Bitcoin inches upward in Sunday trading

However the largest cryptocurrency by market cap was approach approach off final week’s ranges amid gentle weekend buying and selling and escalating tensions a couple of potential conflict with Russia; ether and most different main cryptos dropped.

Good morning. Right here’s what’s occurring:

Market strikes: Bitcoin rose barely on Sunday however was nonetheless approach off its value of per week in the past; most main altcoins dipped over the weekend.

Can You Belief the Celeb Crypto Endorsements on the Tremendous Bowl This 12 months? MATIC Token Surges as Polygon Raises $450M to Help Net 3 Plans

“First Mover” hosts spoke with CoinDesk columnist David Morris for his views on crypto companies like FTX and Crypto.com turning into main promoting gamers at this 12 months’s Tremendous Bowl. Polygon co-founder Sandeep Nailwal shared particulars behind the agency’s newest elevate that enable it to construct Net 3 purposes and spend money on zero-knowledge expertise. Plus, Kareem Sadek of KPMG Canada spoke in regards to the agency’s determination so as to add crypto to its steadiness sheet.

Costs

Bitcoin (BTC): $42,176 +0.1%

Ether (ETH): $2,879 -0.7%

High Gainers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Ethereum Basic | ETC | +3.8% | Good Contract Platform |

| Dogecoin | DOGE | +3.1% | Forex |

| Bitcoin Money | BCH | +1.9% | Forex |

High Losers

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Stellar | XLM | −2.6% | Good Contract Platform |

| Solana | SOL | −2.4% | Good Contract Platform |

| Cosmos | ATOM | −2.0% | Good Contract Platform |

Markets

S&P 500: 4,418 -1.9%

DJ IA: 34,738 -1.4%

Nasdaq: 13,791 -2.7%

Gold: $1,858 +1.7%

Market strikes

Bitcoin inched upward on Sunday however remained effectively off the place it began the week amid traders’ issues about ongoing inflationary strain and a potential conflict with Russia.

On the time of publication, the biggest cryptocurrency by market capitalization was buying and selling at about $42,200 up barely over the previous 24 hours Ether and different main altcoins fell. Ether was buying and selling at about $2,880, off barely.

“General, crypto is down this week, together with a slide in costs Friday that some imagine is correlated to studies of Russian army workout routines indicating that an invasion and potential ensuing conflict is imminent,” stated Joe DiPasquale, the CEO of fund supervisor BitBull Capital.

Buying and selling quantity for the previous week was about half its stage of a 12 months in the past, resulting in the excessive value volatility. “This week has seen the costs of main cryptos each rise and fall sharply,” DiPasquale stated.

Crypto’s uneven efficiency has largely emulated main inventory indexes, which fell sharply on Friday. The S&P 500 dropped practically 2% on Friday and the tech-focused Nasdaq plummeted 2.7%.

To make sure, bitcoin and ether are up for February after a lackluster first month of the year. However Solana and different altcoins are down “as a result of jitters over insecurities within the wormhole protocol,” DiPasquale famous.

He added that “something can occur” if bitcoin approaches $40,000 due to the decrease buying and selling volumes. “If the assist. line holds, we may see a big bounce, but it surely doesn’t, we may see a big drop,” he stated.

