Publicly-Traded Bitcoin Miners Have Been Outperforming The Bitcoin Price

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

In regards to the performance of publicly traded miners, we will be looking at their performance since the start of 2020 in both USD and BTC terms.

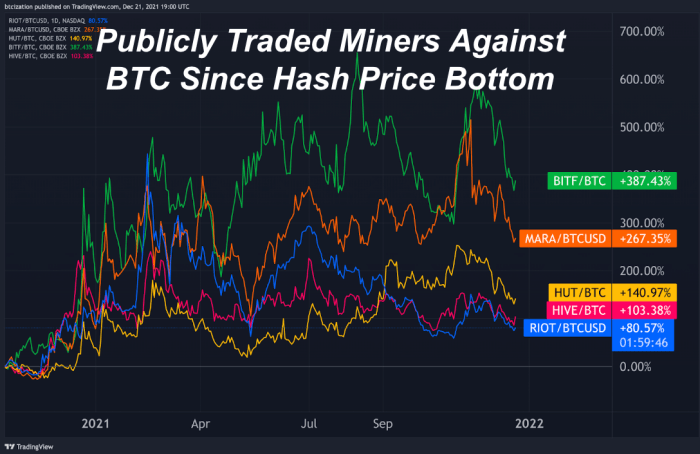

RIOT, MARA, BITF, and HUT will be examined specifically.

Since the start of 2020, these four companies have outpaced the performance of bitcoin, and there’s a few key reasons why. Namely, publicly-traded equities are often valued using a multiple of their current earnings/cash flows.

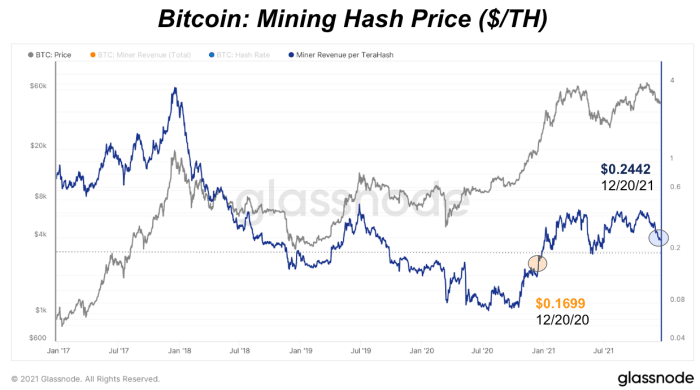

Towards the last quarter of 2020, miner hash price started to explode, and thus the revenue and subsequently public miner market capitalizations followed. Hash price is quantified by dividing hash rate by miner revenue (dollar per terahash in particular).

Since the hash price bottomed in October of 2020, miners have outperformed BTC by a wide margin, due to hash price increasing by as much as 400% during the time period.

What you should gather from evaluating the performance of publicly-traded miners against bitcoin itself is that due to the capital structure of their business and the valuations present in equity markets, miners can and likely will outperform bitcoin over periods when hash price rises significantly.

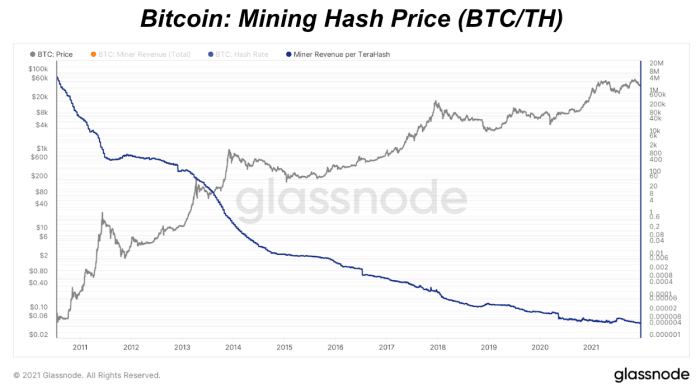

However, over the long term the revenue in bitcoin terms for every mining company is guaranteed to decrease in bitcoin terms, and due to the excessively large earnings multiples that companies currently trade with in equities markets in a zero interest rate world, even bitcoin mining equities trend to zero over time in bitcoin terms (once again, due to the equity multiples assigned in a zero interest rate fiat-denominated world).

Bitcoin-denominated hash price is programmatically trending towards zero as hash rate rises and as issuance declines with each subsequent halving.