HODLers Ethereum Price Prediction for 2022, 2025 and 2030

Vitalik Buterin conceptualized Ethereum in 2013 and published a whitepaper to this effect in which he described a decentralized, censorship-resistant network to develop applications with real-life use cases. However, Ethereum was born in June 2014 when eight co-founders met in the woods to establish the foundation of what was to become the 2nd largest blockchain network.

Since then, Ethereum has grown to become the 2nd biggest blockchain project. The market cap of Ethereum is $293.7 billion as of 25 January 2022. The market cap was much higher during the bull run of 2021, peaking at $549.09 billion in November 2021, according to data from Statista.

Coin Founders

Eight co-founders are behind the development of Ethereum. Vitalik Buterin, Gavin Wood, Anthony Di Iorio, Charles Hoskinson, Amir Chetrit, Jeffrey Wilcke, Mihai Alisie and Joseph Lubin are the eight original founders of Ethereum. Of the eight co-founders, Vitalik Buterin remains the only one still actively involved in work on the platform and has become the public face of the project. At least two of the eight co-founders left to start their blockchain projects. The others are involved in other projects supporting Ethereum or have left the industry entirely.

Ethereum Road map

The development of Ethereum was funded by a crowd sale that took place between July and August 2014. More than $18m was raised, with the first live release of the Ethereum blockchain occurring in 2015. Here is a brief timeline of the Ethereum roadmap.

In May 2015, 25,000 ETH were distributed as rewards for stress tests conducted on the Public Testnet in what was known as the Olympic testing phase. This was followed closely in July 2015 by Frontier, which was the official launch of the public mainnet. The genesis block was mined into existence, with transactions being suspended for a few days to allow for more significant signups from miners and clients. At this time, 5 ETH was the block reward.

Homestead followed in March 2016. This upgrade introduced the Mist ETH wallet and new codes for the Solidity programming language. In addition, the Canary contracts were abolished.

The DAO hard fork occurred in 2016 after the theft of $50m worth of Ethereum. The vulnerability led to the split and creation of Ethereum and Ethereum Classic.

The Byzantium upgrade reduced the mining rewards from 5ETH to 3ETH. This upgrade occurred on 16 October 2017.

February 2019 brought the Constantinople upgrade, reducing block rewards from 3ETH to 2ETH. Smart contracts could now verify each other with a hash of another contract, and this upgrade also provided better support of off-chain transactions. October 2019 brought the Istanbul upgrade, the next hard fork, and upgrade that preceded Serenity. Changes to gas costs for different operations were proposed, and the ProgPoW mining algorithm reduced the efficiency advantage of ASIC miners., known as Ethereum 1.x. The first phase of Serenity (Serenity Phase 0) signals the move from the proof-of-work to the proof-of-stake consensus mechanism.

Serenity Phase 1 launched in 2020, dividing the network’s transactions among several sets of randomly organized validators. The Beacon Chain now supports 1024 Shard chains with validation by collecting 128 nodes.

2020/2021 brings Serenity Phase 2, with expanded functionality of shard chains, and the Ethereum-flavoured Web Assembly (eWASM) is born.

2022 is expected to bring with it the launch of Serenity Phase 3. Exponential sharding and coupling with mainchain security are among the improvements being discussed.

Ethereum Adoption

What has been the story of Ethereum’s price adoption?

