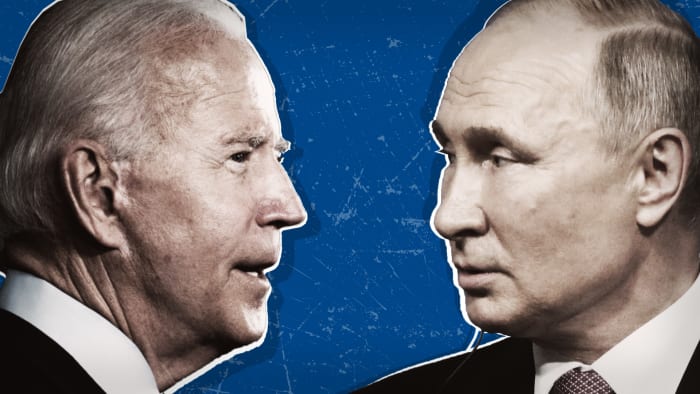

Here’s How Putin, Russia Could Use Bitcoin, Crypto to Bypass Sanctions

Russia’s invasion of Ukraine prompted a barrage of financial sanctions aimed at isolating and punishing Moscow.

The U.S and the European Union have already announced an unprecedented package of sanctions against Russia, without taking drastic measures. Russian President, Vladimir Putin, and his minister of Foreign Affairs, Sergei Lavrov, are now targeted, in addition to more than twenty personalities from the business world.

But neither the U.S. nor Europe has yet threatened to block Russia’s access to the SWIFT system, a consortium financial institutions worldwide use as a crucial communications line for global commerce.

If Russia were ever excluded from SWIFT, many wonder whether Vladimir Putin’s country could then use cryptocurrencies to circumvent this exclusion from the classic global financial system.

This would be an unprecedented situation for this young industry.

Although dissidents, protest movements, and populations in countries at war or in economic turmoil with regularly devalued currencies have turned to crypto, a state that is a great power has really never used crypto on a large scale.

“This is uncharted territory,” says Chris Kline, chief operating officer and co-founder of crypto investment firm Bitcoin Ira.

“Just a few weeks ago, you had two different messages coming out of Russia. One was from the central bank that was anti-crypto and bitcoin, and the other was legislation from their parliament saying that actually, crypto might serve a purpose.”

Michael Fasanello, director of training and regulatory affairs at Blockchain Intelligence Group, said he was also struck by the comments.

“What that said to me was politically, Putin was not on board with them banning crypto because, in fact, he wanted crypto to be a part of Russia’s mainstream finance or at least an alternative to mainstream finance,” he said.

He points out that Russia could find a loophole in sanctions.

“In a decentralized financial environment, Russia is able to basically circumvent global sanctions that are pressed upon them by the United States and our allies,” he said.

Traditionally, sanctions are invoked through banking instruments, like freezing bank accounts.

But the crypto industry is decentralized, which means that there’s no central governor, no central regulator. So you can’t ban cryptocurrency. It is possible to restrict people from using it by banning or regulating cryptocurrency exchanges.

Now, it’s safe to say, all options are on the table about what Russia will do in the event of heavy financial sanctions.

Does Russia Have a Stockpile of Crypto?

“Russia has used crypto since the inception and the first usage of crypto,” says Nick Donarski, a cybersecurity expert and founder of ORE Sys LLC.

“So, even in the case where they’re talking about restricting Russia from the SWIFT system to reduce the ability for them to functionally transfer funds between nation states, they have already a reserve of crypto assets that they’ve collected over the past years.”

Therefore, removing Russia from SWIFT “is not going to completely restrict the ability for them to function and to pay and to transfer funds.”

“Russia started to get bitcoin back when I was buying it at $16 a coin and now that it’s a much bigger thing, now that it’s more adopted and more people are using it, that price per coin has gone up. The valuation of [their] stockpile of crypto has likely in turn directly increased,” Donarski said.

How Can Russia Use Crypto?

One of the most popular ways to liquidate crypto is on an exchange platform. Some exchanges are very compliant with regulations and laws, and other exchanges less so. People also liquidate cryptocurrencies through peer-to-peer transactions.

In the case of Russia, cybersecurity experts interviewed by TheStreet say that Russia has different ways to use its crypto stock if it wants to.

It could get into nonfungible tokens, where some of the digital collectibles are being purchased for millions of dollars, and then flip those for currencies.

