Rise of Crypto.com: from university blog to home of the LA Lakers

Crypto.com started life as the blog of a University of Pennsylvania professor, Matt Blaze, who sold the name in 2018 for an undisclosed sum to a little-known start-up dabbling in cryptocurrency and credit cards called Monaco.

Monaco, now a Singapore-headquartered cryptocurrency exchange renamed Crypto.com, has just agreed to pay $700m to emblazon that blog’s title for 20 years on the Los Angeles arena synonymous with the championship Lakers basketball teams and a concert venue for artists from Taylor Swift to Paul McCartney.

The huge amount of money thrown at the Staples Center is a demonstration of how bitcoin’s meteoric rise is reshaping the corporate landscape and of how freshly minted crypto giants are willing to pay up in order to win new retail customers.

Sports sponsorships are a time-honoured way for companies to gain name recognition trading off the loyalty of fans.

In June, the Bahamas-based exchange FTX bought the naming rights to the stadium home of basketball’s Miami Heat and that same month became the official cryptocurrency platform of Major League Baseball and of seven-time Super Bowl champion quarterback Tom Brady.

AEG, the company which owns and operates the Staples Center, is hoping that the crypto-rebrand works both ways. Todd Goldstein, chief revenue officer of AEG, said it proactively sought out Crypto.com as a naming partner because they hoped to attract “a piece of their demographic” — namely, younger, more tech-savvy consumers.

“When the shock wears off just a little bit, there are people who grasp it, how it can be good for the arena and good for the partner,” Goldstein told the Financial Times.

The move to turn the Staples Center into the Crypto.com Arena from Christmas Day will also attract a greater level of scrutiny to the little-known company as well as questions about its ability to stump up the hundreds of millions of dollars it will need to pay for the name change.

Kris Marszalek, chief executive and majority shareholder, has said it is a “straight cash deal”.

Even if it lacks brand recognition, the five-year-old privately held company has 3,000 employees around the world and generated hundreds of millions of dollars in revenue in the second quarter of this year, according to Marszalek.

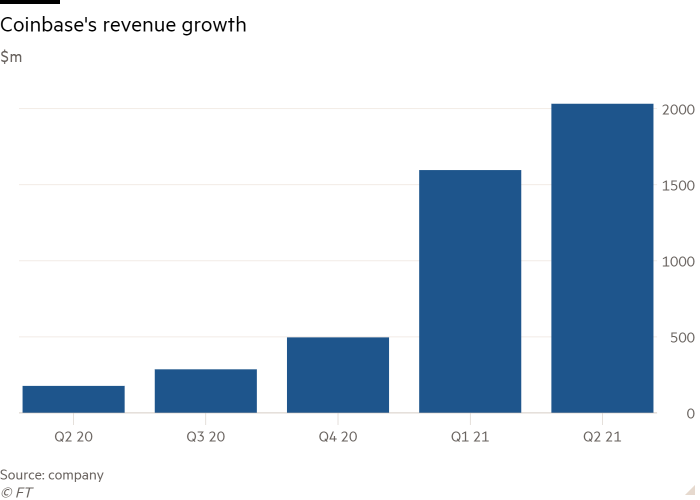

“In the second quarter, we did about a quarter of Coinbase’s revenues and we have been profitable from the start of the year,” the Crypto.com boss told the FT. “The crypto space is extremely hot and we’ve seen a 20-times revenue growth this year.”

Coinbase — which became the only publicly listed cryptocurrency exchange earlier this year at a valuation of $76bn, close to that of France’s BNP Paribas — generated $2bn in net revenues between April and June, surpassing the $1.6bn in the previous quarter.

The surging bitcoin price has transformed a handful of companies, such as Coinbase, into billion-dollar enterprises surfing on an influx of new investors and the high margins they can charge.

Rival exchange FTX recently achieved a valuation of $25bn at a funding round, jumping from just $1bn in value in February last year. Gemini, the crypto company owned by Tyler and Cameron Winklevoss, has also just completed a funding round that put a $7.1bn price tag on the exchange.

Unlike traditional markets where margins have compressed to wafer-thin levels, Crypto.com and its peers can charge 0.4 per cent on transactions that take place on the venue and even more if trading takes place on the company’s mobile app.

Crypto.com turns over billions of dollars worth of cryptocurrency transactions every day and has processed more than $415bn of trades on its exchange since March last year, according to data from digital asset specialist analytics company CryptoCompare.

Weekly newsletter

For the latest news and views on fintech from the FT’s network of correspondents around the world, sign up to our weekly newsletter #fintechFT

This translates to $1.2bn of revenues using a 0.3 per cent average fee, but the figure doesn’t contain trades through the app where exchanges can charge two or three times as much as they do on their main venues. Volumes are not disclosed for such trades, making the FT’s estimate of the company’s revenues a lowball one, according to the company.

Cryptocurrency exchanges typically charge investors less the more they trade. This incentivises retail traders to take bigger risks with their punts on bitcoin and others because aside from putting more and more money into their accounts, they might be tempted to inflate their trades by using leverage. The exchanges can also make money through their own digital currencies and through lending operations.

Crypto.com, for its part, has a rapidly growing portfolio of sports assets, including Paris Saint-Germain and Italy’s Serie A in football, Formula 1 racing, UFC professional fighting, and basketball’s Philadelphia 76ers, all signed to endorsements this year.

It was also “contemplating” raising funds in a market where conditions were extremely favourable, Marszalek said. Venture capital investors agree. Greg Carson, managing partner of XBTO Humla Ventures, said digital asset-focused companies were attracting a premium because of their “explosive” growth and the chunky margins they could charge.

Crypto sceptics are pointing at the deal to rename the stadium as a sign that we are near the top of the market, a suggestion that is scoffed at by many in the industry.

But even if crypto itself is at the centre of disagreement, there appeared to be none about the preferred nickname for the arena. “You’re going to call it The Crypt,” said sports commentator Dan Patrick. “Not Crypto.com or whatever.”