S&P 500 Index Slumps As Concerns Over New Coronavirus Variant Knocks Markets

Wall Street is feeling the brunt of Friday’s flight to safety in the financial markets, with the S&P 500 index down sharply.

10 out of the 11 indices on the S&P 500 index are lower, as traders ditch stocks for bonds and other safe-haven assets in response to the emergence of a new variant of the coronavirus.

The S&P 500 index has been overextended for a while, and the new COVID-19-related development has provided a fundamental basis for the market correction to set in. As of writing, the S&P 500 index is down 2.17%.

S&P 500 Index Outlook

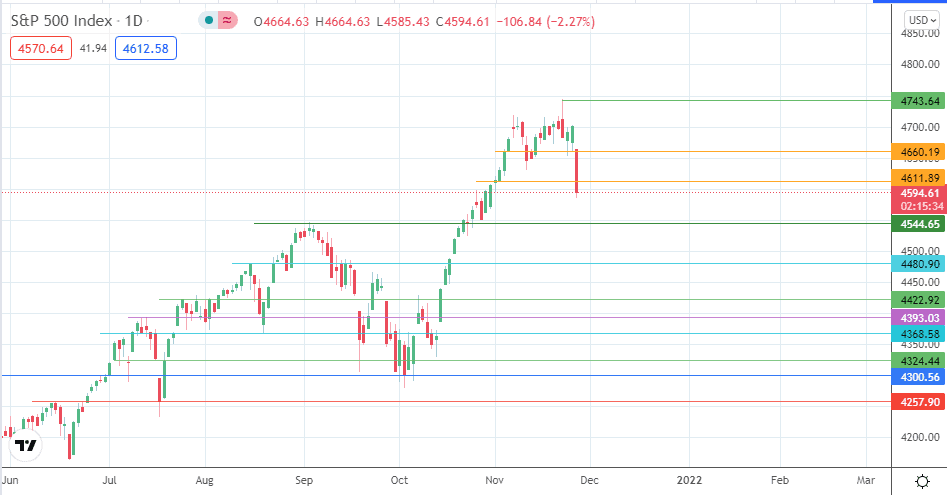

The steep drop of the day has violated the 4611.80 support. If the 3% closing penetration below this support is maintained, the bears will have a clear path towards 4544.65. 4480.90 and 4422.92 are additional support pivots where bulls may try to stem the rot.

On the other hand, a recovery bounce is needed to restore the upside bias, targeting 4660.19 and 4694.19 in the first instance. A return to the all-time high at 4743.83 seems far off at the moment and requires a reversal of sentiment around the new variant.

S&P 500 Index: Daily Chart

Follow Eno on Twitter.