Moscow could also play the system and get around sanctions by trading with other friendly countries.

“If Russia and Venezuela want to do business. Russia wants to transport some oil to Venezuela. Venezuela wants to pay for that,” explains Fasanello.

“Russia may not be able to make use of the traditional finance system because we’re going to clamp down on their banks. We may even eventually cut them off from Swift, the Society for Worldwide Interbank Fund Transfers.

“If we do that, their entire financial system will be largely cut off. If that happens, Venezuela can pay Russia in cryptocurrency using a variety of different addresses and methodologies, ways of staggering the payments so they don’t appear as large. And there is nothing the United States can do about that.”

Fasanello also says that it would be easier for a country as large as Russia to purchase large amounts of weapons on the dark web.

“I mean, I can go on the dark web and I can pay crypto and purchase rocket-propelled grenades, incendiaries, all kinds of things like that. The dark web is just flooded with this stuff. We’ve seen it time after time, whether it’s narcotics, contraband, weapons, child pornography — all these different things exist in the dark web and crypto has been a means of payment.”

One of the advantages of cryptocurrencies is that it’s weightless, borderless, and quick.

How Can Russia Move Billions of Dollars of Crypto?

Moscow can use so-called peels, a sophisticated technique consisting of using hundreds of transactions to obscure the path of funds.

In practice, you can take a large amount of money and hop that money from wallet address to wallet address. You then make multiple transactions to make the trail harder for people to follow. The more transactions you execute, the more likely people will get tired and stop chasing the trail. Read about wallets here.

In the crypto world, this translates into blockchain hopping, where it’ll go from bitcoin blockchain to ethereum blockchain to litecoin to a variety of different blockchains.

And it’s possible to make it more complex, says Fasanello, because there’s also “address hopping within a blockchain from one bitcoin address to another bitcoin address and so on.”

“And as you go along these hops, you can peel off small amounts of this currency. So let’s say you’ve got $20 billion in bitcoin. You can peel off small amounts of that $20 billion through transaction after transaction after transaction. And as you move that money along the blockchain, it sort of gets smaller and smaller as it goes along but not small enough that it’s noticeable.

You wouldn’t go from $20 billion to $1 billion, for example. That would be highly noticeable and it would actually affect the liquidity of the whole marketplace. That’s the kind of waves that Russia wouldn’t want to be making,” Fasanello added.

Donarski says that it is nevertheless possible to trace the origination of cryptocurrencies. But he explains that the crypto exchange platforms do not have the tools necessary to do what appear to be Herculean work:

“The due diligence of KYC (Know your customer) doesn’t go to that level. They don’t do that forensic look at where those funds come from. So essentially, Russia could send, through multiple channels, bitcoin to somebody who takes it out on” a crypto exchange platform.

KYC is the requirement that financial firms carry out certain identity and background checks on their clients before allowing them to use their products. The aim is to prevent money laundering.

Could the U.S and Europe Prevent Russia from Using Crypto?

“Can we ever directly shut down Russia’s use of cryptocurrency? No, can we make it more difficult by, you know, regulating the off channels, the off ramps where they can liquidate their crypto? Yes,” says Fasanello, whose firm offers its customers Blockchain Analysis, a tool to flag suspicious transactions.

The best way, Fasanello suggests, would be for the U.S and their European allies to issue formal regulations for the marketplace participants in the country and reaching agreements with other countries that will do the same.

For example, crypto exchanges could be told not to take transactions from certain Russian individuals, or certain Russian entities, and if any transaction can be traced back to those individuals or entities, it should be blocked.

Cryptocurrency is not entirely anonymous even though no names are attached to transactions. All you see is a date stamp, a time stamp, a value transfer, and the recipient addresses to which the money was sent or the wallet address the money was received from. No personal information, like street address, telephone number or social security number is attached.

But certain software enables tagging transactions, so people using those programs can see a fuller picture of the transactions in the blockchain.

Would Using Crypto to Circumvent Sanctions Affect the Market?

“If you see a large nation state that jumps on to bitcoin, it goes back to really solidifying everything that people have been saying about crypto, that it is only for the bad guys,” warns Donarski. “It’s going to take a hit on bitcoin itself. It is going to lose value.”

“Will it be good or bad for crypto?” asked Kline. “It will get a negative persona to it, so to speak.”