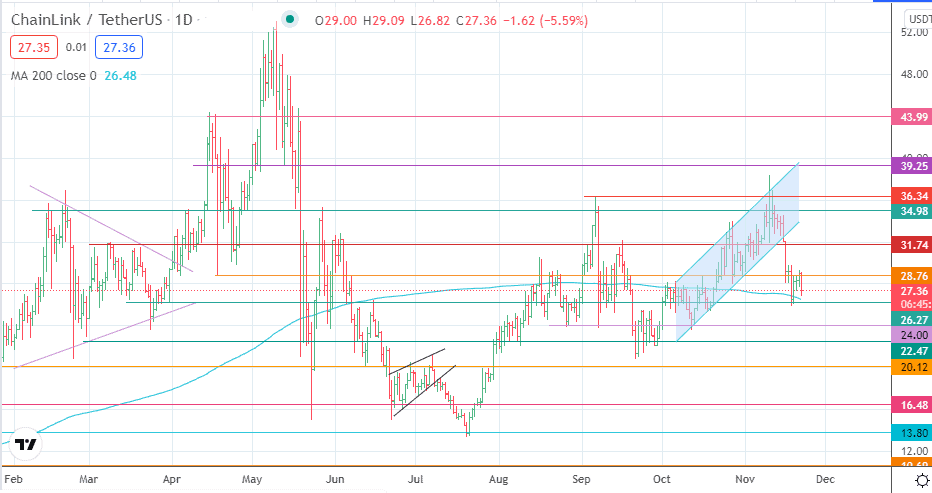

Test of Critical Support Imminent

The future direction of the LINK/USDT pair will become clearer when the price action concludes a test of the critical support posed by the 200-day moving average. This action will dictate the Chainlink price prediction for the LINK/USDT pair heading into the last week of November 2021.

Chainlink was a casualty of last week’s market correction, falling 9% after China issued warnings to firms about Bitcoin mining activities. Following this dip, a brief attempt at a recovery did not show much conviction, which has led to a rejection of price action at the 28.76 resistance.

Following four attempts to break this barrier to the upside, sellers took control and have forced prices down by 5.69% as of writing this Monday. A test of the 200-day moving average at 26.27 is expected at any moment. What are the possibilities at this point?

Chainlink Price Prediction

The 200-day moving average and the 26.27 support level are the current price pivots. A bounce from these points targets 28.76. Above this level, 31.74 and 34/98 line up as potential barriers to the north.

This view is negated if the price declines below 26.27, and this would open the door for a descent towards 24.00, acting as psychological support. Only when this gives way will 22.47 and 20.12 enter the fray as additional price targets to the downside.

Chainlink: Daily Chart

Follow Eno on Twitter.