MIOTA Jumps 20% in ‘Turnaround Tuesday’ Trading

The IOTA price surged to its best daily percentage gain since September, as cryptocurrency investors finally ‘Bought the Dip’.

A massive surge in trading volume lifted IOTA (MIOTA) off the canvas to an intraday high of $1.317 on Tuesday as investors positioned themselves for a year-end rally. For the first time in a while, Cryptocurrency watchlists were a sea of green, with the majority of coins and tokens posting gains. Bitcoin’s bounce to $49k, and Ethereum recovering $4k, spurred a wave of dip-buying in altcoins.

Yesterday’s impulse move higher has helped IOTA add more than $700 million to its market cap in the last week, lifting it to #44 in the crypto rankings. However, despite the bounce, IOTA is down -11% month-to-date, -55% from the 2021 high, and -80% below the all-time high. Nonetheless, holders will be relieved that MIOTA made several technical breakthroughs.

MIOTA Price Forecast

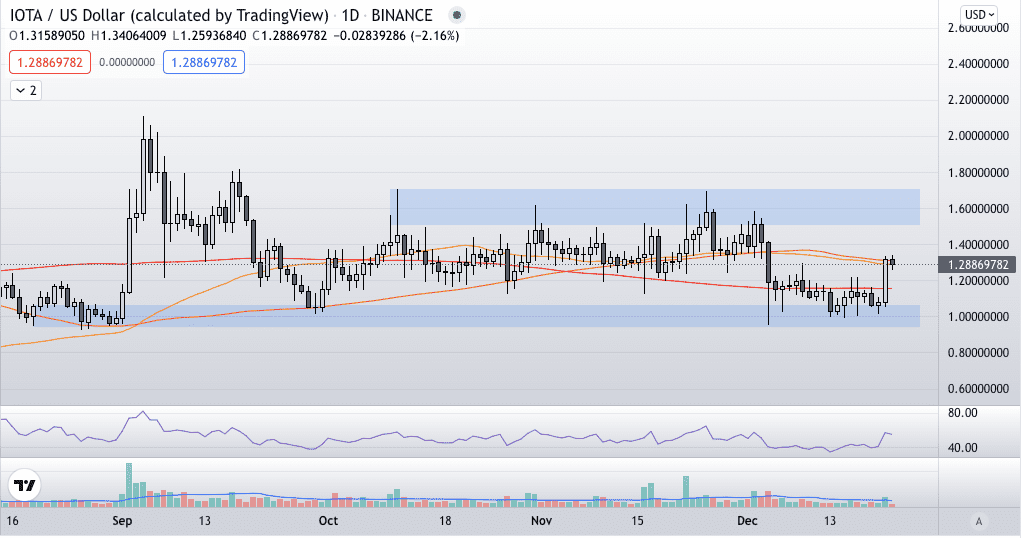

The daily chart shows the IOTA price bounced from the psychological $1.000 support level. The coin cleared the 200-Day Moving Average (DMA) at $1.155 and is now grappling with the 50, and 100-Day indicators.

Decisive clearance of the 100-DMA at $1.310 targets the distribution zone between $1.500-$1.700. Previous extensions above $1.500 in the last two months have attracted selling. Therefore, the IOTA price will struggle to advance above $1.700 unless the crypto complex reverts to a bull market. However, yesterday’s price action is constructive and becomes more so above $1.310. On the other hand, if the 100-DMA rejects MIOTA, the relief rally may fade.

For now, the early signs are encouraging. Nonetheless, it’s difficult to predict if the recent price action is sustainable. For that reason, I am on the sidelines today, waiting for the formation of the daily candle to provide trading cues.

IOTA Price Chart (Daily)

For more market insights, follow Elliott on Twitter.