51% of Generation Z and 36% of Millennials Prefer Cryptocurrencies for Salary: New Report

Researches believe younger “digital natives” embrace crypto because they grew up with innovative tech.

According to results from a recent global survey, more than half of Gen Z (born between 1997 and 2012) and more than a third of Millennials (born between 1980 and 1996) would welcome being paid in cryptocurrencies.

How the study was done

The research was conducted by the deVere Group, a leading financial advisory, asset management and fintech organizations, and it surveyed more than 750 clients under the age of 42 using the deVere Crypto mobile app, capturing the opinions of participants in the U.K., Europe, North America, Asia, Africa, Australia, and Latin America. Study organizers speculate that because these two demographics are digital natives who have grown up with current technology and cryptos, they’re more willing to embrace those innovations as their financial future.

“They’ve been influenced by the enormous surge in tech as they came into adulthood. They are comfortable using and see the value in and massive potential of digital currencies,” stated deVere CEO and founder Nigel Green in the company’s press release and media reports. “They appear to trust an autonomous decentralized digital currency and payment system over a traditional system where legacy financial institutions and governments are in control.”

Younger age demos are also more likely to buy cryptos

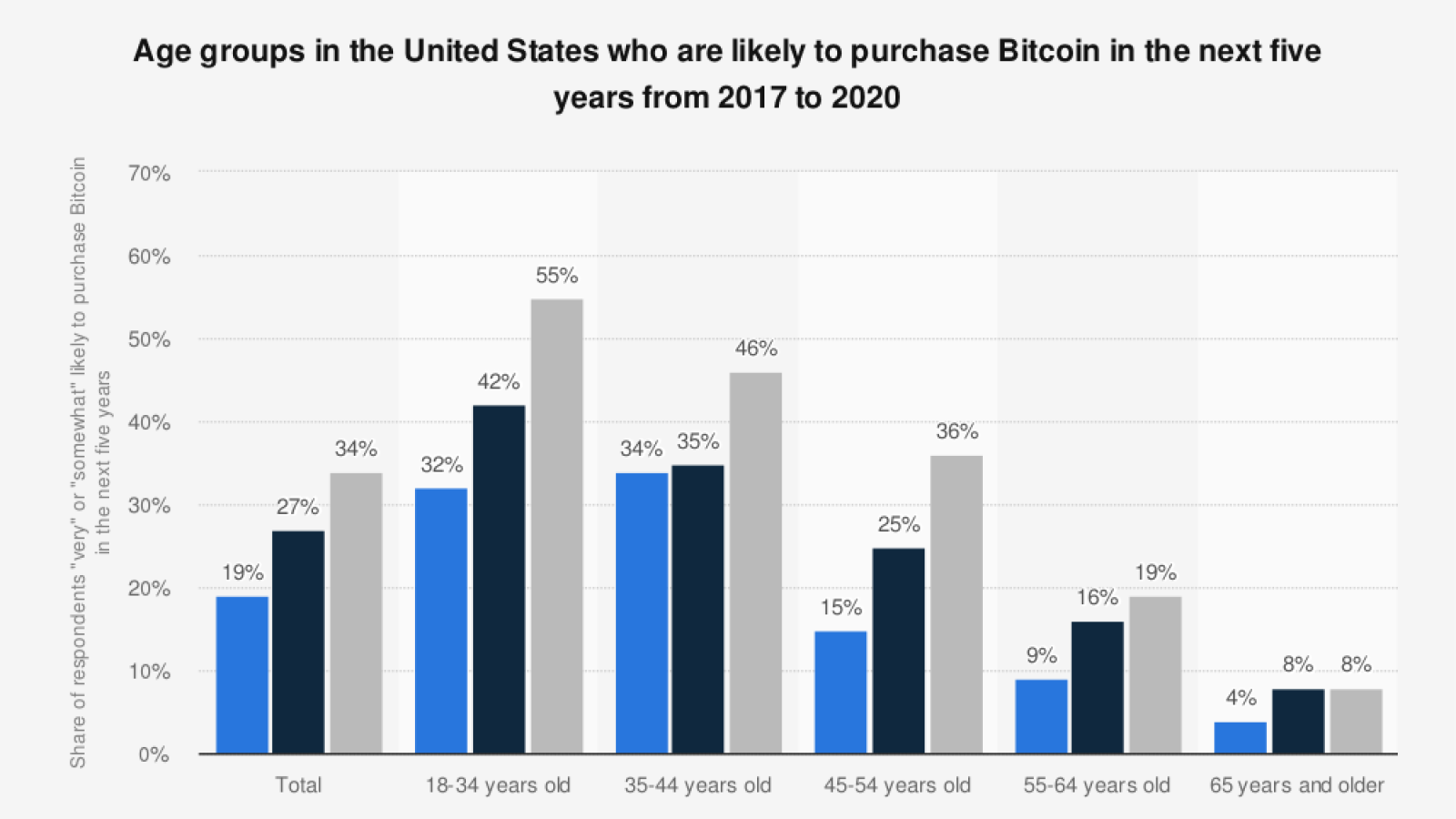

These findings align with recent data published on Statista.com, which found increasing receptivity annually by U.S. adults to buy Bitcoin across all age groups. The highest annual increases have been among younger age groups spearheading this development as seen in this chart.

Image by Statistic.com

The percentage of people indicating they are either “very” or “somewhat” likely to buy Bitcoin in the next 5 years increased by 13 percentage points among 18-to 34-year-olds between the spring of 2019 and the fall of 2020.

Green further stated, “They see the inherent value of digital, borderless, global currencies for trade and commerce purposes in increasingly digitized economies in which businesses operate in more than one jurisdiction.”