Chainlink Price Pops above Trend resistance: Is it LINKs Turn to Surge?

The Chainlink price is up more than 30% over the last week and has finally broken out of its long-term downtrend. Chainlink (LINK/USD) is trading slightly softer at $31.67 (-1.33%) this morning, although up 35% so far in October. LINK’s recent strength has increased its market cap to $14.7 billion, ranking it the 15th most valuable cryptocurrency behind Avalanche (AVAX/USD).

Approaching the Proshares Bitcoin ETF listing altcoins such as Chainlink performed poorly. Capital migrated from lower-tier assets to the market leader as investors rushed to take advantage of the BTC-specific bullish catalyst. However, since reaching a record $66,999, BTC has been trending lower, and as a result, capital is flowing back the other way. Subsequently, several altcoins have reached records of their own in the last few days. Nonetheless, the Chainlink price is way below its all-time high, but it is starting to look constructive. And considering the euphoric atmosphere, more upside could be in store for LINK.

LINK Price Analysis

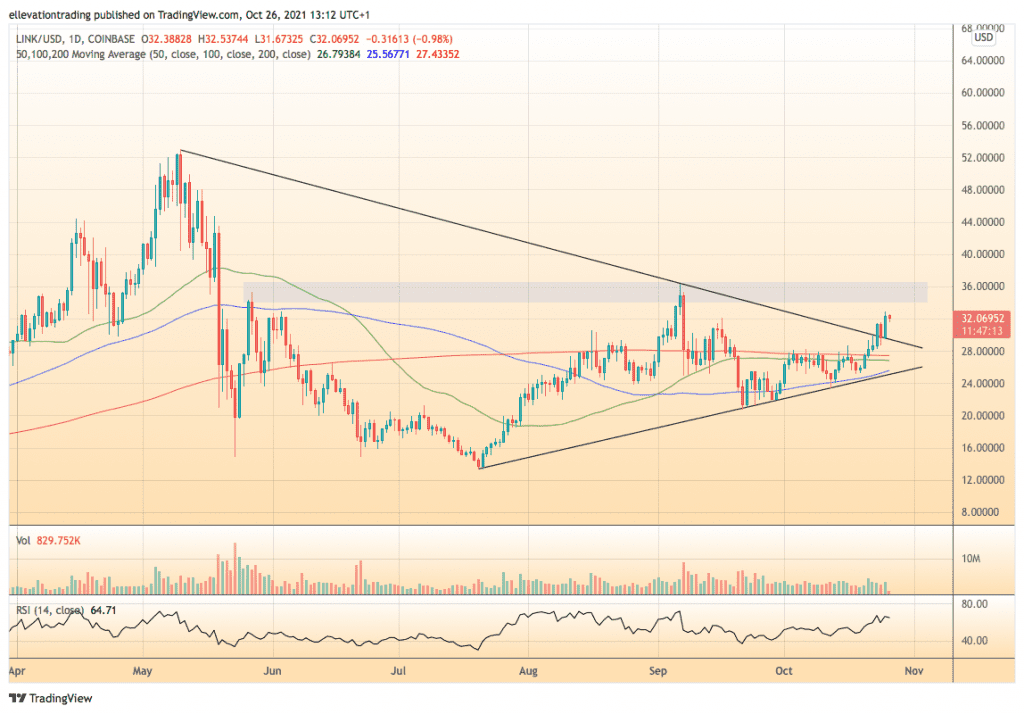

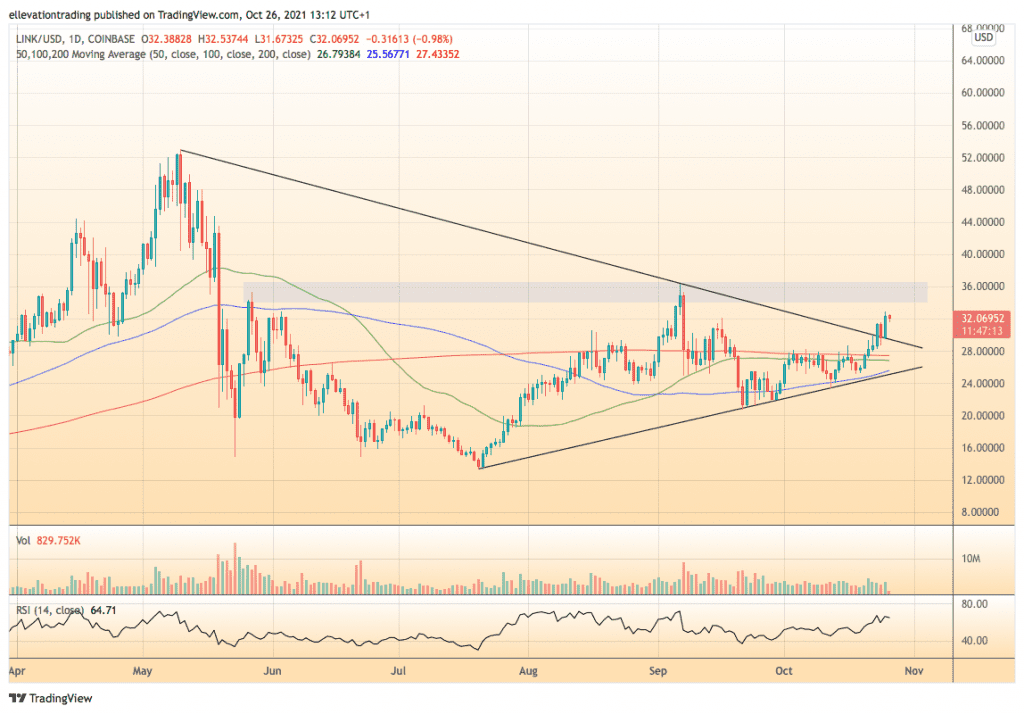

The daily chart shows that LINK cleared trend resistance (now support) at $29.89 on Saturday. Furthermore, after successfully retesting the trend Sunday, the Chainlink Price jumped 9% yesterday, reinforcing the trend support. On that basis, as long as LINK holds above the trend, the outlook is bullish. A logical upside target is the September high at $36.35. However, the rationale goes out of the window in the current environment. Therefore, Chainlink could easily exceed the first target and extend towards $45.00.

The bullish view relies on trend support holding up. Subsequently, if the Chainlink price drops below the trend at $29.56, it invalidates this thesis.

Chainlink Price Chart (Daily)

For more market insights, follow Elliott on Twitter.

The post Chainlink Price Pops above Trend resistance: Is it LINKs Turn to Surge? appeared first on InvestingCube.

Read the rest of the article on investingcube.com.

Forex and CFDs carry a high degree of risk and may expose you to significant losses. Any opinions, news, research, analysis, prices or other information provided by InvestingCube is provided as general market commentary and does not constitute investment advice.