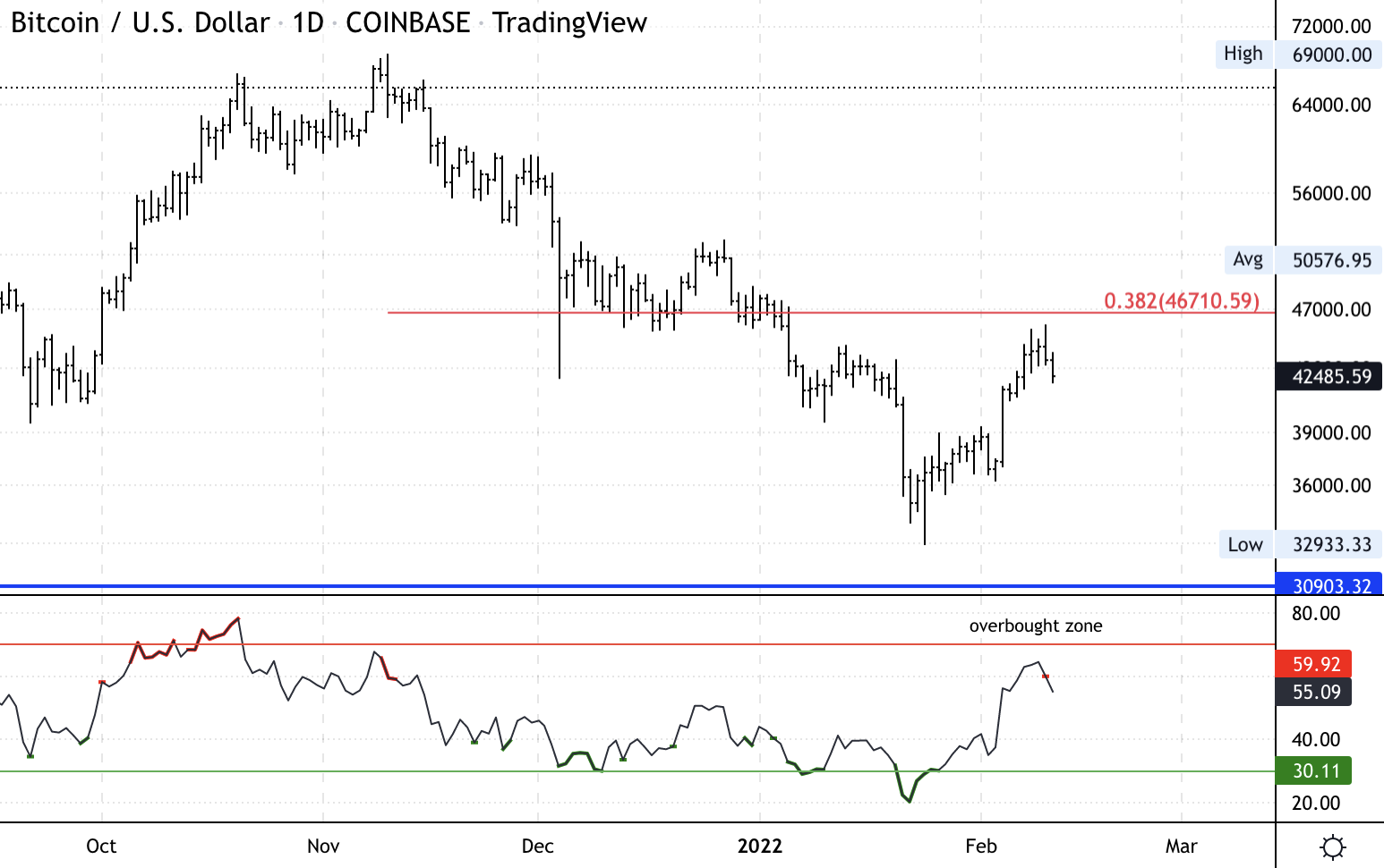

Technician’s take

Bitcoin (BTC) sellers have been lively after patrons didn’t maintain a break above $45,0000 this week. The cryptocurrency was roughly flat over the past 24 hours and was confined to a decent vary over the weekend. Preliminary assist at $40,000 may stabilize pullbacks.

The relative energy index (RSI) on the day by day chart approached oversold territory on Wednesday, which preceded the current downturn in value. On the weekly chart, nonetheless, the RSI is rising from oversold ranges just like what occurred in March 2020, which may maintain patrons lively over the brief time period.

Momentum indicators improved on the weekly chart after BTC rose 4% over the previous seven days. That implies a impartial outlook as long as assist holds above $35,000-$40,000 over the weekend.

Nonetheless, the month-to-month chart seems bearish just like July 2018, which was the center of a crypto bear market.

Essential occasions

New Zealand REINZ home value index (Jan. MoM)

Australia housing new dwelling gross sales (Jan. MoM)

4:30 p.m. HKT/SGT (8:30 a.m. UTC): U.S. 3/6-month invoice public sale

11:50 p.m. HKT/SGT (3:50 p.m. UTC): Japan gross home product (This autumn/QoQ preliminary)