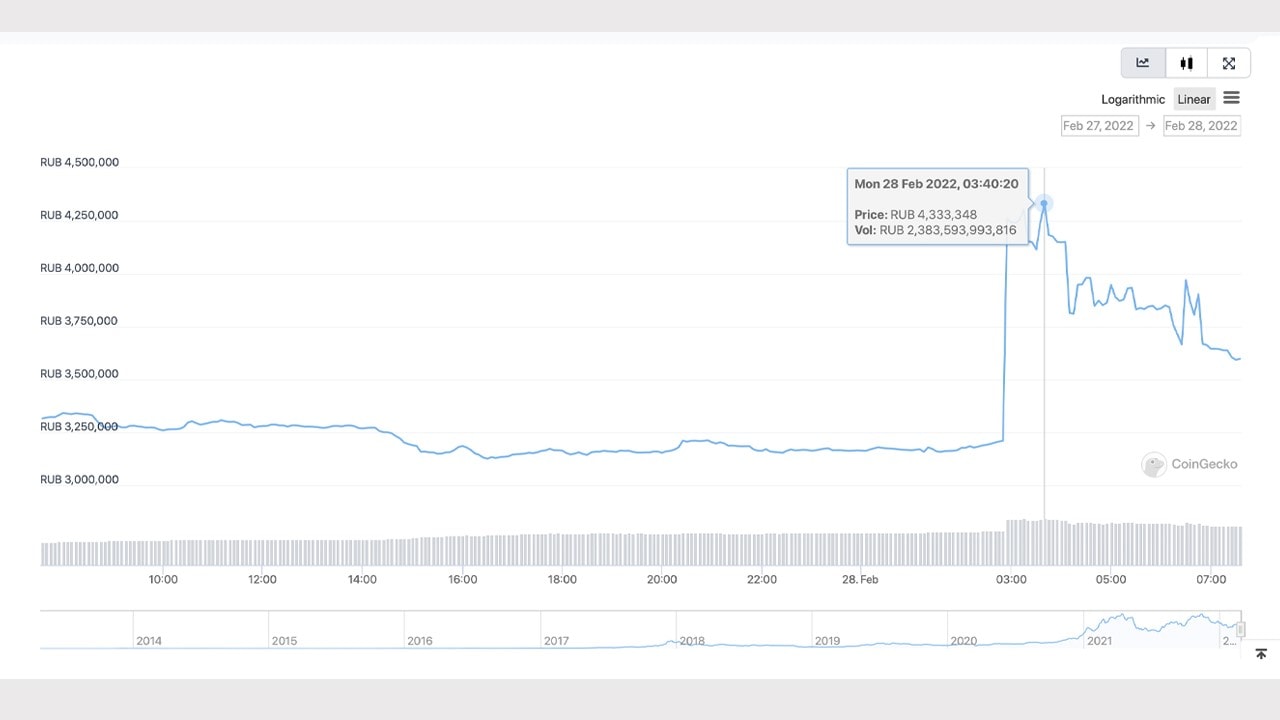

The data also indicated that the increased demand for the BTC-Ruble pair led to a massive 16 percent jump in premium over the global average. According to Bitcoin.com, traders were selling BTC for 3.69 million Rubles, i.e., $39,656 which is over $1,200 above the global average. The premium went as high as $7,853, reported Bitcoin.com. Higher premiums were also observed on Kuna, a crypto exchange that allows trading in the Ukrainian hryvnia.

Figure 1: Coingecko data showed that BTC was briefly trading for as much as 4.33 million Rubles on February 28th.

Figure 1: Coingecko data showed that BTC was briefly trading for as much as 4.33 million Rubles on February 28th.Through the escalating chaos, rating firm Moody’s has slashed Russia’s credit rating to “junk”, and Fitch followed suit. Russian securities are being ousted from the emerging market index (EM) by the widely tracked MSCI Inc and FTSE Russell indices.

The weekend also witnessed retaliatory sanctions as the US, and their allies took strong measures to stop the Russians from accessing SWIFT – the messaging network that helps run financial transactions worldwide. The European Union also stepped up and put a ban on all transactions with the Russian central bank to prevent it from selling its overseas assets.

(Edited by : Jomy Jos Pullokaran)