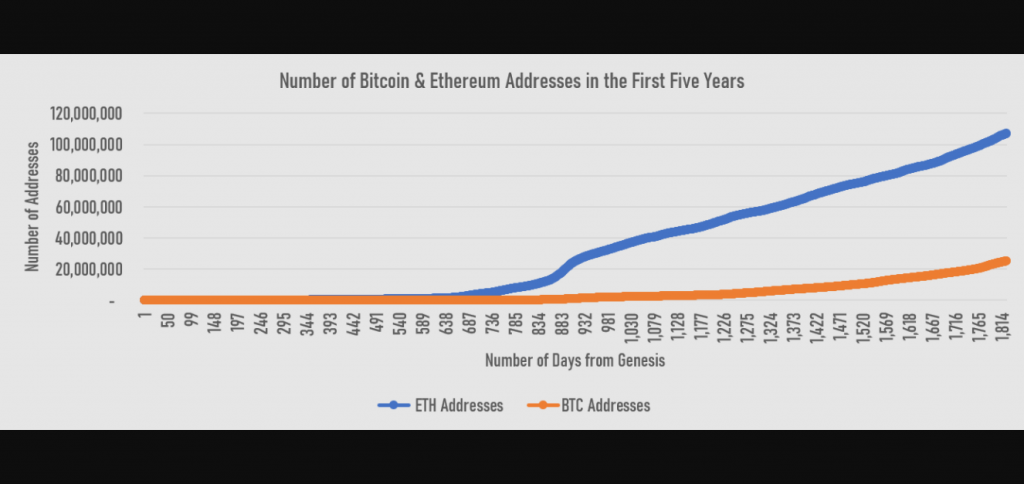

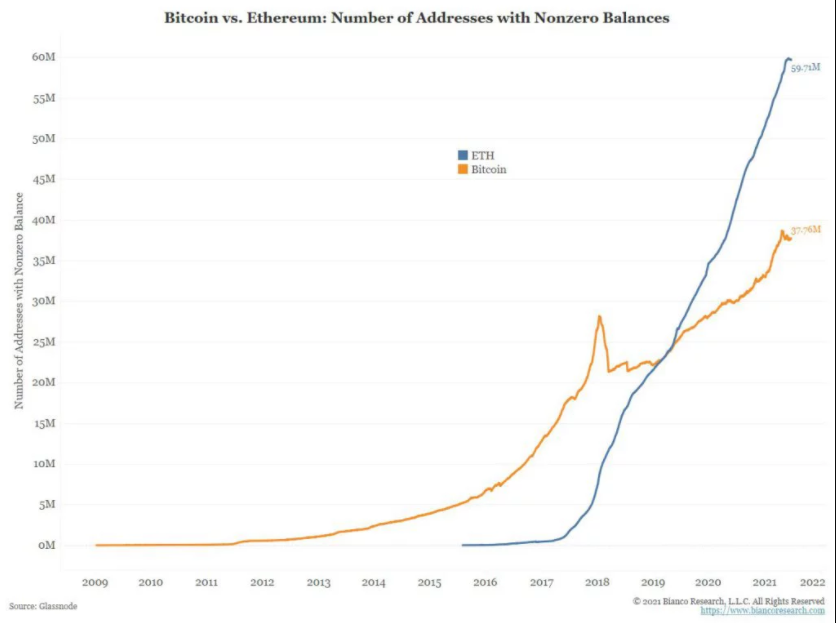

– The number of Ethereum addresses in the last five years has grown tremendously, far exceeding that of Bitcoin.

– Ethereum remains the platform of choice for many developers of decentralized applications (dApps). Nearly 80% of all dApps are built on Ethereum. The data from Consensys is shown below.

As of July 2021, Ethereum had over 689,000 addresses and exceeded the number of active BTC wallets by more than 200,000, in data showcased by Benzinga.

By December 2021, non-zero Ethereum wallets hit an all-time high of 71,364,788. This was made possible by the explosion in interest in non-fungible tokens (NFTs). This data piece was pulled from Glassnode.

The various metrics measured show that Ethereum adoption and usage continues to grow, despite the price correction experienced recently.

Ethereum Price Prediction 2022

The ETH price prediction for 2022 is determined using the weekly chart of the ETH/USDT pair. Despite the correction witnessed in December 2021 and January 2022, the Ethereum price prediction 2022 remains bullish as the market is still in an uptrend.

The Ethereum price prediction 2022 is for Ethereum to gain ground, especially on the back of Ethereum news such as the launch of Serenity Phase 3 later in the year.

The last two weekly price candles have found support at the 50% Fibonacci retracement level (2469.14), with a slight uptick. This pivot could be the relevant support for a new upside push for 2022. Immediate upside price targets are at 3073, 3370, 3651, and 4000.

Ethereum Price Prediction 2025

The Ethereum price prediction 2025 also retains a bullish bias as long as the ascending trendline on the weekly price chart of the ETH/USDT pair is respected. This trendline intersects the 50% Fibonacci retracement level from the swing low of 21 January 2019 to the swing high of 8 November 2021.

ETH/USDT: Weekly Chart

As long as this trendline and support level provided at 2469 stays intact, the outlook which serves as the Ethereum price prediction 2025 will remain bullish, with price targets of at least 4,000 to 4877. However, a breakdown of this trendline could put this outlook in jeopardy.

The team behind Ethereum would need to reduce its gas costs, especially as the Binance Smart Chain and Solana have come up as alternative projects that provide fewer transaction costs than Ethereum. However, Ethereum will remain relevant in the further development of Defi projects in 2025 and beyond.

Ethereum Price Prediction 2030

The Ethereum price prediction 2030 is that the coin could be trading closer to the $10,000 mark. This view is consequent on the ETH/USDT pair breaking above the $4877 mark (all-time high), which allows for a push to sequential Fibonacci extension targets at 7324, 8641, 9328, and 10316. But, again, this Ethereum price prediction 2030 depends on the ability of the bulls to hold the fort at the existing trendline that intersects the 50% Fibonacci extension level.

Is Ethereum a Good Investment?

Suppose there is any cryptocurrency that will remain relevant for years to come in terms of the sheer scale of its utility and application. In that case, Ethereum is a powerful candidate. Indeed, it will be a bold statement to say that the advent of Ethereum is the main reason the cryptocurrency market survived the teething challenges of its early years. The Mt.Gox saga nearly buried Bitcoin, but Ethereum resurrected it and led to the market revolutions that followed. The development of initial coin offerings (ICOs) and decentralized finance (DeFi), the development of smart contracts, and cross-chain interoperability are all products of Ethereum’s entrance into the blockchain arena.

How to buy Ethereum?

How to buy Ethereum is not an issue. It is available on almost every crypto exchange. There are two ways to do this. The Basic function allows for quick conversion of the purchase of fiat or cryptocurrency with Ethereum at market price. The Advanced process allows for expanded purchase options, such as setting limit prices, purchasing specific amounts, etc. Ethereum is usually listed in pairing with Bitcoin (ETH/BTC), US Dollar (ETH/USD), Tether (ETH/USDT) and several other cryptos.

ETH/USDT: Monthly Chart