Crypto news: Bitcoin and altcoins take another quick dip; US$500m liquidated in about an hour

The entire crypto market has taken a sharp fall in the past couple of hours, with some market participants pointing to the liquidation of over-leveraged traders as a contributing factor.

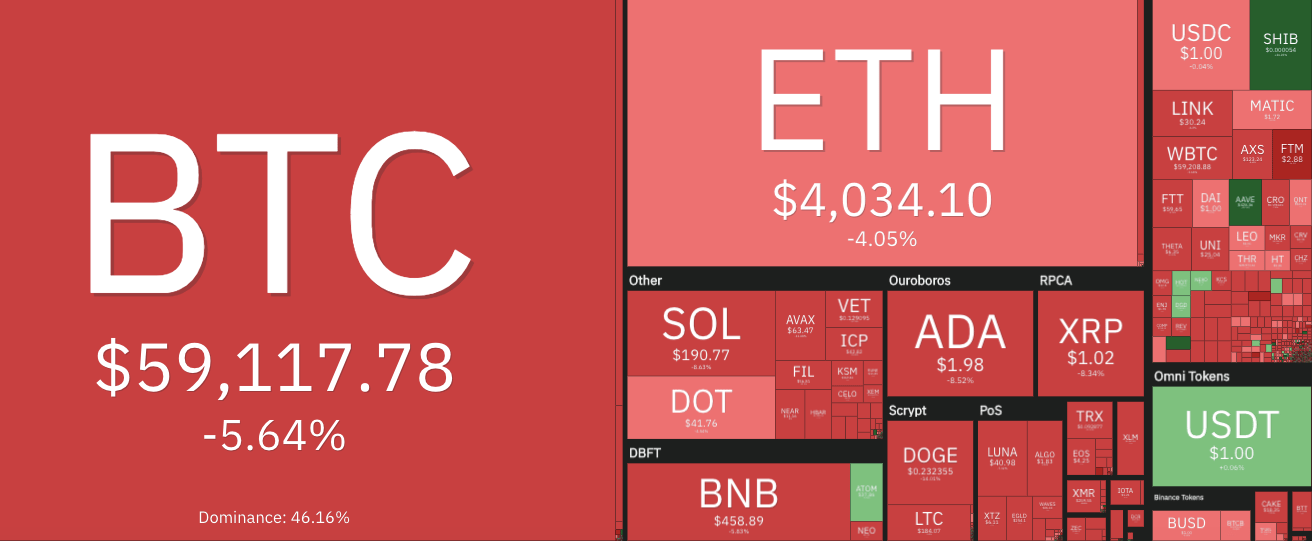

According to the CoinGecko Bitcoin chart, a short time ago BTC lost about US$2,800 in the space of just one hour, with at least $1K of that gone in less than five minutes. Most altcoins have fallen with it, many tumbling harder as they customarily do.

Several top coins quickly saw double-digit losses over 15 per cent in the quick plummet, including Solana (SOL) and Cardano (ADA), which has currently lost the USD two-dollar level its been holding for a good couple of months. Shiba Inu (SHIB) is a notable outlier, bizarrely still pumping away, up about 24 per cent since this time yesterday.

At the time of writing, the market is attempting to recover some of the rapid losses, amid “buy the dip” rallying cries on Twitter.

Bitcoin, having dropped down to US$58,178, has clawed its way back to US$59,117. Ethereum (ETH), meanwhile has just recovered US$4K again.

Dippage reasons? Some market watchers are pointing to a liquidation event of over-leveraged traders, going too hard on their long positions both in Bitcoin and Ethereum and being exposed by whale action playing the wash-out game.

Half a billion in liquidations! Whales hunting for stops and washing out over leveraged traders. #bitcoin https://t.co/6VnDRY5jiF

— Lark Davis (@TheCryptoLark) October 27, 2021

This flush is led by ETH with $283M gone dow the drain.

People was longing the ETH follow up trade a bit too hard.

— Lex Moskovski (@mskvsk) October 27, 2021

But other analysts say they’ve been anticipating a corrective move regardless of big-bag-holding “whale” games and overzealous, lever-lovers…

Keep calm people. Have been expecting/waiting for a drop to 57-58k for some time now. This could very well be the bottom. Lose this region on a weekly closing basis and we likely fall to 52k but I think the chances we hold this level are very high. $BTC pic.twitter.com/hRGWeNzTYL

— CrediBULL Crypto (@CredibleCrypto) October 27, 2021

As reported by Stockhead several hours ago, Charles Edwards, CEO of investment firm Capriole, had earlier said that “Bitcoin looks incredible here on most metrics, but leverage traders have gone out of control,” adding: “We won’t get sustainable price rises until that happens.”

He’s now calling the dip a “good cleanse”.

Good cleanse. Resume bull market. As you were. https://t.co/i67oB5mcR0

— Charles Edwards (@caprioleio) October 27, 2021

Just a bump in the bull-run road? Maybe… much of Crypto Twitter certainly seems to think so.

— naiive (@naiiveclub) October 27, 2021