BTC, ADA and BNB Price Analysis for November 6

Has Bitcoin (BTC) accumulated enough strength to rise faster than altcoins?

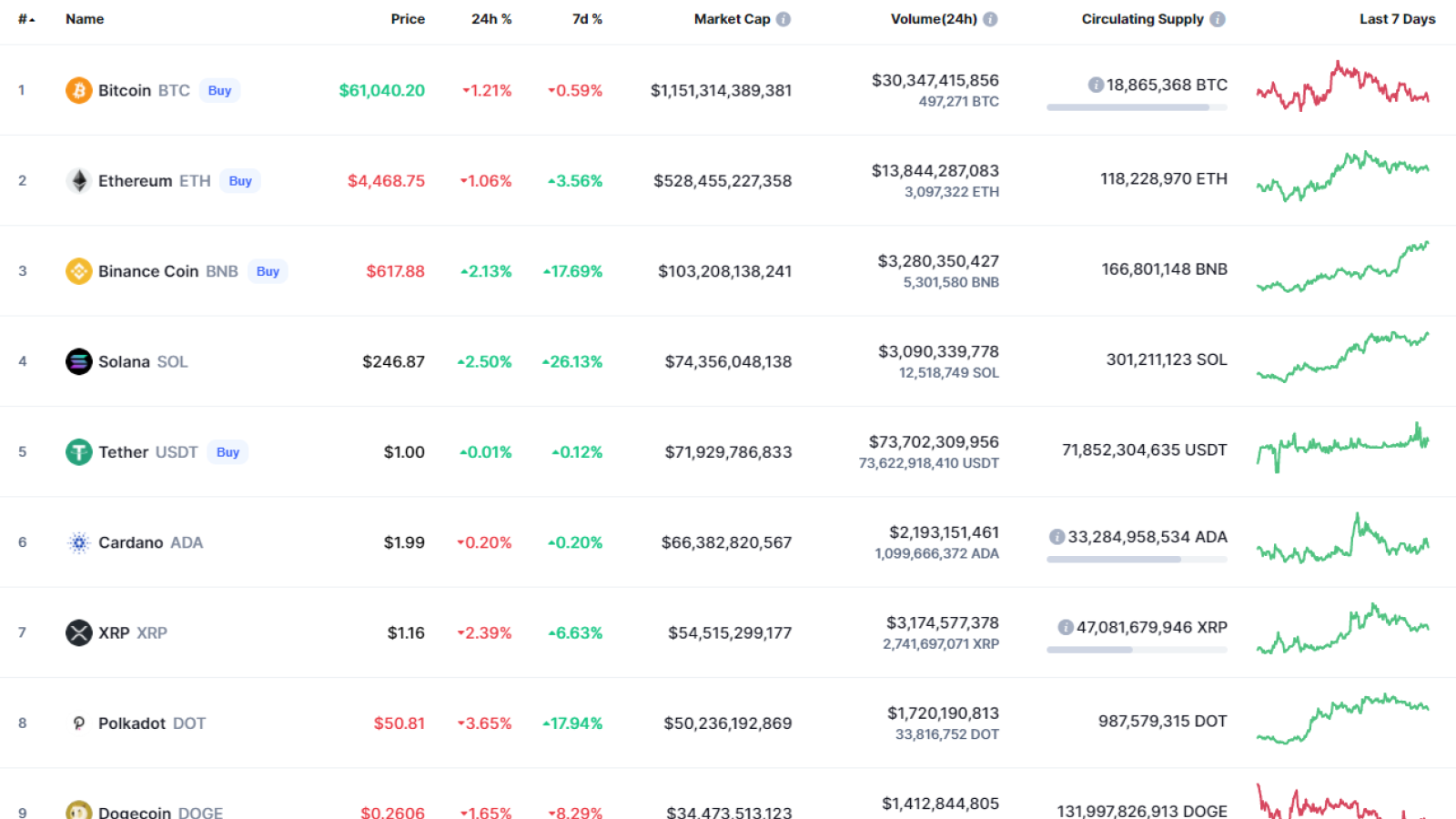

The weekend has begun with the fall of some coins, while others remain in the green zone.

BTC/USD

The rate of Bitcoin (BTC) has gone down by 1% over the last 24 hours.

On the daily chart, Bitcoin (BTC) keeps trading in a wide range between the support at $56,560 and the resistance at $67,000. The trading volume is low, which means that the coin is accumulating power for a sharp move.

At the moment, one needs to wait until BTC approaches either the support or resistance. In case it goes below $56,560, bears might come back and seize the initiative.

Bitcoin is trading at $61,012 at press time.

BNB/USD

Binance Coin (BNB) is the main gainer today as the native exchange coin has increased by 2.43% since yesterday.

Despite the rise, Binance Coin (BNB) keeps going up after it fixed above the vital $600 mark. The rise is accompanied by a high trading volume, which means that bulls are ready to keep the rise. If the situation continues, one may expect the attempt to get to another crucial level at $700 within the nearest days.

BNB is trading at $617 at press time.

ADA/USD

Cardano (ADA) is trading almost at the same level as yesterday, going down by 0.26%.

Cardano (ADA) is looking more bearish than Bitcoin (BTC) or Binance Coin (BNB) as it could not fix above the area of $2. In terms of the nearest price prediction, the sideways trading is about to continue between the support at $1.832 and the liquidity zone at $2.118.

The mid-term picture remains bullish until sellers break the support and fix below it.

ADA is trading at $1.987 at press time.